See How We're Different

or Call Us: 951-547-6770

Protecting Your Vintage Investment: Classic Car Insurance Essentials

Classic car insurance comparison reveals significant differences from standard auto insurance. Here’s what you need to know:

| Feature | Classic Car Insurance | Standard Auto Insurance |

|---|---|---|

| Valuation | Agreed value (guaranteed payout) | Actual cash value (depreciated) |

| Cost | 36% cheaper on average | Higher for equivalent coverage |

| Usage | Limited pleasure driving | Daily commuting allowed0 |

| Requirements | Secure garage storage, separate daily driver | Basic parking requirements |

| Top Providers | Specialized classic car insurers | Standard carriers |

That vintage beauty in your garage isn’t just a car — it’s a time machine, a masterpiece, and an investment. Whether you’re proudly driving your 1969 Mustang to weekend car shows or painstakingly restoring a classic Corvette in your garage, the right insurance makes all the difference.

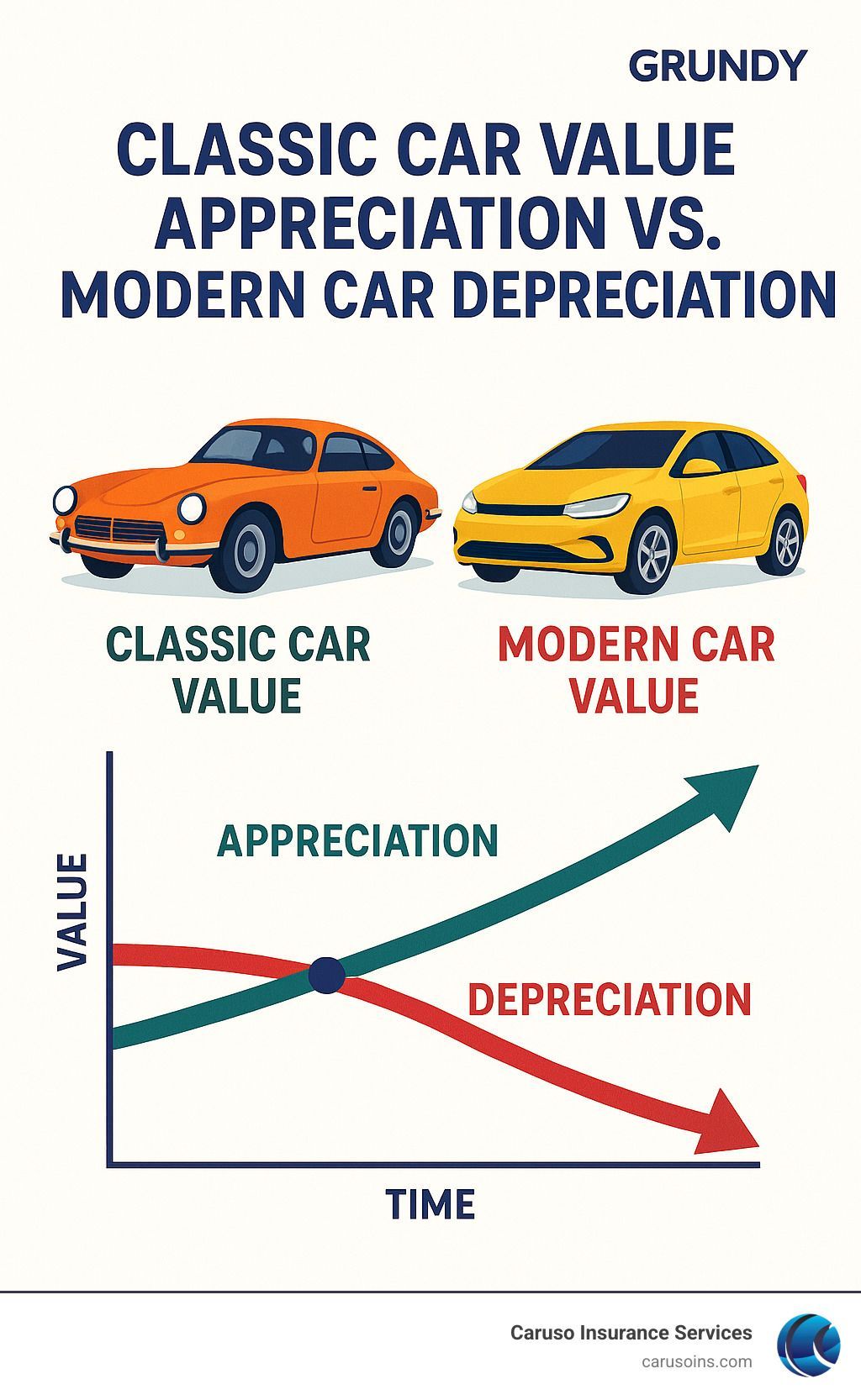

Unlike standard auto policies, classic car insurance is specifically designed for vehicles that appreciate rather than depreciate. These specialized policies offer agreed value coverage, which means you and your insurer agree upfront on your car’s worth, guaranteeing that amount if your vehicle is totaled.

Most classic policies also include benefits standard insurance doesn’t offer:

- Flexible mileage plans (usually 1,000-7,500 miles annually)

- Spare parts coverage (typically $500-$1,000)

- Inflation protection to guard against rising restoration costs

- Specialized roadside assistance with flatbed towing

- Trip interruption reimbursement

I’m Patrick Caruso, an independent agency owner with years of experience helping collectors find the perfect

classic car insurance comparison options to protect their prized vehicles while keeping premiums affordable. My approach combines personalized service with access to multiple specialized carriers to ensure you get complete coverage at competitive rates.

What Makes Classic Car Insurance Unique?

Ever noticed how classic car owners talk about their vehicles? It’s never just “my car” – it’s “my baby,” “my pride and joy,” or “my investment.” That’s because these aren’t ordinary vehicles, and they shouldn’t have ordinary insurance.

Classic car insurance is built specifically for collector vehicles that spend more time being admired than being driven. Unlike your daily commuter, these beauties often increase in value over time – a concept completely foreign to standard auto insurance.

When we talk about collector vehicles, we’re including quite a range: classics (typically 10-20 years old), antiques (25+ years), modified customs, exotic luxury models, classic trucks and motorcycles, vintage military vehicles, and even kit cars or replicas. What unites them all is their collectible status and limited use pattern.

The heart of classic car insurance comparison is understanding that these vehicles serve a different purpose. They’re driven primarily for pleasure – weekend cruises down coastal highways, showing off at car meets, or participating in club events – not for mundane daily commutes or grocery runs.

As one passionate collector put it: “That vintage beauty in your garage isn’t just a car — it’s a time machine, a masterpiece and an investment.” This perspective is why specialized coverage isn’t just nice to have – it’s essential.

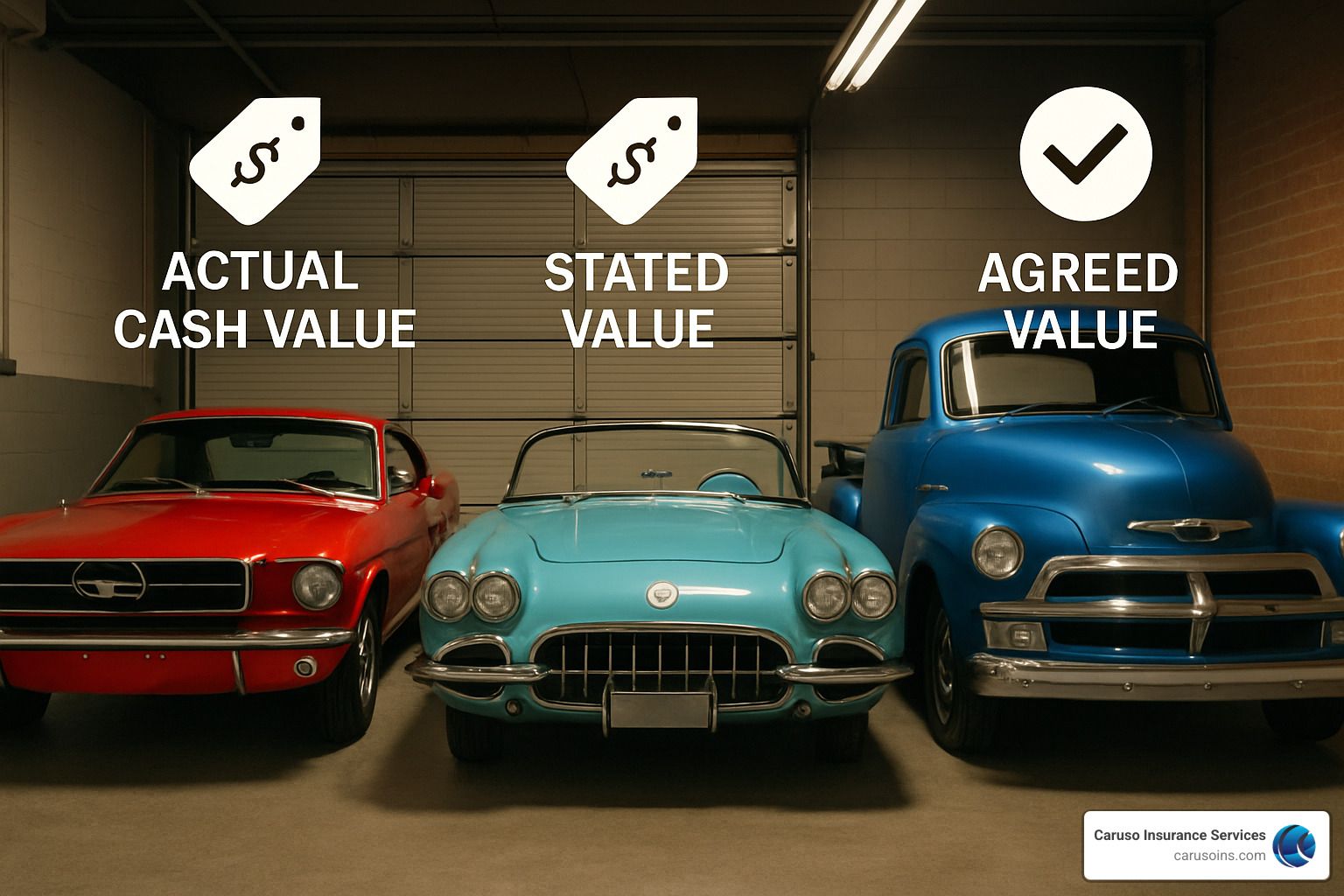

Perhaps the most critical difference is how your vehicle’s value is determined. Standard policies use Actual Cash Value (ACV), which factors in depreciation (ouch!). Classic car policies typically offer Agreed Value coverage, where you and your insurer determine your vehicle’s worth upfront. If the worst happens, that’s exactly what you’ll receive – no haggling, no depreciation calculations.

Many policies also include inflation guard protection that automatically increases your coverage (typically 4-6% annually) to keep pace with appreciation and the ever-rising costs of restoration. This feature alone can save you thousands if you ever need to file a claim.

Classic car insurance vs. standard auto policies

When you dive into a thorough classic car insurance comparison, the differences between specialized and standard coverage become crystal clear:

Standard auto insurance sees your vehicle as a depreciating asset, offering only the Actual Cash Value at the time of loss. Your carefully restored ’69 Camaro? Just another used car getting older by the day. Classic car insurance, on the other hand, provides Agreed Value coverage – you and your insurer agree on the value upfront, and that’s what you’ll receive regardless of market fluctuations.

Usage expectations differ dramatically too. Standard policies assume you’re commuting daily and racking up significant mileage. Classic policies know your vintage beauty comes out primarily for special occasions, typically limiting annual mileage to between 1,000-7,500 miles. This limited use is partly why classic car insurance premiums average about 36% less than standard coverage – a pleasant surprise for many first-time collectors.

Storage requirements matter enormously with collectible vehicles. While your regular insurance might not care where you park, classic car policies typically require secure, enclosed storage – usually a private garage or specialized storage facility. This requirement helps keep premiums lower while ensuring your investment stays protected.

The specialized benefits make a world of difference too. Instead of basic roadside assistance that might send any tow truck, classic policies often provide flatbed towing specifically designed to prevent damage. Many include coverage for spare parts, trip interruption if your car breaks down far from home, and even medical coverage for auto show incidents.

According to the Insurance Information Institute, standard auto policies simply miss the mark for collector vehicles. The actual cash value approach can be devastating for classic car owners who’ve invested countless hours and dollars into their passion projects.

As one classic car owner finded after a garage fire: “If I had standard insurance, my ’67 Mustang fastback would have been valued at a fraction of its true worth. The agreed value policy guaranteed I received what the car was actually worth to collectors.”

At Caruso Insurance Services, we understand that your classic isn’t just transportation – it’s a passion. That’s why finding the right specialized coverage matters more than you might think.

Classic Car Insurance Comparison – Core Policy Types

When shopping for classic car coverage, understanding the different valuation methods is crucial for proper protection. Each type offers different levels of financial security in the event of a total loss

Agreed Value Plans & classic car insurance comparison

Imagine this: you’ve spent years restoring your 1965 Mustang, investing thousands in parts and countless weekends under the hood. If disaster strikes, you want to know exactly what you’ll receive – no surprises.

That’s why Agreed Value is the gold standard in classic car insurance comparison and the preferred choice for most collectors.

With Agreed Value coverage, you and your insurer shake hands upfront on your vehicle’s worth. If your prized possession is totaled, you’ll receive the full agreed amount – no depreciation calculations, no haggling when you’re already dealing with the heartbreak of losing your classic.

The appraisal process is straightforward but thorough. Most insurers will ask for documentation like professional appraisals, detailed photographs from multiple angles, restoration receipts, and comparable sales data. This paperwork might seem tedious, but it’s your protection against undervaluation.

What really sets quality Agreed Value policies apart is inflation protection. Many include an inflation guard rider that automatically increases your coverage amount annually (typically 4-6%) to account for appreciation. Many specialized insurers offer inflation protection of up to 6% at no extra premium, ensuring your coverage keeps pace with rising values.

Some companies go even further – certain specialized classic car insurance programs may pay up to 150% of the insured amount if your car appreciates beyond the agreed value. Now that’s peace of mind for serious collectors!

Stated Value & classic car insurance comparison

At first glance, Stated Value policies look similar to Agreed Value – you declare what your classic is worth, and that’s what appears on your policy. But there’s a critical difference that every collector should understand.

The fine print in most Stated Value policies contains language that allows the insurer to pay either the stated amount OR the actual cash value, whichever is LESS at the time of loss. This partial payout risk means your cherished classic could be significantly undervalued when you need coverage most.

These policies often contain depreciation clauses that can take a big bite out of your payout. While stated value policies may offer slightly lower premiums, the potential financial hit rarely justifies the modest savings.

When conducting a classic car insurance comparison, be especially wary of stated value policies masquerading as agreed value. I’ve seen collectors devastated when they find what they thought was guaranteed protection actually left them tens of thousands short after a loss. Always read the fine print, especially regarding payout terms.

Actual Cash Value (when it still makes sense)

While not ideal for most collector vehicles, Actual Cash Value (ACV) policies can make sense in specific scenarios.

If you’re working on a budget build or project car that hasn’t yet reached true collector status, ACV might be appropriate. The same goes for classics that see high mileage (over 10,000 miles annually) or vehicles in original but unrestored condition.

ACV policies determine value based on your vehicle’s depreciated worth at the time of loss, considering age, condition, and current market value. For vehicles that haven’t appreciated or required significant investment, this approach might be sufficient.

Here’s how these options compare:

| Valuation Methode | Guaranteed Payout | Depreciation Applied | Best For | Typical Cost |

|---|---|---|---|---|

| Agreed Value | Yes | No | Restored classics, rare vehicles | $$$ |

| Stated Value | No | Possibly | Mid-range classics, driver-quality | $$ |

| Actual Cash Value | No | Yesting allowed0 | Project cars, daily-driven classics | $ |

At Caruso Insurance Services, we believe your classic deserves protection as special as the car itself. We’ll help you steer these options to find the perfect balance of coverage and value, because your passion project deserves nothing less.

Coverage Add-Ons That Matter

Beyond the core coverage, several add-ons can make a significant difference in your protection. When conducting a thorough

classic car insurance comparison, these extras often separate good policies from great ones.

Must-have endorsements

Your classic car deserves more than just basic coverage. Think of these must-have endorsements as the premium fuel for your insurance policy – they might cost a bit more, but they keep everything running smoothly when you need it most.

Inflation Guard protection automatically increases your coverage limit (typically 4-6% annually) to keep pace with rising values and restoration costs. Without this safety net, your agreed value can quickly fall behind market reality, leaving you undercovered just when you need protection most. Imagine finding your $30,000 agreed value from five years ago now only covers two-thirds of your car’s current worth!

The New Acquisition Grace Period is a collector’s best friend during those impulsive “I have to have it” moments. This provides automatic coverage for newly purchased collector vehicles for a limited time (typically 30 days) before you formally add them to your policy. Hagerty, for instance, offers 30 days of coverage for up to $50,000 on new purchases – plenty of time to call your agent with the good news about your latest find.

Perhaps the most emotionally valuable add-on is the Cherished Salvage Option. This allows you to keep your vehicle after a total loss while still receiving the full agreed value payout (minus a small salvage value). For many collectors, this is priceless—especially for rare or extensively customized vehicles.

As one of our clients shared after a garage fire damaged his beloved ’57 Chevy: “I was able to keep the car AND receive the payout. I’ve since restored it again, and it means even more to me now. The stories this car could tell!”

Nice-to-have perks

While not essential, these specialized perks can provide valuable protection for specific situations that many classic car enthusiasts encounter.

Club Event Liability extends your coverage for participation in car club activities, shows, and exhibitions. This is particularly valuable if you’re active in the collector community and regularly showcase your vehicle at organized events where standard policies might have exclusions.

For the international collector, Overseas Transit Coverage offers protection while your vehicle is being transported across borders for shows or events. Peace of mind when your pride and joy is traveling farther than you are is worth every penny of premium.

The Track Day Rider provides limited coverage for non-competitive track events. While most classic policies exclude racing (and for good reason), some offer coverage for organized driving events where you can safely enjoy your vehicle’s performance capabilities in a controlled environment.

Beyond these, consider how valuable Spare Parts Coverage might be when you’ve accumulated thousands of dollars in original or hard-to-find components. Or how Specialized Roadside Assistance with flatbed-only towing could save your vehicle’s undercarriage from damage during an unexpected breakdown.

Other thoughtful additions include Trip Interruption reimbursement for when your classic leaves you stranded far from home, Auto Show Medical coverage for injuries at car shows, Disaster Relocation expenses during natural disasters, and even Pet Injury Coverage for your four-legged co-pilots.

At Caruso Insurance Services, we can help you

steer these auto insurance optionsto create a comprehensive policy custom to your specific needs. The right add-ons provide peace of mind that goes beyond basic coverage, ensuring your classic car journey remains a joy, not a worry.

Eligibility Checklist for Cars & Drivers

Not every vintage vehicle can qualify for classic car insurance, and not every driver meets the requirements either. Before you start your classic car insurance comparison, it’s important to understand what makes both you and your vehicle eligible.

When it comes to your cherished vehicle, age matters – but it’s not the only factor. Most insurers consider cars between 10-20 years old as “classics,” while the “antique” label typically applies to vehicles 25 years or older. If you’ve got your eye on something newer but with serious collector potential, don’t worry! Some carriers offer “future classic” coverage for vehicles that are likely to appreciate.

The condition of your car plays a huge role too. Your beauty should generally be in good to excellent shape, though some insurers make exceptions for restoration projects (we all have to start somewhere!). While stock or period-correct modifications are usually fine, extensive modern changes might require special coverage options. The bottom line? Your vehicle needs to have demonstrable collector value.

How you use your classic is perhaps the most important factor. These specialized policies assume your vintage ride isn’t your daily commuter. Most policies limit annual mileage to somewhere between 1,000 and 7,500 miles, with the understanding that you’re using it primarily for fun – weekend cruises, car shows, and the occasional nostalgic road trip.

As for the person behind the wheel (that’s you!), insurers look for drivers with clean records. This typically means no major violations in the past 3-5 years, no DUIs or reckless driving charges, and limited or no at-fault accidents. Many companies also want to see that you’ve had your license for at least 5 years and are over 25 years old. For particularly valuable or exotic classics, you might need to demonstrate prior experience with collector vehicles.

One requirement that sometimes surprises people: you’ll need to own a separate daily-use vehicle for each licensed driver in your household. This reinforces that your classic isn’t for everyday errands and commuting.

For a deeper dive into eligibility factors, check out our Classic Car Insurance Requirements guide. These criteria help keep premiums affordable by maintaining the lower risk profile associated with collector cars.

Mileage & usage rules explained

Understanding the mileage limits is crucial when shopping for classic car coverage. These restrictions aren’t just arbitrary rules – they directly impact your premiums and protection.

The Show Plan is perfect if you’re preserving a museum-quality treasure. With limits between 1,000-1,500 miles annually, it’s designed for vehicles that primarily attend car shows, exhibitions, and occasional sunny-day drives. This tier offers the lowest premiums but requires strict documentation of your limited use.

Most active collectors opt for the Hobby Plan, which allows for 2,500-7,500 miles annually. This sweet spot provides enough flexibility for weekend drives, club events, and the occasional road trip, without the premium hike that comes with unlimited mileage. It’s the perfect balance of enjoyment and protection.

If you’re looking for more freedom, some insurers like Grundy offer Unlimited Mileage Options. You’ll still need to prove you have a separate daily driver, and the premiums will be higher, but you won’t need to watch your odometer quite so anxiously. Remember though, even these plans prohibit commuting and business use.

Safeco stands out by offering a regular-use option with up to 10,000 miles annually – perfect for classics that see more frequent enjoyment. Just be honest about your driving habits when choosing a plan. Exceeding your stated mileage limit could result in a denied claim when you need coverage most.

Storage do’s and don’ts

Where and how you store your classic isn’t just an insurance requirement – it’s essential for preserving your car’s condition and value over time.

Proper storage includes keeping your vehicle in a locked, enclosed structure – whether that’s your private garage or a specialized storage facility. Using a car cover adds another layer of protection, while climate control is highly recommended, especially for high-value vehicles. Smart collectors also install security systems and fire protection, and maintain detailed records of both storage conditions and regular maintenance.

On the flip side, avoid storing your classic outdoors or in unsecured locations. Street parking is a definite no-no for primary storage, as is sharing space with hazardous materials that could damage your vehicle. Even during storage periods, don’t neglect regular maintenance – a sitting car can develop problems too.

According to research on vehicle preservation, proper storage significantly impacts how well your classic retains its value over time. Temperature swings, humidity, and exposure to the elements can quickly deteriorate everything from paint and chrome to upholstery and mechanical components.

While some insurers offer more flexible storage requirements, the best protection typically comes with stricter storage standards. At Caruso Insurance Services, we understand that everyone’s situation is different. We can help you understand how storage impacts your classic car insurance requirements and find solutions that work for both your prized vehicle and your budget.

Cost Factors & Smart Ways to Save

Let’s face it – we all love our classic cars, but we also love saving money where we can. The good news?

Classic car insurance comparison typically reveals rates about 36% cheaper than standard auto insurance. That’s a nice chunk of change you can put toward that carburetor rebuild or fresh coat of paint!

Sample premium ranges

Most classic car enthusiasts are pleasantly surprised when they see their insurance quotes. Typically, you’re looking at $200-$600 annually – a far cry from the $1,000+ you might pay for standard coverage on a newer vehicle.

Why so affordable? It’s simple: insurers understand that your pride and joy isn’t facing the same risks as a daily driver. As one of my clients recently told me, “My ’65 GTO only sees sunshine and smooth roads – never rush hour traffic or grocery store parking lots!”

What determines where you fall in that price range? Several factors come into play:

Your vehicle’s value makes a big difference. That entry-level $20,000 classic might cost just $250 a year to insure, while your neighbor’s $100,000 Shelby Cobra could command $600 or more. The valuation method matters too – agreed value policies offer better protection but might cost slightly more than stated value or ACV options.

Your location plays a surprising role as well. Living in a rural area with low crime rates and minimal natural disaster risk? You’ll likely pay less than collectors in hurricane-prone coastal regions or high-density urban areas.

Your driving record speaks volumes to insurers. A clean history suggests you’ll treat your classic with the same care – and they’ll reward you with lower premiums. As one insurance specialist explained to me, “Classic cars are often driven less frequently, maintained more carefully, and stored more securely than daily drivers, resulting in fewer claims.”

Discount hunting checklist

At Caruso Insurance Services, I love helping clients uncover every possible discount. It’s like a treasure hunt that puts money back in your pocket! Here are some savings opportunities to consider during your classic car insurance comparison:

Bundle and save. Combining your classic car policy with your home insurance can shave 5-15% off your premium. Insuring multiple classics with the same carrier? That’s another 10-15% in potential savings. Our expertise in bundling home, auto, and umbrella insurance often results in substantial reductions.

Drive less, pay less. The less you drive your classic, the less you’ll pay. Opting for a lower mileage plan (like 1,000 miles annually versus 7,500) can significantly reduce your premium. Some insurers even offer seasonal designations for vehicles tucked away during winter months.

Secure your investment. Adding anti-theft devices, alarm systems, or GPS trackers can earn you 5-10% discounts. That climate-controlled garage you invested in? It might save you another 5-15% on your premium.

Show your passion. Many insurers offer 5-10% discounts for car club memberships. It makes sense – active club members typically take better care of their vehicles and stay informed about maintenance best practices.

Smart payment choices. Simple things like paying your annual premium in full (5-10% savings), setting up paperless billing (3-5%), or renewing early (5-10%) can add up to meaningful discounts.

Some specialized classic car insurers really go the extra mile with discounts. Many offer reductions of up to 45% based on factors like age, location, and driving record. Others provide special rates when you add multiple classics to your policy.

I recently helped a client save nearly $300 annually by identifying four discounts they qualified for but hadn’t been receiving. As they told me afterward, “That’s enough to cover my annual car club membership and still have money left for a few Sunday drives!”

The cheapest policy isn’t always the best value. The right coverage should protect your passion without breaking the bank. At Caruso Insurance Services, we’ll help you find that sweet spot where protection meets affordability – because your classic deserves nothing less.

How to File – and Win – A Classic Car Claim

Even with the best coverage, the true test of any insurance policy is how it performs when you need to file a claim. Understanding the claims process before an incident occurs can significantly improve your experience and outcome.

Let’s face it – no collector wants to think about their prized vehicle being damaged. But being prepared can make all the difference between a smooth resolution and a frustrating experience.

Preparation is your best friend when it comes to claims. Document everything from day one – keep all restoration receipts, maintenance records, and a detailed inventory of parts and accessories. I always tell my clients to store this documentation both physically and digitally (cloud storage is your friend here!). When my client Mark’s 1965 Mustang was damaged in a hailstorm, his meticulous documentation helped secure a full payout within days.

Creating a visual record is equally important. Take high-quality photos of your vehicle from all angles, including special features and modifications. Update these photos annually or after any significant changes. For vehicles valued over $100,000, consider professional appraisal videos – they’re worth every penny if you ever need to file a claim.

Establishing proper value is where many collectors fall short. Professional appraisals should be updated every 2-3 years or after major restoration work. Research comparable sales to support your valuation, and don’t hesitate to discuss valuation changes with your insurer proactively. Your car’s value isn’t static – make sure your coverage keeps pace.

Finally, know your policy details inside and out. Understanding coverage limits, exclusions, and the claims process before you need it can save tremendous headaches later. When conducting a classic car insurance comparison, pay close attention to each company’s claims reputation and process. Specialized insurers typically offer more knowledgeable adjusters who understand the unique aspects of collector vehicles.

Step-by-step claims timeline

If disaster strikes and you need to file a claim, here’s what typically happens:

The journey begins with your initial report on day one. Contact your insurer immediately, provide basic information about what happened, and receive a claim number. Document the scene and damage if it’s safe to do so – these photos can be invaluable later.

Within 1-3 days, expect adjuster assignment. A specialized classic car adjuster (this specialization is why collector-specific insurance matters!) will contact you to gather details, schedule an inspection, and review your coverage options.

The damage assessment usually occurs within 3-7 days. This includes physical inspection, determining if the vehicle is repairable or a total loss, and discussing repair options. Most classic policies allow you to choose your repair facility – something standard policies often restrict.

Between days 7-30, the repair or settlement process begins. For repairs, you’ll select a repair facility (ideally one with classic car expertise). For total losses, you’ll complete paperwork for your agreed value payout. This stage includes discussions about sourcing rare parts and arrangements for alternative transportation.

Claim resolution typically happens within 15-60 days. For total losses with agreed value policies, payment is usually issued within 15 days – significantly faster than standard auto insurers. For repairs, this includes completion, quality inspection, and claim closure.

Hagerty, for example, typically responds to claims within one business day, with most claims paid within 15 days. This efficiency is one reason they maintain high customer satisfaction ratings.

Avoiding common claim denials

When comparing classic car insurance options, be aware of these common reasons claims get denied:

Usage violations top the list. Using your classic as a daily driver, for commercial purposes, ridesharing, racing, or lending to unauthorized drivers can all void your coverage. One client nearly had his claim denied after his brother (not listed on the policy) borrowed his ’57 Chevy for a wedding – we had to negotiate extensively to get the claim approved.

Documentation failures cause countless headaches. Without proof of your vehicle’s condition, maintenance records, or adequate value documentation, you’re at a disadvantage. Keep everything organized and accessible.

Policy breaches include exceeding mileage limitations, improper storage, allowing unapproved drivers behind the wheel, or failing to maintain a separate daily driver. These requirements exist for a reason – they help keep premiums affordable by reducing risk.

Preventable damage from neglect, poor maintenance, improper storage, or mechanical failure due to lack of upkeep often leads to denied claims. Insurance covers unexpected events, not inevitable consequences of neglect.

Maintaining a simple mileage log (even a notebook in your glove box works), documenting your storage situation with periodic photos, and keeping thorough records of all maintenance can prevent most claim denials. At Caruso Insurance Services, we offer guidance on proper documentation and claim preparation to ensure you’re protected when it matters most.

Remember – the best claims experience is the one you’re thoroughly prepared for but never have to use!

Frequently Asked Questions about Classic Car Insurance Comparison

What vehicles qualify for collector coverage?

Wondering if your pride and joy qualifies for special coverage? You’re not alone. Eligibility requirements vary between insurers, but there are some common guidelines that most companies follow.

In terms of age, most insurance companies consider vehicles between 10-20 years old as “classics,” while those 25+ years old earn the distinguished “antique” title. If you’ve got your eye on something newer but with clear collector appeal, don’t worry! Some forward-thinking insurers now offer “future classic” coverage for vehicles that are likely to appreciate.

Beyond just traditional classics like that gorgeous ’57 Chevy, specialized coverage extends to a surprising variety of vehicles. Modified and custom cars, lovingly built kit cars and replicas, exotic and luxury vehicles that turn heads, classic trucks and SUVs with vintage charm, motorcycles from bygone eras, military vehicles with historical significance, and even antique tractors and farm equipment can all find proper protection.

Your vehicle should generally be in good to excellent condition—though don’t panic if yours is still a work in progress, as some understanding insurers offer coverage for restoration projects. As for modifications, they should ideally be period-correct or tasteful customs that improve rather than diminish the vehicle’s character.

Perhaps most importantly, the vehicle cannot serve as your daily transportation. As one underwriter put it: “We’re looking for vehicles that are maintained as collectibles rather than basic transportation. The care and passion owners show for these vehicles translate to lower risk.”

Can I insure my classic as a daily driver?

I hear this question frequently, and I have to be honest—the answer is generally no, though there are some exceptions worth knowing about.

When conducting a thorough classic car insurance comparison, you’ll find that limited usage is a fundamental requirement for specialized coverage. Insurance companies typically expect your classic to be driven occasionally for pleasure (not for mundane commuting or running errands), limited to between 1,000-7,500 miles annually, and supplemental to a regular-use vehicle.

That said, you do have some options if you want to drive your classic more regularly:

Some specialized insurers stand out with their Regular Use Option, allowing up to 10,000 miles annually—perfect for classics you just can’t bear to keep garage-bound. For true daily drivers, a standard auto policy with an agreed value endorsement might be necessary, though be prepared for significantly higher premiums. Some insurers also offer hybrid policies for vehicles that aren’t quite daily drivers but exceed typical classic car mileage limits.

The most important thing? Be transparent with your insurance agent about how you actually use your vehicle. Misrepresenting usage might save a few dollars up front but could result in devastating claim denials when you need coverage most.

How is the car’s value determined for payout?

This might be the most crucial question in any classic car insurance comparison, since valuation directly impacts your financial protection if the worst happens to your beloved vehicle.

With agreed value determination—the gold standard for classic cars—you propose a value based on your vehicle’s condition, rarity, and market position. You’ll need documentation to support your valuation, including detailed photos, professional appraisals, and receipts for restoration work or improvements. Your insurer reviews this material and, once they agree to a specific amount, that becomes your guaranteed payout in case of a total loss.

To establish an accurate value, you might use professional appraisals from certified classic car experts, auction results for comparable vehicles, valuation tools from reputable sources, valuation services through classic car clubs, or recent sales of similar vehicles.

Your vehicle’s insured value isn’t static, either. Many policies include inflation guard increases (typically 4-6% annually), and you can update your coverage to reflect documented improvements and restoration work. Market appreciation for specific models might also affect value, which is why periodic reappraisal (recommended every 2-3 years) is so important.

Some providers offer exceptional protection against appreciation. Some specialized classic car insurance programs stand out by potentially paying up to 150% of the insured amount if your car appreciates beyond the agreed value. Many specialized insurers offer inflation protection of up to 6% at no extra premium.

The fundamental difference between classic and standard insurance lies in this valuation approach: classic policies lock in an agreed value that doesn’t depreciate, while standard policies pay actual cash value, which factors in depreciation—often leaving you with far less than you need to replace your special vehicle.

Classic Car Insurance Blog: Insights, Tips, and Comparisons

Navigating classic car insurance comparison doesn’t have to be as complex as rebuilding a vintage carburetor. As we’ve seen, the right policy strikes that perfect balance between robust coverage and reasonable premiums, all while acknowledging what makes your collector vehicle special.

After diving deep into the options, here’s what stands out:

First and foremost, valuation method is your foundation. Agreed value coverage gives you that ironclad guarantee your beauty will be covered for its full worth, not some computer-calculated depreciation figure. It’s the difference between getting what your ’67 Corvette is actually worth versus what a standard insurer thinks a “used car” from 1967 might fetch.

The specialized carriers simply get it. They understand why you keep that garage spotless, why you have a separate calendar for car shows, and why you talk about your vehicle like it’s part of the family. This understanding translates into policies custom for collectors, adjusters who appreciate restoration work, and premiums that won’t make you wince.

Those usage limitations? They’re actually working in your favor. You can’t commute in your classic, but did you really want to expose your pride and joy to rush hour fender-benders anyway? The mileage caps and storage requirements directly contribute to those substantially lower premiums you’ll enjoy.

Documentation becomes your best friend if trouble ever strikes. Those folders of receipts, the detailed photographs, and regular appraisals aren’t just for showing off at car club meetings—they’re your insurance policy for your insurance policy. The collectors who sail through claims are invariably the ones who kept meticulous records.

Don’t overlook those discount opportunities. From bundling with your home insurance to leveraging your car club membership, these savings add up quickly. Many of our clients are pleasantly surprised to find their cherished classic costs less to insure than their daily driver.

At Caruso Insurance Services, we’ve helped countless collectors throughout Corona, CA, and surrounding areas find that perfect classic car coverage. We understand these aren’t just vehicles—they’re time machines, investments, and often the culmination of lifelong dreams.

Our independent agency approach gives us the flexibility to shop multiple specialized carriers, finding that sweet spot where coverage, cost, and service align with your specific needs. Whether you’re insuring your first restoration project or managing a growing collection, we’ll help you steer the options with the same attention to detail you’ve put into your vehicle.

For more information about

classic car insurance optionsor to request a personalized quote, reach out to us at Caruso Insurance Services. Let’s make sure your automotive passion has protection that matches the care you’ve invested in your classic.