See How We're Different

or Call Us: 951-547-6770

Understanding the Insurance Challenge for Classic Car Daily Drivers

How to insure a classic car as a daily driver requires understanding the unique challenges and solutions available to protect your vehicle. Here’s what you need to know:

| Quick Answer: How to Insure a Classic Car as a Daily Driver |

|---|

| 1. Use a standard auto insurance policy with comprehensive and collision coverage |

| 2. Document the vehicle’s agreed value with photos and appraisals |

| 3. Expect to pay higher premiums than specialized classic car insurance |

| 4. Consider adding special endorsements for original parts coverage |

| 5. Install safety upgrades to potentially reduce premiums |

Imagine cruising to work in your 1960s muscle car, turning heads at every stoplight. While the experience is best, standard classic car insurance won’t cover daily driving. Most collector policies specifically exclude commuting and everyday errands, with strict annual mileage limits between 2,500 and 7,500 miles.

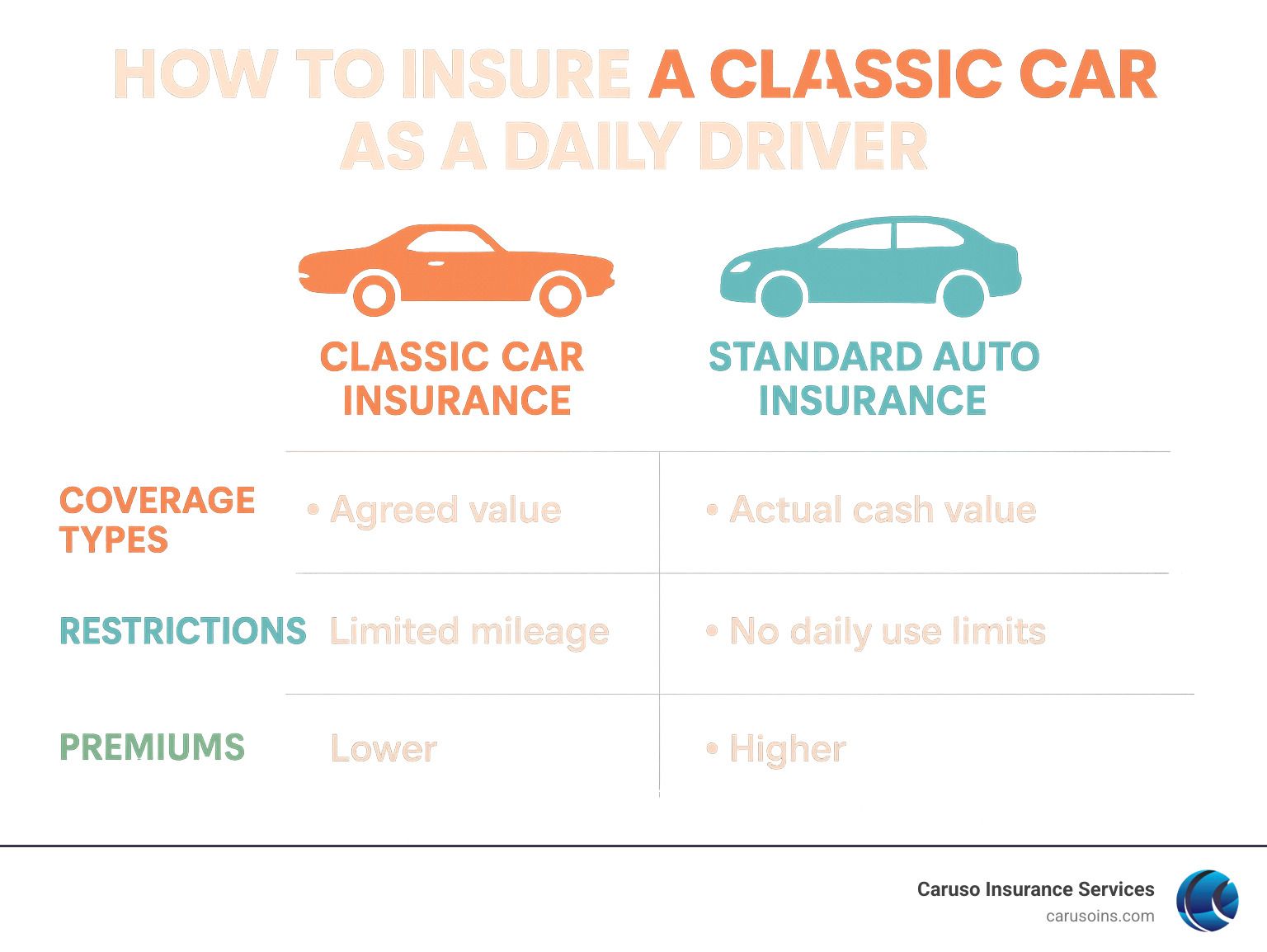

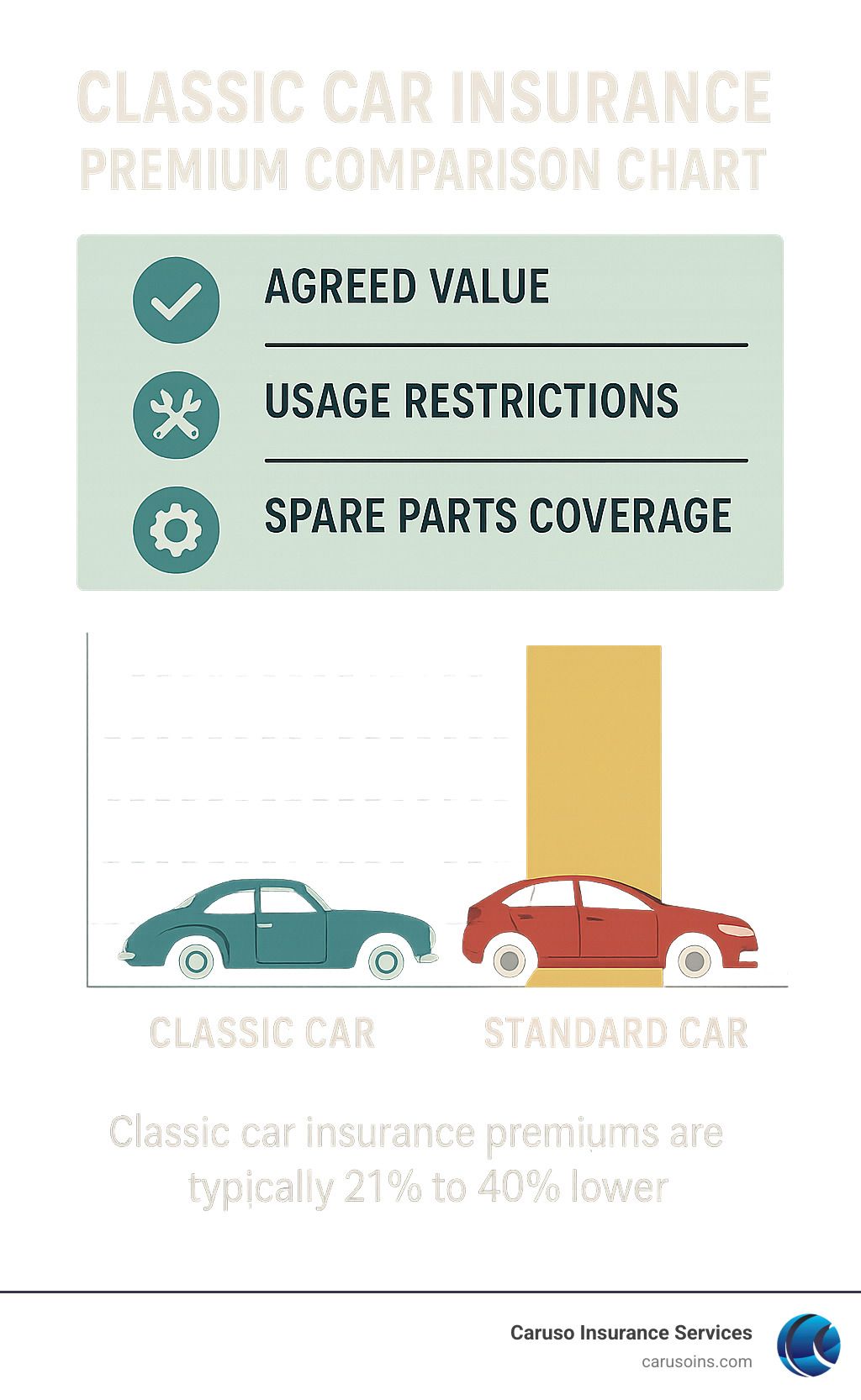

The key difference? Classic car insurance is designed for occasional pleasure driving, not daily use. These policies offer agreed-value coverage at lower rates (typically 21-40% less than standard policies) but require:

- Limited annual mileage

- Secure garage storage

- A separate daily driver for each licensed household member

- Clean driving records

When you plan to drive your classic regularly, you’ll need a standard auto insurance policy instead. This means higher premiums but ensures you’re properly covered for all driving scenarios.

As Patrick Caruso, I’ve helped numerous classic car enthusiasts steer the complex world of how to insure a classic car as a daily driver through my experience as an independent agency owner specializing in both personal and commercial insurance solutions.

Key how to insure a classic car as a daily driver vocabulary:

– classic car insurance comparison

How to Insure a Classic Car as a Daily Driver: Step-by-Step Roadmap

Turning your weekend showpiece into your Monday-through-Friday ride requires a different insurance approach. Let me walk you through exactly how to protect that beauty when it’s hitting the pavement regularly.

First things first – be completely honest about usage. I can’t stress this enough. Tell your insurer that beautiful ’67 Mustang will be your daily commuter. Hiding this fact might save a few dollars initially, but can lead to devastating claim denials later. Trust me, I’ve seen the heartbreak firsthand.

Next, gather documentation that proves your car’s value. This includes professional appraisals, all those restoration receipts you’ve been saving, photos from every angle (engine bay, interior, undercarriage), and comparable sales data. This paperwork becomes your evidence for establishing an agreed value with your insurer.

Tracking your mileage might seem tedious, but it’s worth the effort. A simple logbook noting dates, destinations, and odometer readings can demonstrate your actual driving patterns. Some insurance companies will offer higher mileage allowances if you’re willing to pay a bit more in premium.

When it comes to valuation, you’ll need to choose between

agreed value and stated value coverage. The difference matters tremendously. Agreed value guarantees a specific payout amount if your classic is totaled, while stated value policies might pay either the stated amount or actual cash value (whichever is less). For daily drivers, the protection of agreed value is often worth the extra cost.

| Feature | Classic Car Policy | Standard Auto Policy |

|---|---|---|

| Usage | Limited pleasure driving, car shows, club events | Daily commuting, unlimited mileage |

| Valuation | Agreed value | Actual cash value (depreciation applies) |

| Mileage Limits | Typically 2,500-7,500 annually | No restrictions |

| Premium Cost | Lower (21-40% less on average) | Higher |

| Storage Requirements | Secured garage or facility | No specific requirements |

| Daily Driver Requirement | Separate vehicle needed for each licensed driver | Not required |

| Parts Coverage | Original/OEM parts often included | Aftermarket parts typically used |

| Roadside Assistance | Specialized (flatbed towing, soft straps) | Standard |

Since you’ll be in traffic daily, set higher liability limits than you might for a weekend cruiser. Fender benders happen, and you want ample protection. Consider limits of 100/300/100 or higher to safeguard your personal assets.

Your deductible choice affects both premiums and out-of-pocket costs. A higher deductible lowers your premium but means more money from your pocket if you need repairs. For a daily-driven classic, finding the sweet spot is crucial – I typically recommend $500-1,000 for most clients.

Choosing the Right Policy Type When You Need to “Insure a Classic Car as a Daily Driver”

For regular transportation in your classic, a standard auto policy typically makes the most sense. Comprehensive coverage protects against those non-collision nightmares like theft, vandalism, and weather damage. Collision coverage handles accidents regardless of fault – essential when you’re on the road daily.

Don’t skimp on uninsured/underinsured motorist coverage. Unfortunately, about 1 in 8 drivers on the road has no insurance at all. If one of them hits your irreplaceable classic, this coverage becomes your financial lifeline.

“Many classic car owners don’t realize that their collector policy won’t cover them if they’re using the vehicle for daily commuting,” explains our insurance specialist at Caruso Insurance Services. “A standard policy with the right endorsements provides the protection you need for everyday use.”

If available, add an original parts endorsement to your policy. This ensures repairs use factory or equivalent parts rather than cheaper alternatives that might diminish your classic’s value and authenticity.

More info about Auto Insurance

Filing the Application: Where the Phrase “How to Insure a Classic Car as a Daily Driver” Shows Up in Underwriting Questions

When you sit down to complete your insurance application, be prepared for specific questions about your classic’s daily use:

Proof of separate vehicles will likely be requested. Even with standard policies, insurers often want to know if you have modern cars in your household. Having another vehicle doesn’t disqualify you from daily-driving your classic, but it helps establish your usage patterns.

Be realistic with your annual mileage estimate. Underestimating could jeopardize future claims, while overestimating might unnecessarily inflate your premiums. At Caruso Insurance, we help clients calculate reasonable mileage projections based on commute distance and typical errands.

Storage documentation remains important even for daily drivers. Photos of your garage or secure parking situation demonstrate that your vehicle is properly protected when not in use, potentially helping with rates.

Many insurers require an odometer affidavit documenting your current reading. This establishes a baseline for future mileage verification and helps prevent fraud in the insurance system.

Your driving record becomes especially important when insuring a classic for daily use. Insurers view this arrangement as higher risk than weekend-only pleasure driving, so clean records are particularly valuable for keeping premiums manageable.

“The application process for daily-driven classics requires more documentation than standard vehicles,” notes our team at Caruso Insurance Services. “We help our clients steer these requirements to ensure they receive appropriate coverage.”

Classic vs. Standard Auto Insurance: Key Differences That Impact Daily Drivers

Let’s talk about what really sets classic and standard auto insurance apart – because when you’re driving that beautiful vintage car every day, these differences matter more than you might think.

Agreed Value vs. Actual Cash Value

When you’ve got a classic car insurance policy, you and your insurer shake hands on what your car is worth before you ever sign anything. This “agreed value” means if the worst happens, that’s exactly what you’ll get paid – no arguments about depreciation.

With standard auto insurance, it’s a different story. Your payout is based on actual cash value, which factors in depreciation. That makes perfect sense for your everyday Honda that loses value the minute you drive it off the lot, but it can be a real problem for classic car owners whose vehicles might actually be gaining value over time.

“Many of our clients are surprised to learn how much money they might leave on the table with standard coverage,” our insurance specialist at Caruso Insurance shares. “We often recommend looking into stated value endorsements that can better protect the true worth of daily-driven classics.”

Usage Restrictions

Classic car policies are designed with the weekend driver in mind. They expect you’ll take that beauty out for Sunday drives, car shows, and maybe the occasional club event. That’s why they cap your annual mileage – typically between 2,500 and 7,500 miles.

On the flip side, standard auto policies don’t care if you’re commuting 50 miles each way or running daily errands. Drive as much as you want, whenever you want – that’s what they’re built for.

Spare Parts Coverage

Anyone who’s ever owned a classic knows finding parts can be like hunting for buried treasure. That’s why classic car insurance often includes coverage for those hard-to-find spare parts – sometimes up to $750 or more at no extra cost.

With standard auto insurance, you’re generally on your own when it comes to parts. Some insurers do offer special endorsements for this purpose, but it’s not built into most policies.

Premium Differences

Here’s where things get interesting for your wallet. Industry data shows that classic car insurance premiums typically run 21% to 40% lower than standard insurance. That’s a nice chunk of savings – until you start daily driving. Then those savings vanish faster than a muscle car at a green light.

Claims Handling

When something goes wrong with your ’67 Mustang, you want someone who understands what makes it special. Classic car insurers typically have adjusters who speak your language – they understand restoration costs and know how to source those vintage parts.

Standard auto insurers are great at handling fender benders on modern vehicles, but may not appreciate the difference between original and reproduction parts for your classic beauty.

Classic Car Insurance Comparison

Why Most Classic Policies Exclude Commuting

There’s method to the madness when classic policies limit your driving. Here’s why they put the brakes on daily use:

- Mileage caps protect value: Every mile adds wear and tear, potentially diminishing what makes your classic special.

- Risk exposure: Let’s be honest – driving in rush hour traffic five days a week dramatically increases your chances of an accident compared to occasional Sunday drives.

- Actuarial loss data: Insurance companies aren’t just making this stuff up. Their statistics show daily-driven classics file more claims, plain and simple.

- Household vehicle requirement: Most insurers assume your classic is your “fun” car, not your only means of getting to work.

“Think of classic car insurance as being priced for a part-time relationship with your car,” our team often explains with a smile. “When you move in together and see each other every day, the relationship changes – and so does the insurance.”

When a “Hybrid” Endorsement or Higher Mileage Rider Makes Sense

Not everyone’s situation is black and white. Maybe you’re not quite a daily driver, but definitely more than a weekend warrior. That’s when these middle-ground options might be your sweet spot:

Limited-use endorsements can be perfect if you commute just once or twice a week while keeping your classic garaged the rest of the time.

Increased mileage tiers are offered by some specialty insurers who understand your passion for driving. They might allow up to 10,000 miles annually for an additional premium.

If you live somewhere with distinct seasons, seasonal daily use options might let you enjoy summer commuting in your convertible while keeping classic car benefits.

And regardless of which policy type you choose, an umbrella liability policy provides that extra layer of protection that can help you sleep better at night.

“I have a client who drives his ’65 Corvette three days a week from April through October,” shares our insurance specialist. “We found him a specialty policy with a seasonal adjustment that gives him the best of both worlds.”

Classic vs. Standard Auto Insurance: Key Differences That Impact Daily Drivers

Let’s face it – insuring your classic beauty for daily driving comes with a few problems to clear. Whether you’re looking at a specialty policy with higher mileage allowances or a standard auto policy with classic car endorsements, certain factors can make or break your eligibility.

Driver Age & Record

Most insurance companies want to see that you’ve got some life experience under your belt – typically requiring drivers to be at least 25 years old. And that driving record? It needs to be cleaner than your car’s engine bay. Generally, no serious tickets or accidents in the past three years is the standard. When you’re planning to daily drive your classic, insurers get even more particular about your driving history since they view it as higher risk.

“We often see clients with perfect driving records get significantly better rates when insuring classics for regular use,” our team at Caruso Insurance Services has observed.

Separate Daily Vehicle

Even when pursuing standard insurance, having another car in your garage can work wonders for your rates and eligibility. It shows insurers that your ’67 Mustang isn’t your only way to get groceries, which they find reassuring. Think of it as proving you’re not putting all your transportation eggs in one vintage basket.

Secure Storage

While specialty classic policies are strict about garage requirements (often demanding locked, secure facilities), even standard policies care about where you park your treasure. A documented garage or secure parking situation can not only lower your premiums but also reduces theft risk. Those photos of your secure garage might just save you hundreds on your policy.

Vehicle Condition

That gleaming paint job and carefully maintained interior aren’t just for car shows – they matter to insurers too. Well-maintained classics in good-to-excellent condition typically qualify for better rates. Keeping detailed maintenance records shows you’re serious about preserving your vehicle, even while using it regularly.

Documentation Photos

“One of the most common mistakes we see is inadequate documentation of the vehicle’s condition and value,” our team often tells clients. Those smartphone photos might seem like a hassle, but comprehensive pictures showing your vehicle’s condition, modifications, and storage situation help establish value and can make a world of difference when filing a claim.

It’s worth noting that according to the National Highway Traffic Safety Administration (NHTSA) findings on older-car safety, the chances of fatal injuries increase with a car’s age. This makes safety considerations particularly important when you’re using your classic as more than a weekend cruiser.

Classic Car Insurance Requirements vary between insurers, but these fundamentals remain consistent across most providers.

Mileage Limits, Odometer Audits, and How to Negotiate Higher Caps

Understanding the mileage game can help you steer your insurance options more effectively:

Most classic policies offer tiered mileage allowances – typically 2,500, 5,000, or 7,500 annual miles. Some specialty insurers might stretch to 10,000 miles if you’re willing to pay a bit more. For the tech-savvy classic owner, some companies offer usage-based options with GPS tracking to verify your driving patterns and mileage.

Keeping a written log of your trips can demonstrate responsible usage and might support your case when asking for higher mileage allowances. And if you’re primarily a fair-weather classic driver, look into seasonal waivers that acknowledge your car hibernates during winter months.

“When negotiating higher mileage caps, a strong history of responsible ownership makes all the difference,” notes our insurance specialist. “We’ve helped clients get custom mileage allowances by showing their consistent care and seasonal driving patterns.”

What Insurers Require as Proof of a “Daily-Use Vehicle” in the Household

When you’re applying for classic car insurance (even with higher mileage options), insurance companies typically want proof that each licensed driver has another car for everyday use. They’ll usually ask for registration copies for all household vehicles, insurance ID cards showing coverage on modern vehicles, financing paperwork proving ownership of daily drivers, and driver’s license information for everyone in your home.

“Motorcycles and public transportation generally don’t satisfy the daily driver requirement for classic car policies,” our team explains with a smile. “Insurers want to see that you have practical alternative transportation – they understand that your Shelby Cobra probably isn’t ideal for grocery runs in December.”

By understanding these requirements before applying, you’ll save yourself time and frustration when figuring out

how to insure a classic car as a daily driver. The right documentation and preparation make all the difference.

Coverage & Cost Trade-Offs for Everyday Use

Let’s talk money – because when you’re driving that beautiful classic every day, your wallet needs to know what to expect.

Daily driving your classic car definitely impacts your insurance costs. While traditional classic car policies might run you just $200-$600 per year, standard policies for daily-driven classics typically jump to $1,000-$2,500 or more annually. Why such a difference? Your premiums depend on several factors: the value and age of your vintage beauty, your driving history, where you live, how you store it, what coverage limits you choose, and whether you’ve added safety or anti-theft features.

Finding the right deductible balance is crucial when insuring your daily-driven classic. Higher deductibles will lower your premiums, but they also mean more out-of-pocket costs if something happens. Many of our clients at Caruso Insurance Services find success with different deductibles for comprehensive versus collision coverage. We also recommend building an emergency fund specifically for covering potential deductibles – this strategy helps you manage risk while keeping your premiums reasonable.

One challenge unique to classic cars is parts scarcity. When your 1968 Mustang needs a new quarter panel, you can’t just run down to the local auto parts store! Insurance policies handle this differently – some standard policies include OEM (Original Equipment Manufacturer) endorsements, while others offer specialty parts coverage as add-ons. Without specific coverage, you might be looking at aftermarket parts for repairs, which could affect your classic’s authenticity and value.

Unlike modern vehicles that depreciate the moment you drive them off the lot, many classics actually appreciate over time. Standard insurance typically doesn’t account for this unique characteristic, which is why accurate valuation and regular policy reviews are essential for daily-driven classics.

“We recommend annual reviews of your classic car’s value to ensure your coverage keeps pace with market changes,” advises our team at Caruso Insurance Services.

How Much is Classic Car Insurance?

Special Coverages & Endorsements Worth Considering

When you’re using your classic as more than a weekend cruiser, certain specialized coverages become particularly valuable. Roadside assistance designed specifically for classic cars (with flatbed towing and soft straps) can be a lifesaver when your vintage vehicle leaves you stranded. Spare parts coverage is especially important for daily drivers experiencing regular wear and tear – it helps cover those hard-to-find components when you need them.

Inflation guard protection automatically increases your coverage limits to keep pace with rising values and restoration costs – particularly important for classics that appreciate. If the worst happens and your car is totaled, salvage retention allows you to keep the vehicle after a loss while still receiving the insured value (minus salvage value). And since your classic is your daily transportation, rental reimbursement ensures you’re not left without wheels while repairs are being made.

“For clients who use their classics as daily drivers, we often recommend comprehensive endorsement packages that address the unique risks these vehicles face,” notes our insurance specialist.

The Claims Process for Daily-Driven Classics

Understanding how claims work before you need to file one can save you significant headaches. With standard policies, you might face restrictions on repair shop choice, while specialty policies typically allow you to choose your preferred facility – crucial when your car needs someone who understands vintage vehicles.

Without specific endorsements, standard policies typically default to aftermarket parts for repairs, which may affect your vehicle’s value and authenticity. Classic car repairs also generally take longer due to parts sourcing challenges, making rental coverage particularly important for daily drivers.

Perhaps most critically, how your policy determines value significantly impacts your financial outcome if your car is deemed a total loss. This is where the difference between actual cash value and agreed value policies becomes most apparent.

“The claims process is where the differences between policy types become most apparent,” explains our team. “We help clients understand these differences before they need to file a claim.”

The bottom line?

How to insure a classic car as a daily driver

means balancing premium costs against comprehensive protection. With the right coverage in place, you can enjoy driving your classic every day while protecting both your investment and your peace of mind.

Making Your Classic Car Safer, More Reliable, and Cheaper to Insure for Daily Duty

There’s something special about cruising to work in a classic car that turns heads at every stoplight. But let’s be honest – these beautiful machines weren’t exactly built with modern safety standards or today’s stop-and-go traffic in mind. The good news? With some thoughtful upgrades, you can make your vintage ride both safer and more insurance-friendly.

When I talk with classic car owners about daily driving their prized possessions, safety upgrades are always part of the conversation. Modern seat belts are usually first on my list – upgrading from those basic lap belts to three-point systems can literally be a lifesaver. And those drum brakes that were “good enough” in 1965? They’re downright scary in modern traffic. A disc brake conversion might be the best money you’ll ever spend, especially when that delivery truck stops short in front of you on a rainy morning.

“My ’67 Mustang stopped like it was thinking about it before I upgraded to discs,” one of our clients told me recently. “Now it stops when I tell it to – big difference when you’re commuting every day!”

Radial tires are another must-have upgrade that dramatically improves handling and wet-weather performance compared to original bias-ply tires. Pair those with LED lighting upgrades, and suddenly your classic isn’t just safer for you – it’s more visible to everyone else on the road.

Don’t overlook the reliability improvements that make daily driving less stressful. Electronic ignition systems eliminate those frustrating no-start mornings when the points get damp. An upgraded cooling system prevents the dreaded roadside boil-over in summer traffic. And power steering might feel like a luxury until you’ve tried parallel parking a classic without it on your lunch break!

Safety Upgrades that Can Lower Premiums

When we’re helping clients insure a classic car as a daily driver, we always discuss how certain safety upgrades might actually save them money. Insurance companies love to see anti-theft devices – modern alarm systems and immobilizers can significantly reduce your theft risk and your premium.

Steering wheel locks might seem old-school, but they’re visually deterring and, when combined with hidden kill switches, create layered protection that insurers appreciate. A mounted fire extinguisher shows you’re serious about safety and can prevent a small issue from becoming a total loss.

One client installed a discreet GPS tracking system that not only qualified for an anti-theft discount but gave him peace of mind knowing his irreplaceable Corvette could be recovered if stolen. And don’t assume modern tech can’t blend with vintage style – backup cameras and proximity sensors can be installed without compromising your car’s classic appearance.

“Document everything,” I always tell clients. “Take photos of your safety upgrades and keep all receipts. These records can lead to meaningful premium reductions when we’re shopping for your policy.”

Routine Maintenance Best Practices for High-Mileage Classics

A daily-driven classic needs more attention than one that only comes out for Sunday drives. How to insure a classic car as a daily driver isn’t just about the right policy – it’s about proving you’re maintaining it properly.

Think of fluids as your car’s lifeblood. Check and change your oil more frequently than you would in a modern car – every 3,000 miles is a good rule of thumb for classics driven daily. Don’t forget transmission fluid, coolant, and brake fluid checks should be part of your regular routine.

Belts and hoses face constant stress in daily driving. I recommend inspecting them monthly for cracks, wear, and proper tension. Smart owners keep spares in the trunk for roadside emergencies – nothing worse than having your commute ended by a $15 part!

Spark plugs and ignition components need more frequent attention in daily drivers. Establish a relationship with a mechanic who specializes in your make and model – they’ll become your most valuable resource. As one of our classic-owning agents likes to say, “Find someone who speaks fluent carburetor.”

Rust prevention becomes critical with daily exposure. Regular undercarriage cleaning is essential, especially if you’re driving through winter road salt or live near the coast. And don’t forget those suspension components – bushings, ball joints, and shock absorbers wear faster with daily use and deserve frequent inspection.

For sourcing quality replacement parts, many of our clients find this replacement part guide particularly helpful.

At Caruso Insurance Services, we understand that daily driving your classic is about balancing passion with practicality. With the right upgrades, maintenance routine, and insurance coverage, you can enjoy your classic every day while protecting its value for the future. We’re here to help you steer that balance with coverage that works as hard as your classic does.

Frequently Asked Questions about Insuring a Classic Car You Drive Every Day

Can you really insure a classic car as a daily driver?

Yes, you absolutely can insure your beloved classic for daily driving, though not in the way many enthusiasts initially expect.

Traditional classic car insurance won’t typically work for daily use. Instead, you’ll need a standard auto insurance policy with comprehensive and collision coverage that protects your vintage beauty through all your daily trips. Some owners find success with specialty endorsements that provide agreed value coverage or guarantee OEM parts for repairs.

“The most important thing is properly documenting your classic’s value,” says our team at Caruso Insurance. “Clear photos, professional appraisals, and detailed restoration records create a solid foundation for your coverage, regardless of how often you drive.”

Some specialty insurers do offer middle-ground solutions with higher mileage allowances up to 10,000 miles annually, which might accommodate limited commuting. But for true everyday use—driving to work, running errands, and all life’s daily journeys—standard auto insurance typically provides the most appropriate protection.

How much more will I pay compared with collector-only insurance?

Be prepared for a notable difference in your premium when transitioning from collector-only to daily driver coverage. Most daily-driven classics cost about 2-4 times more to insure than their weekend-only counterparts.

While collector policies might only set you back $200-$600 annually, standard coverage for that same vehicle when driven daily typically ranges from $1,000-$2,500+ per year. This significant difference reflects the dramatically increased risk exposure from regular road time.

Several factors influence exactly how much more you’ll pay:

– Your classic’s value and type (some models are inherently more expensive to insure)

– Your personal driving history and demographics

– Where you live and how you store the vehicle

– The coverage limits and deductibles you choose

“Many of our clients find the additional premium worth the joy of experiencing their classic every day rather than just on special occasions,” our insurance specialists often note. “We help them find the sweet spot between adequate protection and affordable premiums.”

Will safety modifications hurt or help my vehicle’s value?

This question touches on the delicate balance between preservation and practicality that every classic car owner faces. The honest answer: it depends entirely on how thoughtfully the modifications are performed.

Safety upgrades that often improve value include tastefully installed seat belts that match your interior, professionally done disc brake conversions using period-correct components, and hidden modern electronics that improve reliability without changing appearances. The key feature of value-enhancing modifications is that they can typically be reversed to original specification if desired.

Modifications that might reduce value involve cutting or drilling original components, adding visibly non-period-correct elements, or making changes that permanently alter the vehicle’s originality. Poor-quality installations can also significantly hurt your classic’s value regardless of the modification type.

“We’ve seen beautifully executed safety upgrades actually increase a vehicle’s market appeal,” explains our insurance specialist. “Today’s buyers often appreciate classics that combine vintage charm with modern safety features, especially when those upgrades were performed by respected specialists and thoroughly documented.”

The sweet spot seems to be modifications that respect your classic’s historical integrity while making it more enjoyable and safer for how to insure a classic car as a daily driver situations. When done right, these upgrades can protect both you and your investment.

At Caruso Insurance Services, we understand the unique challenges of daily-driving a classic car and can help you steer both the insurance considerations and the modifications that make the most sense for your specific situation.

Conclusion

How to insure a classic car as a daily driver isn’t just about finding coverage—it’s about protecting something you love while still enjoying it every day. After all, what’s the point of owning that beautiful vintage Mustang if you only admire it in the garage?

The journey to properly insuring your daily classic requires finding that sweet spot between protection, cost, and practicality. Yes, you’ll pay more than you would for a collector-only policy, but the peace of mind knowing you’re covered during your morning commute is worth every penny.

As you move forward, keep these essentials in mind:

Be completely honest with your insurance company about how you use your vehicle. Transparency now prevents headaches later when you need to file a claim.

Document your classic’s value thoroughly with professional appraisals, detailed photographs, and restoration receipts. This documentation becomes your safety net if the worst happens.

Consider those safety upgrades we discussed—not just for insurance discounts, but for your protection. Modern disc brakes and three-point seat belts might save more than just money.

Stick to a rigorous maintenance schedule. Daily-driven classics need more attention than weekend cruisers, and preventative care helps avoid roadside breakdowns.

Review your coverage annually as classic car values tend to change, often appreciating rather than depreciating like modern vehicles.

Here at Caruso Insurance Services, we don’t just understand insurance—we understand the joy that comes from sliding behind the wheel of your classic every morning. There’s something special about driving a piece of automotive history through modern streets, and we believe you should be able to do that with confidence.

Our team specializes in finding creative coverage solutions for classic car enthusiasts throughout Corona, CA and beyond. We work with multiple carriers to craft protection that fits your specific situation, whether you’re commuting in a muscle car or taking the kids to soccer practice in your vintage wagon.

The road to properly insuring your daily-driven classic might have a few twists and turns, but you don’t have to steer it alone. We’re here to help you steer through the complexities and find coverage that lets you enjoy your automotive passion on your terms.