See How We're Different

or Call Us: 951-547-6770

Why You Need a Fillable ACORD Certificate of Insurance

A fillable acord certificate of insurance is a digital PDF of the ACORD 25 form that lets you quickly complete and share proof of your business liability insurance. Here’s what you need to know:

Quick Answer: Getting Your Fillable ACORD Certificate

- What it is: A standardized form (ACORD 25) showing your insurance coverage details.

- Where to get it: From your insurance provider’s portal, your agent, or ACORD-approved sources.

- How to use it: Fill out the PDF, then share it digitally or print it.

- Who needs it: Contractors, tenants, event organizers, and businesses entering contracts.

- Key benefit: Provides instant proof of insurance without waiting for your agent.

The ACORD 25 Certificate of Liability Insurance is the industry standard for proving you have adequate insurance. Since over 90% of U.S. insurance companies use ACORD forms, you’ll likely need one when bidding on a project, signing a lease, or working with a new client.

A certificate of insurance is not an insurance policy. It’s a snapshot of your coverage at a specific time. As the form states: “This certificate is issued as a matter of information only and confers no rights upon the certificate holder.”

The fillable PDF format has revolutionized this process. Instead of waiting days for an agent to mail a certificate, you can often generate one yourself in minutes, which is critical for meeting tight deadlines.

I’m Patrick Caruso, an independent agency owner and commercial insurance specialist. At Caruso Insurance Services, I’ve helped countless business owners steer fillable acord certificate of insurance requirements across multiple states, saving them time and helping them secure important contracts.

What is an ACORD 25 Certificate of Liability Insurance?

Think of an ACORD 25 form as your insurance policy’s resume. It’s a standardized document providing a clear, at-a-glance summary of your liability coverage. ACORD (Association for Cooperative Operations Research and Development) is a non-profit that creates standardized forms to simplify the insurance industry. The ACORD 25, or “Certificate of Liability Insurance,” is its most widely used form.

The fillable acord certificate of insurance verifies that you, the insured, have adequate insurance coverage. However, it’s not the policy itself—a critical distinction. The certificate is a snapshot of your coverage at a specific moment. Your actual policy may be over 100 pages, but the ACORD 25 distills it into a two-page document for quick review.

When you give an ACORD 25 to a client or landlord (the “certificate holder”), you give them an efficient way to confirm your insurance status. But remember, the certificate doesn’t change, extend, or alter your actual insurance coverage. The fine print on every form makes this clear; the terms and limits are always governed by your underlying policy. For more on this, see our guide on a

Certificate of Liability Insurance.

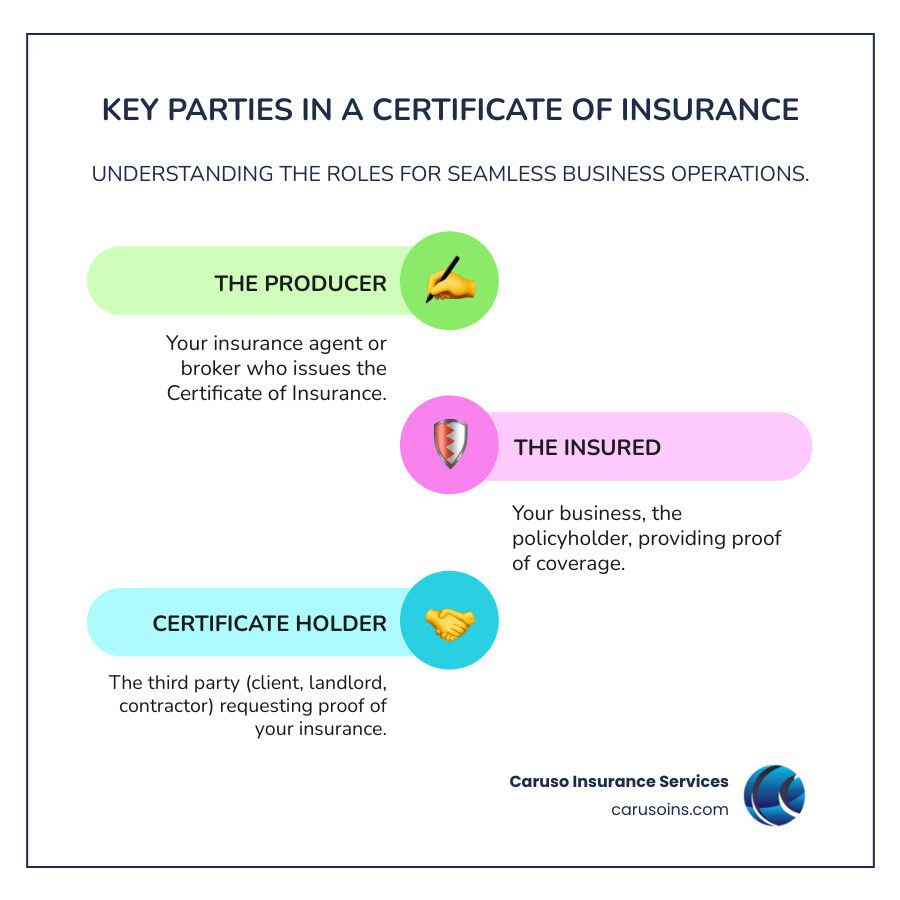

Key Information on an ACORD 25 Form

The ACORD 25 packs essential information into a standard layout. Key details include:

- Producer: Your insurance agent or broker who issued the certificate.

- Insured: Your business’s legal name and address, exactly as it appears on your policy.

- Insurers: The insurance companies providing your coverage, identified by their NAIC number.

- Coverages: This section details each type of liability insurance you carry, such as Commercial General Liability (CGL), Automobile Liability, Workers’ Compensation, and Umbrella Liability.

- Policy Details: For each coverage, the form shows the policy number and the effective and expiration dates, proving your coverage is active.

- Liability Limits: This shows your financial protection, including per occurrence limits (the max paid for one incident) and aggregate limits (the total max paid during the policy period).

- Description of Operations: A flexible space for adding project-specific details, or noting special requirements like “additional insured” status or a “waiver of subrogation.”

- Certificate Holder: The name and address of the person or entity requesting the certificate.

- Cancellation: A clause explaining how the certificate holder will be notified if your policy is canceled.

- Authorized Representative: The signature from the insurance agency that validates the certificate.

Who Needs an ACORD 25?

If you own a business in Colorado, Arizona, Florida, Nevada, Texas, Tennessee, or Idaho, you’ve likely needed an ACORD 25. It’s a universal requirement across many industries.

- Contractors and subcontractors are the most frequent users. General contractors require proof of liability insurance before work begins to protect them from claims. Our guide on Contractor Insurance offers more insight.

- Commercial tenants must provide an ACORD 25 to their landlord to confirm liability coverage for their operations on the property.

- Event organizers need to show proof of insurance to venues, municipalities, and sponsors.

- Any business entering into agreements with other companies will likely exchange ACORD 25s to build trust and clarify financial responsibility.

- Clients and lenders may also request a certificate to verify you have sufficient coverage to protect their interests.

The common thread is risk management. Anyone with a vested interest in your business operations will ask for an ACORD 25 to establish credibility and ensure you’re properly insured.

How to Get and Use a Fillable ACORD Certificate of Insurance

Gone are the days of waiting for a paper certificate in the mail. The fillable acord certificate of insurance has transformed how businesses prove their coverage, turning a multi-day process into a task you can complete in minutes.

A fillable PDF form lets you type information directly into its fields on a computer. You can make changes instantly, save your work, and share the document electronically with anyone who needs it. This speed and efficiency mean you’re no longer at the mercy of business hours or postal delivery. When a client asks for a certificate on a Friday afternoon, you can deliver it promptly, helping you secure contracts and start projects on schedule.

Many insurance providers now offer online portals where you can generate certificates 24/7. Some platforms even include tools to help customize certificates for specific contract requirements, which is a lifesaver on a tight deadline.

Benefits of a Fillable PDF Format

The shift to fillable PDFs offers several advantages for busy business owners:

- Easy to Complete: Type directly into the form instead of handwriting, ensuring legibility.

- Share Digitally: Email a certificate in seconds or upload it to a portal. This is essential when managing projects across states like Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho.

- Print Multiple Copies: Provide documentation to everyone who needs it from a single digital file.

- Save as Templates: If you work with the same clients repeatedly, save a partially completed form to save time on future requests.

- Improved Accuracy: Typing reduces errors, and some forms have validation features to catch mistakes.

- Professional Appearance: A neatly typed certificate reinforces your business’s professional image.

Your Options for Obtaining a Fillable ACORD Certificate of Insurance

Getting a fillable acord certificate of insurance is straightforward, but it’s important to understand your options.

- Direct Downloads: You can find blank forms on various insurance resource sites. However, while you can fill it out, it must be officially issued and signed by an authorized representative from your insurance agency to be valid.

- Online Portals: Many insurance companies provide self-service portals where you can log in and generate your own certificates. These portals often pull your policy information automatically, reducing errors.

- Request from Your Agent: This remains a reliable method. Your agent can ensure every detail is accurate, especially for special provisions like additional insured status. At Caruso Insurance Services, we regularly help clients in Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho with these requirements.

- COI Management Platforms: Some businesses use specialized software that integrates with insurance data to streamline certificate generation, which is useful for managing complex compliance needs.

No matter how you obtain the form, official issuance must come from your insurance provider or their authorized agent. A certificate you fill out yourself is not valid until it’s been reviewed and signed by your agent. If you need to review your coverage options first, our guide to

Business Insurance can help.

A Step-by-Step Guide to Filling Out the ACORD 25 Form

While your insurance agent is responsible for issuing your ACORD 25, understanding its structure helps you gather the right information and verify its accuracy. Here’s a walk-through of each section of the fillable acord certificate of insurance.

Section 1: Producer, Insured, and Insurers

This top section identifies the key parties involved:

- Producer: Your insurance agent or broker’s contact information.

- Insured: Your business’s exact legal name and address, which must match your policy perfectly.

- Insurers: The insurance companies providing your coverage, listed with their unique NAIC (National Association of Insurance Commissioners) numbers.

Section 2: Coverages and Limits

This is the core of the certificate, detailing your liability coverage and financial limits. It shows the certificate holder what protection you have.

Common coverages listed include:

- Commercial General Liability (CGL): Foundational coverage for bodily injury or property damage claims. Learn more about Business Liability Insurance.

- Automobile Liability: Essential if your business uses vehicles. See our Commercial Auto Insurance page for details.

- Workers’ Compensation: Mandatory in most states if you have employees, covering on-the-job injuries. Our Workers’ Compensation Insurance page explains more.

- Excess or Umbrella Liability: Provides an extra layer of protection above your primary policies.

For each coverage, the form includes the policy number, effective and expiration dates, and indicates if a CGL policy is “Occurrence” or “Claims-made.” It also lists your per occurrence limits (the maximum paid for a single incident) and aggregate limits (the total maximum paid during the policy period).

Section 3: Description of Operations, Locations, and Vehicles

This flexible section is used to add context and address specific contractual needs. It’s the most customizable part of the fillable acord certificate of insurance.

Here, your agent can note special provisions, project names, or work locations. Two critical items often included are Additional Insured status and a Waiver of Subrogation. It’s vital to understand that simply writing these terms on the certificate is not enough. Your actual insurance policy must be endorsed to grant these rights; the certificate only confirms that the endorsement exists.

If more space is needed, your agent can attach an ACORD 101 (Additional Remarks Schedule) form.

Section 4: Certificate Holder and Cancellation

The final section identifies who receives the certificate and explains what happens if your coverage changes.

- Certificate Holder: The full legal name and address of the person or entity that requested the certificate.

- Cancellation Clause: This standard language states that if a policy is canceled, the insurer will “endeavor to mail written notice to the certificate holder” but does so “in accordance with the policy provisions.” This means notification is governed by your policy, not the certificate itself. Guaranteed notice of cancellation typically requires a specific policy endorsement.

- Authorized Representative: The signature from your agent or insurance company representative that validates the document. Without this signature, the certificate is not official.

Understanding these sections helps you review certificates confidently and communicate effectively with your agent. At Caruso Insurance Services, we guide clients in Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho through their ACORD 25 forms to ensure everything is accurate.

Common Scenarios and Important Disclaimers

The fillable acord certificate of insurance is a key document for many business transactions. You’ll need one when bidding on construction projects, signing a commercial lease, planning an event, or entering into vendor contracts. In all these cases, the other party needs to verify your Contractor Insurance or Business Liability Insurance to manage their own risk. This is standard practice in states like Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho. Our General Liability Insurance for Renters Guide explores one common scenario in detail.

Understanding the Fine Print: Key Disclaimers

Every ACORD 25 form includes disclaimers that define what the certificate is and what it isn’t. It’s crucial to understand them.

- It’s for information only. The most critical disclaimer states the certificate “is issued as a matter of information only and confers no rights upon the certificate holder.” It’s a summary, not a grant of new rights.

- It cannot change your policy. The form also says it “does not affirmatively or negatively amend, extend, or alter the coverage afforded by the policies below.” If there’s a conflict between the certificate and the policy, the policy always wins.

- It is not a contract. The ACORD 25 “does not constitute a contract” between your insurer and the certificate holder. It’s a statement of fact, not a separate legal agreement.

- Limits may be reduced. A note often clarifies that limits shown may have been reduced by paid claims. The information is accurate at the time of issuance but can change.

These disclaimers clarify the certificate’s role as an informational tool, not a policy extension.

Handling Special Requests on a Fillable ACORD Certificate of Insurance

Contracts often require more than just proof of insurance; they may ask for “additional insured status” or a “waiver of subrogation.” These must be properly handled on your fillable acord certificate of insurance, but just writing them on the form is not enough.

When a client asks to be an additional insured, they want coverage under your policy for claims arising from your work. A waiver of subrogation prevents your insurer from seeking reimbursement from that party after paying a claim. Another common request is for primary and non-contributory language, meaning your policy pays first in a claim.

The golden rule for these requests is simple: the ACORD 25 only documents these provisions; it does not create them. Each of these special requirements must be formalized through an endorsement added to your actual insurance policy. Your agent will work with your insurer to add the correct endorsements before issuing a certificate that reflects them.

At Caruso Insurance Services, we help business owners across Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho steer these requirements daily. We ensure your policies have the right endorsements, so your certificate accurately represents your coverage.

Frequently Asked Questions about ACORD 25 Forms

When dealing with a fillable acord certificate of insurance, questions are natural. Having helped business owners across Colorado, Arizona, Florida, Nevada, Texas, Tennessee, & Idaho, we’ve heard the same ones repeatedly. Here are the answers to the most common questions.

Is a fillable ACORD 25 form a legally binding contract?

No, it is not. This is one of the most critical points to understand. The ACORD 25 is an informational summary of your insurance coverage at a specific moment. Every form states it “is issued as a matter of information only and confers no rights upon the certificate holder.”

The actual contract is your insurance policy document. The certificate is just a convenient tool for communicating the basics of that policy. If there is ever a discrepancy between the certificate and your policy, the policy’s terms will always prevail.

What happens if a policy is cancelled after an ACORD 25 has been issued?

The certificate’s cancellation clause states that notice will be delivered “IN ACCORDANCE WITH THE POLICY PROVISIONS.” In plain English, this means the notification process follows the rules in your actual insurance policy.

Most standard policies only require the insurer to notify you, the named insured, of a cancellation. They are not automatically obligated to notify every certificate holder. If a certificate holder requires guaranteed notification of cancellation, they must request a specific endorsement be added to your policy. Without that endorsement, the standard language on the certificate offers no guarantee.

Can I fill out an ACORD 25 form myself?

This is a two-part answer. You can type information into a fillable PDF of an ACORD 25 to prepare the details for your insurance agent. This can speed up the process and help ensure accuracy.

However, you cannot legally issue or authorize an ACORD 25 certificate yourself. The form is only valid once it has been officially issued and signed by an authorized representative of your insurance company or agency. This signature validates that the information is accurate.

Altering an issued certificate or creating an unauthorized one is insurance fraud and can lead to serious legal consequences. Your role is to provide your agent with the necessary information. Your agent will then ensure the fillable acord certificate of insurance is correctly completed, authorized, and accurately reflects your coverage.

Conclusion

Understanding the fillable acord certificate of insurance empowers your business to move forward with confidence. Whether you’re a contractor, tenant, or business owner, this standardized document is your key to proving you have the right protection.

The ACORD 25 form streamlines how businesses verify coverage, and its fillable PDF format makes the process fast and professional. You can type information clearly, share it digitally, and maintain accurate records.

However, it’s crucial to remember that while you can fill in the details, the certificate must be officially issued and authorized by your insurance agent or provider. This step gives the document its credibility and ensures it accurately reflects your policy’s coverage. Your agent is your partner in making sure everything is compliant and backed by the proper endorsements.

For businesses in Colorado, Arizona, Florida, Nevada, Texas, Tennessee, & Idaho, navigating insurance requirements is vital. At Caruso Insurance Services, we specialize in guiding clients through every step, from selecting coverage to issuing accurate certificates that meet all contractual needs.

We’re here to provide comprehensive protection and peace of mind. If you need help with your insurance, we’ve got your back.