See How We're Different

or Call Us: 951-547-6770

Understanding the Basics of PWC Protection

When you’re looking for a jet ski insurance rate, you’ll typically pay between $100 to $500 annually for coverage. Here’s what you need to know right away:

Quick Rate Overview:

- Basic Coverage: $100-$300 per year

- Standard Protection: $300-$500 per year

- High-Performance Models: $400-$800 per year

- Factors: PWC value, your experience, location, and coverage level

Jet skis bring incredible joy on the water, but they also come with real financial risks. A single accident can lead to thousands in repair costs, medical bills, or liability claims. As one forum user shared, “I was paying $100 a year for two personal watercraft and a trailer. Total value was about $7000” – showing how affordable protection can be for your investment.

Your jet ski faces multiple risks:

- Collisions with other watercraft or docks

- Theft from storage areas

- Weather damage during storms

- Liability for injuries to others

- Damage to other people’s property

Whether you’re cruising lakes in Colorado, enjoying the Gulf waters off Florida, or exploring Nevada’s recreational areas, insurance protects both your financial security and peace of mind.

As Patrick Caruso, an independent insurance agent specializing in recreational vehicle coverage, I’ve helped countless clients find the right

jet ski insurance rate for their needs and budget. My experience with watercraft policies across multiple states gives me unique insight into what drives costs and how to secure the best protection for your situation.

What is the Average Jet Ski Insurance Rate?

Planning your first jet ski adventure? One of the biggest questions on your mind is probably: “What’s this going to cost me?” The good news is that protecting your personal watercraft doesn’t have to break the bank.

Most jet ski owners pay between $100 to $500 annually for their insurance coverage. However, the range can vary quite a bit depending on what you’re riding and where you’re riding it.

Here’s what you can typically expect to pay:

- Basic coverage for older models: As low as $100-$200 per year

- Standard recreational PWCs: $300-$500 annually

- High-performance and luxury models: $400-$800 per year

- Multiple watercraft policies: Often come with discounts that can save you money

I’ve seen some pretty wide variations in what people actually pay. One client with older models paid just $32 per year for two older personal watercraft in Colorado. On the flip side, the owner of a brand-new 2024 performance model might pay around $200 annually, while someone with a top-of-the-line 2023 model could see rates closer to $115 monthly.

State variations play a big role in your jet ski insurance rate too. If you’re enjoying the waters in Florida, you might pay more due to year-round riding season and higher theft rates. Meanwhile, Arizona and Nevada riders often see lower premiums since the riding season is shorter.

The basic rule? The more expensive your PWC, the more you’ll pay to insure it. This makes sense when you think about it – a $25,000 performance machine costs a lot more to repair or replace than a $5,000 older model.

| PWC Type (Example) | Value (Approx.) | Average Annual Premium (Range) | Notes |

|---|---|---|---|

| Recreational Lite (Older Model) | $5,000 – $8,000 | $100 – $300 | Basic coverage, older PWC, clean record. |

| Standard Recreational | $8,000 – $15,000 | $300 – $500 | Good balance of coverage and cost. |

| Performance/Luxury | $15,000 – $25,000 | $400 – $800 | Newer, faster models. |

| Multiple PWCs | $10,000+ | $700 – $1,500+ | Often comes with multi-PWC discounts. |

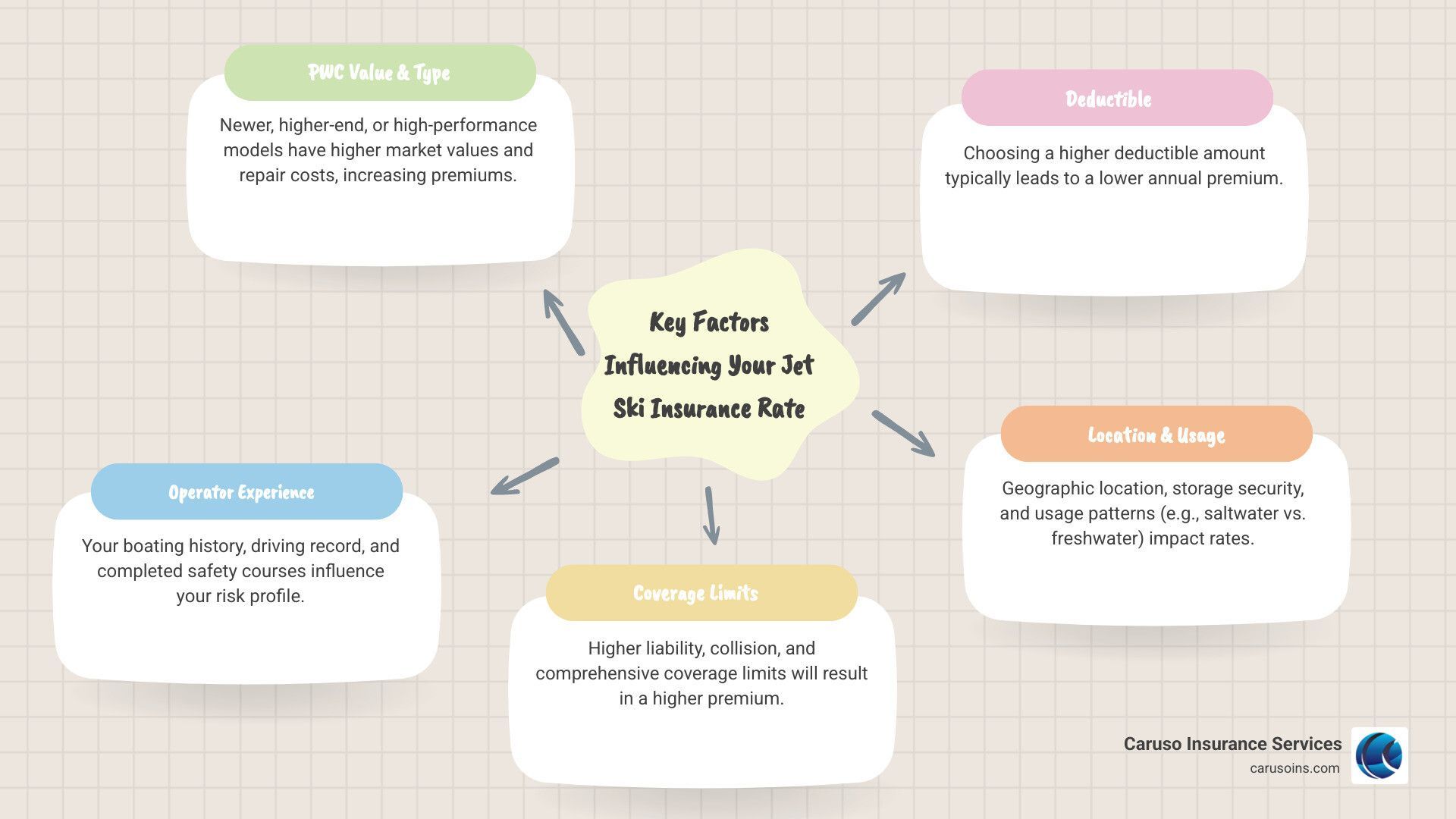

Factors That Influence Your Premium

Your specific jet ski insurance rate isn’t just pulled out of thin air. Insurance companies look at several key factors when calculating your premium.

PWC value is the biggest factor – more expensive watercraft cost more to insure. Operator experience matters too – seasoned riders with clean records typically pay less than newcomers to the sport.

Coverage limits and your chosen deductible directly impact your rate. Higher coverage limits mean higher premiums, while choosing a higher deductible can lower your annual cost. Your location also plays a role – watercraft stored in secure facilities in low-crime areas of Texas or Tennessee will cost less to insure than those in high-theft areas.

Understanding Your Quoted Rate

When you get a quote from us at Caruso Insurance Services, we want you to understand exactly what you’re paying for. Your quote will show whether the premium is calculated annually or broken down into monthly payments.

Policy details are crucial. We’ll walk you through what’s included in your base coverage and what optional add-ons might benefit you. Pay close attention to included coverages – some policies automatically include trailer coverage while others charge extra for it.

Exclusions are just as important as what’s covered. Most standard policies won’t cover racing or commercial use of your PWC. We make sure you know exactly what situations are covered and which ones aren’t, so there are no surprises when you need to file a claim.

Key Factors That Determine Your Insurance Premium

Think of your

jet ski insurance rate as a recipe – multiple ingredients come together to create the final result. Just like understanding wind patterns helps you steer better on the water, knowing what drives your premium helps you make smarter insurance decisions.

Insurance companies evaluate risk through three main lenses: who you are as an operator, what type of watercraft you own, and how you use it. It’s actually quite similar to how we assess coverage for other recreational vehicles – your PWC is just another fun toy that needs protection. You can see how this approach works across different vehicle types on our Off-Road Vehicle Insurance page.

Every detail matters because insurers want to predict the likelihood of a claim. The good news? Once you understand these factors, you can often influence some of them to work in your favor.

Your Personal Profile and Experience

Your background tells a story, and insurance companies are great readers. Age plays a significant role – younger operators typically face higher premiums because statistics show they’re more likely to have accidents. It’s not personal; it’s just math.

Your boating history is like your report card on the water. A clean record with no accidents or claims is pure gold to insurers. I’ve seen clients with decades of spotless boating experience save hundreds of dollars annually because of their track record.

Here’s something that surprises many people: your driving record for your car can affect your jet ski rates. Insurers figure that someone who drives responsibly on land probably operates responsibly on water too. Makes sense when you think about it.

Your credit score might seem unrelated to watercraft insurance, but in most states, it’s actually a factor. Higher scores often translate to lower premiums because they suggest financial responsibility. It’s another piece of the puzzle that helps insurers assess overall risk.

Boating safety courses are a win-win investment. You become a safer operator while potentially earning discounts on your premium. It’s one of the easiest ways to show insurers you’re serious about responsible PWC operation.

Your Personal Watercraft (PWC) Details

Your jet ski’s characteristics directly impact your insurance costs. The make, model, year, horsepower, and engine size all factor into the equation. A brand-new, high-performance machine costs more to insure than an older recreational model – simply because it’s more expensive to repair or replace.

Market value is straightforward math. The more your PWC is worth, the more it costs to insure. This is why that shiny new performance model might cost twice as much to insure as your friend’s five-year-old recreational unit.

Custom modifications can be tricky territory. That custom paint job, performance exhaust, or upgraded electronics increase your PWC’s value – and your insurance costs. The key is making sure we know about any modifications so they’re properly covered. Nothing’s worse than finding out your expensive upgrades aren’t protected after something happens.

How Location and Usage Affect Your Jet Ski Insurance Rate

Where you live and how you use your jet ski create the final layer of risk assessment. Geographic location plays a bigger role than many people realize. In Florida, with its year-round boating season and hurricane risks, premiums might be higher than in Colorado, where the season is shorter and weather risks are different.

Even within states like Texas, Nevada, Tennessee, Idaho, and Arizona, your specific location matters. Areas with higher theft rates or frequent severe weather typically see higher premiums.

Storage security is something you can control. Keeping your PWC in a locked garage or secure marina with surveillance systems can lower your rates compared to leaving it on a trailer in your driveway. Thieves prefer easy targets, and so do insurance companies when calculating risk.

The difference between saltwater and freshwater use might seem minor, but salt is tougher on engines and components. Some insurers factor this increased wear and tear into their pricing, though the impact is usually modest.

Lay-up periods offer a silver lining for seasonal riders. If you’re in a state where winter means your PWC sits covered for months, many policies offer seasonal discounts. Why pay full price when your jet ski is hibernating under a tarp? It’s one of those logical adjustments that makes insurance feel a bit more fair.

Decoding Your Jet Ski Insurance Policy

Think of your jet ski insurance policy like a Swiss Army knife – it has multiple tools designed to protect you in different situations. Understanding what’s inside your policy is just as important as knowing your jet ski insurance rate. After all, the cheapest policy isn’t always the best deal if it leaves you exposed when you need coverage most.

Most people focus on the premium, but the real value lies in understanding what protection you’re actually buying. It’s like buying a life jacket – you want to make sure it’ll actually keep you afloat when the waves get rough. For more comprehensive information about watercraft protection, check out our Boat Insurance Coverage page.

Standard Coverage Types

Every solid jet ski insurance policy starts with three foundational coverages that work together to protect you and your investment.

Liability coverage is your financial lifeline when accidents happen. Here’s a sobering fact: personal watercraft were involved in 22% of all reported boating accidents in 2020. When you’re zipping across the water at high speeds, the potential for accidents is real. This coverage protects you in two crucial ways.

Bodily injury liability steps in when you accidentally hurt someone else while operating your jet ski. Whether it’s another rider, a swimmer, or passengers on your own PWC, this coverage handles their medical bills, lost wages, and pain and suffering costs. Given that jet skis often carry multiple riders, the risk of injury claims can add up quickly.

Property damage liability covers the cost when you accidentally damage someone else’s stuff. Maybe you misjudge a turn and scrape another boat, or perhaps you crash into a dock. This coverage handles the repair or replacement costs so you don’t have to pay out of pocket. You can learn more about what liability insurance covers through this helpful resource.

Collision coverage is like having a safety net for your own jet ski. When your PWC gets damaged in a crash – whether you hit another watercraft, strike a submerged log, or accidentally ram into a dock – this coverage pays for repairs or replacement. It doesn’t matter who’s at fault; your jet ski gets fixed.

Comprehensive coverage protects against all the other things that can go wrong when you’re not even riding. Theft is unfortunately common with jet skis since they’re relatively easy to steal and transport. Vandalism coverage kicks in when someone deliberately damages your PWC. Weather damage is especially important if you live in states like Florida or Texas, where hurricanes and severe storms can wreak havoc on watercraft.

Some comprehensive policies even cover quirky situations you might not expect, like damage from rodents that decide to make a nest in your engine compartment, or invasive species like zebra mussels that can clog your cooling system.

Optional Add-Ons for Improved Protection

While standard coverage gives you a solid foundation, optional add-ons can fill in the gaps and give you even more peace of mind on the water.

Uninsured and underinsured boater coverage protects you when the other guy doesn’t have enough insurance. Just like with car accidents, you might find yourself dealing with someone who has no coverage or barely minimum limits that won’t cover your injuries or damages.

Medical payments coverage acts like a fast-track solution for medical bills. It covers medical expenses for you and your passengers regardless of who caused the accident. Instead of waiting months for liability investigations to conclude, your medical bills get paid quickly.

Trailer coverage is often overlooked but essential if you transport your jet ski. Your auto insurance typically won’t cover your boat trailer, so this add-on protects against theft or damage to the trailer itself.

Personal effects coverage protects all the gear you bring along for your water adventures. Whether it’s expensive fishing equipment, water sports gear, or even just your sunglasses and phone, this coverage handles items that get damaged or stolen while on board.

On-water towing coverage becomes your best friend when your engine dies in the middle of the lake. It covers the cost of getting towed back to shore or to the nearest repair facility. Roadside assistance extends this protection to your journey home, covering breakdowns while you’re trailering your jet ski.

At Caruso Insurance Services, we help you build a policy that matches your specific needs and budget. Whether you’re cruising the lakes of Colorado, exploring Arizona’s waterways, or enjoying the Gulf Coast waters of Florida, we’ll make sure you have the right protection for your adventures.

Smart Strategies to Lower Your Jet Ski Insurance Rate

Nobody wants to pay more than they have to for insurance – and the good news is you don’t have to! There are several proven ways to reduce your jet ski insurance rate while still getting excellent protection for your watercraft. As your independent agent, I love helping clients find these money-saving opportunities. You can also explore additional cost-cutting strategies on our Boat Insurance Rates page.

The easiest way to save money is through bundling policies. If you already have auto or home insurance, adding your jet ski to the mix often open ups significant multi-policy discounts. Insurance companies reward loyalty, and they’ll pass those savings directly to you. I’ve seen clients save 15-25% just by consolidating their coverage.

Higher deductibles offer another straightforward path to lower premiums. By choosing a $1,000 deductible instead of $500, you’re telling the insurance company you’re willing to handle smaller claims yourself. This confidence translates into real savings on your annual premium. Just make sure you’re comfortable with that higher out-of-pocket amount if you need to file a claim.

Safety course completion is a win-win strategy. Taking a certified boating safety course through the U.S. Coast Guard or your state agency makes you a better, safer operator while qualifying you for insurance discounts. Many insurers offer 5-10% discounts for course completion – and the knowledge you gain is priceless.

Anti-theft devices serve double duty by protecting your investment and reducing your comprehensive coverage costs. GPS tracking systems, engine locks, or alarm systems show insurers you’re serious about preventing theft. In states like Florida and Arizona where PWC theft rates are higher, these devices can lead to meaningful premium reductions.

Maintaining a clean record remains one of the most powerful ways to keep your rates low. This means both your boating history and your driving record. Insurance companies look at your overall responsibility pattern, so avoiding accidents and claims across all your vehicles demonstrates you’re a low-risk customer.

If you own multiple PWCs, insuring them all under one policy typically qualifies you for multi-craft discounts. Whether you’re storing two jet skis in Colorado for summer lake adventures or keeping a fleet ready for year-round fun in Texas, consolidating coverage usually saves money.

The key is working with an experienced agent who knows all these strategies and can apply them to your specific situation. At Caruso Insurance Services, we specialize in finding every available discount while ensuring you never sacrifice the protection you need.

Frequently Asked Questions about PWC Insurance

After helping countless clients secure the right

jet ski insurance rate for their needs, I’ve noticed the same questions come up again and again. Let me share the answers to the most common concerns we hear at Caruso Insurance Services.

Is jet ski insurance legally required?

The short answer? It depends on your situation, but probably not by state law alone.

State requirements vary, and in the states where we’re licensed – Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho – jet ski insurance typically isn’t mandated by state law for personal recreational use. However, don’t let that fool you into thinking you can skip it entirely.

Marina and facility requirements often fill the gap where state laws don’t. Many marinas, boat launches, and docking facilities require proof of liability insurance before they’ll let you use their services. They’ve seen enough accidents to know they need protection from potential damage claims.

Public waterways and private lakes sometimes have their own rules too. While less common, certain bodies of water may require insurance coverage for all watercraft users.

Even when it’s not legally required, I always tell my clients that jet ski insurance is one of those “better safe than sorry” investments. The potential costs of an accident far exceed what you’d pay for a good policy.

Is insurance required if I finance my jet ski?

Absolutely, yes. This one’s pretty much universal across all lenders.

Lender requirements exist to protect their investment in your jet ski. Think about it from their perspective – they’ve loaned you thousands of dollars for an asset that spends time on the water, where accidents happen. They want assurance that if something goes wrong, they can recover their money.

Comprehensive and collision coverage are typically the minimum requirements. Your lender wants to know that whether your jet ski gets stolen from storage, damaged in a collision, or destroyed by weather, there’s coverage to repair or replace it.

Loan agreements spell out these insurance requirements in detail, including minimum coverage limits and the requirement to list your lender as a “loss payee” on the policy. We help our clients steer these requirements to ensure they meet all their obligations while still getting the best jet ski insurance rate possible.

Does my homeowners policy cover my jet ski?

This is probably the biggest misconception we encounter, and unfortunately, the answer is usually no – or at least, not in any meaningful way.

Limited coverage might exist for very small, low-powered watercraft stored on your property, but modern jet skis typically exceed these limits. Even when there’s some coverage, it’s usually minimal and comes with significant restrictions.

Exclusions are the real problem. Most homeowners policies specifically exclude liability coverage when you’re operating watercraft on the water. This means if you cause an accident while riding your jet ski, your homeowners insurance won’t protect you from medical bills, property damage claims, or legal costs.

Liability on water presents unique risks that homeowners policies simply aren’t designed to handle. The speeds involved, the potential for serious injuries, and the expensive watercraft and dock property that can be damaged all require specialized coverage.

That’s why we always recommend a

separate PWC policy designed specifically for personal watercraft. These policies understand the unique risks of jet ski ownership and operation, providing the comprehensive protection you need both on and off the water.

Conclusion: Ride with Confidence

As we wrap up our journey through jet ski insurance rates, I hope you’re feeling more confident about protecting your investment and your adventures on the water. Understanding what goes into your premium – from your experience level to where you store your PWC – gives you the power to make smart decisions that work for your budget and lifestyle.

The bottom line is simple: jet ski insurance is a smart investment. Whether you’re cruising the lakes of Colorado, enjoying Florida’s year-round boating season, or exploring the waters of Texas, Arizona, Nevada, Tennessee, or Idaho, having the right coverage means you can focus on what matters most – having fun on the water.

Think about it this way: you wouldn’t drive your car without insurance, so why risk it with your jet ski? The financial security that comes with proper coverage far outweighs the annual cost, especially when you consider that a single accident could cost thousands in repairs, medical bills, or liability claims.

At Caruso Insurance Services, we’ve seen how the right policy can make all the difference. Our approach isn’t about selling you the most expensive coverage – it’s about understanding your specific situation and crafting a policy that fits like a well-custom wetsuit. We take the time to explain every aspect of your coverage, from liability limits to optional add-ons, so there are never any surprises when you need your insurance most.

Whether you’re a weekend warrior with an older recreational model or someone who’s invested in a high-performance machine, we’ll work with you to find coverage that protects your passion without breaking the bank. Our personalized policies reflect our commitment to treating every client as an individual, not just another policy number.

Ready to secure your ride and ensure your adventures are worry-free? Don’t let another season pass without proper protection.

Get a personalized boat and PWC insurance quote today

Your peace of mind is worth it, and we’re here to make the process as smooth as gliding across calm water.