See How We're Different

or Call Us: 951-547-6770

Why Finding the Right Coverage for Your Older Vessel Matters

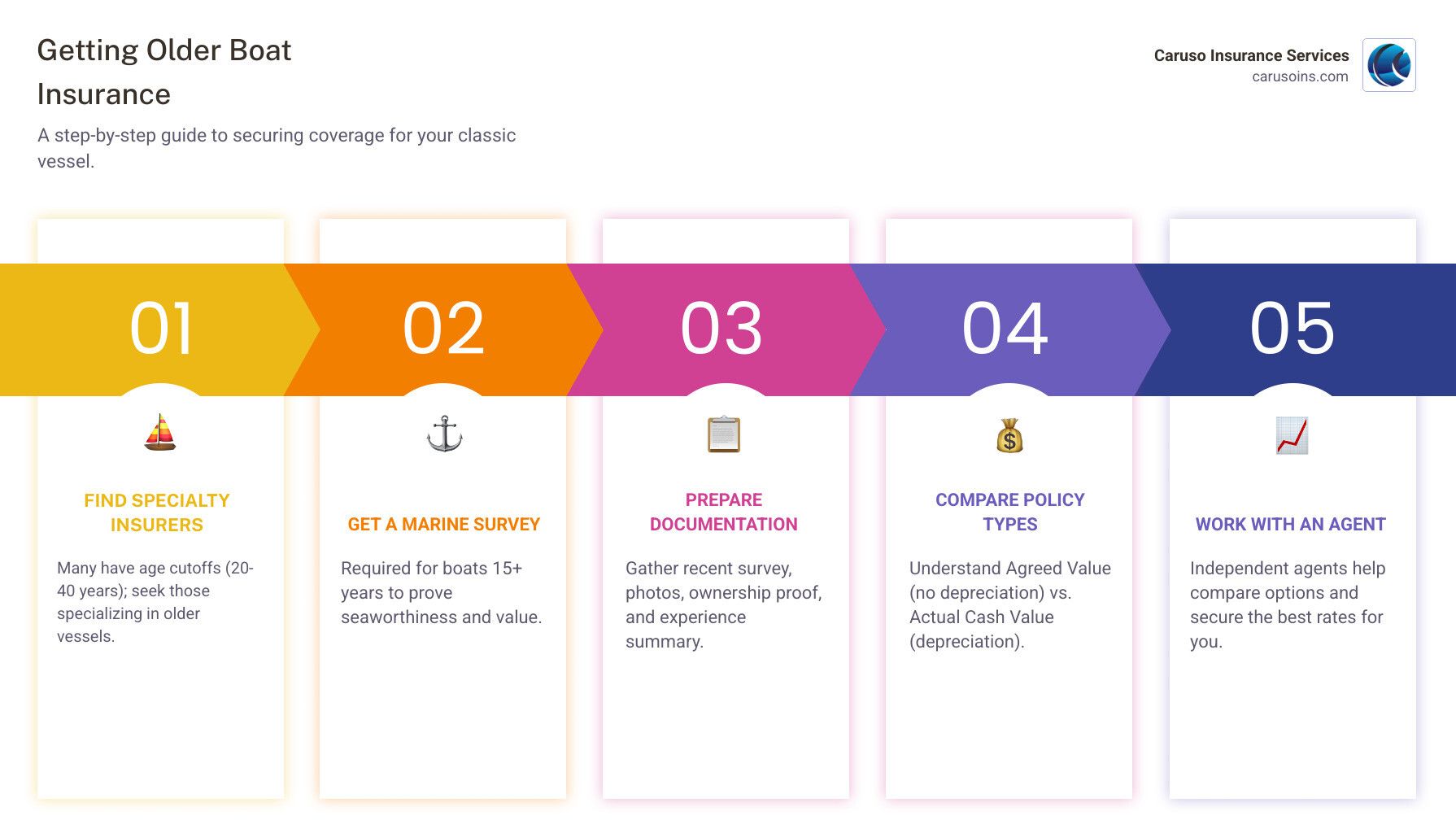

Securing older boat insurance quotes is essential for protecting your investment, but it can be challenging. Insuring vessels over 20 years old requires special consideration, and some insurers decline coverage for boats over 30 years old entirely.

Quick Answer for Older Boat Insurance Quotes:

- Age Limits: Most insurers have cutoffs at 20-40 years

- Survey Required: Marine survey typically needed for boats 15+ years old

- Specialized Insurers: Certain specialty providers offer coverage for older vessels

- Premium Range: Expect 1-1.5% of boat’s value annually

- Documentation Needed: Recent survey, photos, ownership proof, experience summary

Insurance for boats older than 20 years is becoming more difficult to obtain, with specific age limits varying by insurer. For example, some companies only insure fiberglass boats up to 40 years old, while others may require boats under 40 feet if they’re over 30 years old.

Your older boat is a significant financial investment and a source of joy. Whether you’re cruising coastal waters in Florida or enjoying lake life in Colorado, the right insurance coverage protects against unexpected costs that could sink your savings.

The key challenges you’ll face include:

- Limited insurer options willing to cover older vessels

- Required marine surveys to prove seaworthiness and value

- Higher premiums due to perceived increased risk

- Potential coverage gaps with depreciation schedules

I’m Patrick Caruso, an independent insurance agent specializing in boat insurance. My experience helping clients secure older boat insurance quotes shows that preparation and working with the right professionals makes all the difference in finding affordable, comprehensive coverage.

Why Insuring an Older Boat Can Be a Unique Challenge

Older boats have a unique charm, but getting older boat insurance quotes can be a headache. Insurers view older vessels differently, with most companies imposing strict vessel age limits, often at the 20-year threshold. Some have 30-year cutoffs and won’t consider coverage for boats beyond that age, regardless of condition.

This is due to insurer risk perception. Older vessels are seen as having a higher chance of mechanical failures, structural problems, and hard-to-find replacement parts, which can make repairs costly.

Hull material bias also plays a role.

Fiberglass boats are generally easier to insure than

wooden or steel vessels.

Wood is prone to rot, while steel hulls face rust and corrosion. Both materials often require expensive, specialized repairs, leading to

higher scrutiny during underwriting. Your classic vessel will face detailed questions about maintenance, storage, and

seaworthiness concerns. It’s similar to how classic cars need specialized attention.

More info about Classic Car Insurance.

The Critical Role of a Marine Survey

To get coverage for an older boat, you’ll almost certainly need a comprehensive marine survey. It’s like a physical exam for your vessel, and it’s a requirement for most insurers for boats 15 years or older.

Proving seaworthiness is the survey’s primary job. It also establishes value for your coverage, which is crucial for claims. The process involves an out-of-water inspection by a qualified professional. The surveyor’s report becomes your boat’s health certificate, documenting its condition, including moisture levels in the hull, signs of osmosis (hull blisters), and electrolysis damage to metal components.

A survey identifies existing issues before they become insurance headaches, giving both you and your insurer confidence.

How Your Boating Experience and Record Matters

Your experience is as important as the boat itself. Insurers want to see that you are a competent and responsible operator.

Demonstrating competence starts with your years of experience. If you’re moving to a larger or more complex older vessel, insurers look for comparable vessel operation experience. A clean record on smaller boats is good but may not be enough for a 40-foot classic cruiser.

Your clean claims history is vital. Insurers prefer no more than one boating loss in the past three years and may also check your driving record, as careful driving often translates to careful boating.

Boating safety courses and certifications show insurers you’re proactive about safety and can lead to discounts.

Operator qualifications are especially important with older boats, which often require more nuanced handling. The more you demonstrate your understanding of your vessel, the better your chances of securing favorable coverage.

Key Factors That Influence Your Insurance Premiums

When seeking

older boat insurance quotes, understanding what drives premium costs helps you make smarter decisions. Insurers consider a complex mix of factors beyond just your boat’s age.

Your boat’s value is central to premium calculations. A higher-valued vessel costs more to insure because replacement or repair costs are higher.

Age, size, and length paint a risk picture for insurers. As we’ve covered, age creates challenges, but larger and longer vessels also face higher premiums due to increased repair costs.

The condition and maintenance of your boat can lead to better rates. A well-maintained vessel with recent upgrades and a positive marine survey often secures more favorable premiums. Safety improvements can help offset age-related premium increases.

Your storage location matters. A secure, covered facility typically earns better rates than an open mooring because it protects the boat from weather, theft, and vandalism.

Your navigational territory significantly affects premiums. Cruising hurricane-prone waters off Florida or the Texas coast will result in higher rates than boating on the lakes of Colorado or Tennessee. Insurers know that Florida hurricane risk and Texas coastal considerations create exposure to catastrophic losses.

Boat insurance averages about 1.5% of your vessel’s value annually, but your specific situation will determine your actual cost. More info about Boat Insurance Rates.

Understanding Agreed Value vs. Actual Cash Value (ACV)

This is one of the most important decisions when securing

older boat insurance quotes. The difference can mean thousands of dollars at claim time.

Agreed Value coverage means you and your insurer agree on your boat’s worth when you buy the policy. In a total loss, you receive that full amount—no depreciation applied. This is valuable for older vessels with significant investments in restoration or upgrades. Some agreed value policies even offer depreciation waivers for partial losses on older boats.

Actual Cash Value (ACV) policies factor in depreciation, paying what your boat was worth at the time of loss. For a total loss, this could leave you short of what’s needed for a replacement. Depreciation on partial losses can be harsh with ACV policies. For example, a policy might only pay a fraction of replacement costs for parts on a 40-year-old boat.

Agreed value is better for classics, while ACV policies offer lower premiums but create potential for underinsurance. For most older boat owners, the peace of mind from agreed value coverage outweighs the premium savings of ACV.

How Your Location in AZ, CO, FL, ID, NV, TN, or TX Affects Rates

Geography significantly impacts insurance costs. Each state we serve—Arizona, Colorado, Florida, Idaho, Nevada, Tennessee, or Texas—has unique risks that insurers factor into premiums.

Coastal versus inland risks create the biggest premium differences. Boating in Florida or along the Texas Gulf Coast means you’re in storm-prone areas, leading to higher premiums and special requirements like hurricane haul-out plans.

State regulations also vary, affecting coverage limits and how claims are handled.

Lay-up periods in colder climates like Colorado can help lower premium costs. Similarly,

mooring security

in a protected Tennessee marina presents a different risk than an exposed dock on the Texas coast.

Navigating Coverage Options and Common Pitfalls

When getting

older boat insurance quotes, don’t just focus on the premium. The cheapest policy may not be the best if it lacks crucial coverage. Understanding what is and isn’t covered is critical for older vessels with unique vulnerabilities.

Boat insurance is a multi-layered safety net. Liability protection is the foundation, protecting you financially if you’re at fault for an accident that damages property or injures someone.

Hull coverage protects your boat itself—the hull, machinery, and equipment—against threats like fire, theft, and collision.

Other key coverages include:

- Medical payments: Covers injuries on your boat, regardless of fault.

- Personal effects: Protects your belongings on board, like fishing gear and electronics.

- Emergency towing and assistance: Gets you back to shore if your engine fails.

- Wreck removal: Covers the costly process of removing a sunken vessel, which is often required by law.

- Pollution liability: Protects you from cleanup costs and fines from accidental fuel spills.

More info about Boat Insurance Coverage.

Watch Out for These Policy Exclusions and Depreciation Clauses

Even comprehensive policies can have tricky clauses, especially with older boat insurance quotes. I’ve seen many boat owners caught by surprise when filing a claim.

The biggest pitfall for older boats is depreciation on partial losses. As discussed, an ACV policy might only cover a fraction of a new engine’s cost for a 25-year-old boat after depreciation, leaving you with a large out-of-pocket expense.

Wear and tear exclusions are standard. Your policy won’t cover damage from normal aging or lack of maintenance, which is why detailed maintenance records are so important.

Other common exclusions to watch for include:

- Ice and freezing damage: Critical if you don’t properly winterize your boat in states like Colorado, Idaho, or Tennessee.

- Rodent damage: Mice can chew through wiring, and this damage is often excluded.

- Navigational limits: Your policy specifies where your boat is covered. Venturing outside these boundaries can void your protection.

- Tender and dinghy coverage: Often has specific limitations on when and where your dinghy is covered.

The key is to read the fine print. We walk clients through these details to prevent surprises later.

How to Get the Best Older Boat Insurance Quotes

Finding the best older boat insurance quotes requires the right guide. Simply filling out an online form rarely provides the right coverage or price for a vintage vessel.

Working with an independent agent is your secret weapon. At Caruso Insurance Services, we have relationships with multiple carriers across Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho. We know which insurers specialize in older boats and can shop on your behalf to find providers who understand the value of vintage vessels.

Success depends on preparation and presentation. You must show insurers you’re a serious owner who maintains their vessel. Gather all documentation before starting the quote process to tell a compelling story about why your boat deserves coverage.

Highlighting recent upgrades and consistent maintenance can make a huge difference. New engines, updated electrical systems, or modern safety equipment show insurers you’re committed to seaworthiness.

Being transparent about your usage is also important. Your intended cruising grounds—whether the lakes of Colorado or the coast of Florida—and how you use the boat helps us find the right insurer for your situation. More info about Boat Insurance Cost.

We focus on finding coverage that actually protects you, with terms that make sense for your older vessel.

What Documentation Do You Need for Older Boat Insurance Quotes?

To get accurate older boat insurance quotes, your paperwork must be in order. This documentation acts as your boat’s resume, showing it’s a well-maintained vessel with a responsible captain.

The most critical document is a recent marine survey. For boats 15 years or older, this professional assessment is often mandatory. It should be recent (less than a year old) and include an out-of-water inspection to prove seaworthiness and establish value.

Other essential documents include:

- Bill of sale and proof of ownership: To verify you legally own the vessel.

- Detailed, current photographs: High-quality pictures of the boat’s exterior, interior, and engine compartment help underwriters assess its condition.

- Boating resume: A summary of your boating experience, safety courses completed, and claims history.

- List of safety equipment: Details about your boat’s specifications, safety gear, and any notable modifications.

Having this documentation ready speeds up the process and shows insurers you’re a responsible boat owner.

Frequently Asked Questions about Older Boat Insurance

Here are answers to common questions about older boat insurance quotes, based on my experience helping clients across Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho.

Do I need a survey to get insurance for my older boat?

Almost always, yes. For most older boat insurance quotes, a marine survey is required once a boat is 15-20 years old. Some insurers are stricter, requiring them for boats as young as 10. The requirement also depends on the boat’s value and the specific insurer’s guidelines.

Insurers insist on surveys to get proof that your boat is seaworthy and worth the value you’re claiming. The survey establishes both the condition and an accurate replacement value. For very old or valuable vessels, some insurers may even require annual surveys to ensure the boat remains in insurable condition.

What makes wooden or steel boats harder to insure?

Wooden and steel boats face extra scrutiny due to perceived risk and repair complexity, which makes insurers nervous.

Wooden boats carry the threat of rot and deterioration. Repairs often require specialized, expensive craftsmen.

Steel boats battle rust and corrosion, especially in salt water. Like wooden boats, they often need specialized repair facilities and skilled welders.

The repair costs and complexity for both materials typically exceed those for a fiberglass boat. Finding qualified repair facilities can also be challenging. These factors lead to higher premiums and fewer willing insurers. However, specialty providers exist who appreciate well-maintained traditional boats, and an agent can help you find them.

Can I get coverage if I live aboard my older boat?

Living aboard an older boat adds complexity to getting insurance, but it’s possible with the right preparation. Liveaboard situations present increased risks for insurers due to constant use and higher liability exposure.

Most insurers require extensive experience living aboard a similar vessel, sometimes five years or more. They need confidence that you understand the challenges and can handle emergencies.

Your older boat must be in excellent condition, proven by a recent, favorable marine survey that covers not just seaworthiness but also living systems like electrical and plumbing.

Specialized liveaboard policies are often required. These policies account for the increased risks of using your boat as a primary residence. The process requires patience, but we have successfully helped liveaboard clients find the right coverage.

Safeguard Your Older Boat: Secure Optimal Insurance Quotes

Finding the right older boat insurance quotes doesn’t have to be a struggle. While insuring an older vessel has challenges like age limits and required surveys, they are insurable when you approach the process correctly.

Preparation is key. A recent marine survey, a clean boating record, and proof of experience matter greatly. When you demonstrate competence and care, doors open with specialty insurers who understand classic vessels.

The right coverage provides security so you can enjoy your time on the water. Whether in Florida, Texas, Colorado, Tennessee, or Idaho, proper insurance lets you relax and make memories without worry.

Choosing between Agreed Value and Actual Cash Value coverage is a critical decision. Understanding policy exclusions helps you avoid costly surprises, and working with an independent agent can save you time and money.

At Caruso Insurance Services, we understand your older boat is a passion. We specialize in tailoring policies to fit your needs across Arizona, Colorado, Florida, Idaho, Nevada, Tennessee, and Texas. We’ll help you steer the complexities so you can get back to what you love: being on the water.