See How We're Different

or Call Us: 951-547-6770

Why Business Insurance for Sole Proprietorship Is Essential Protection

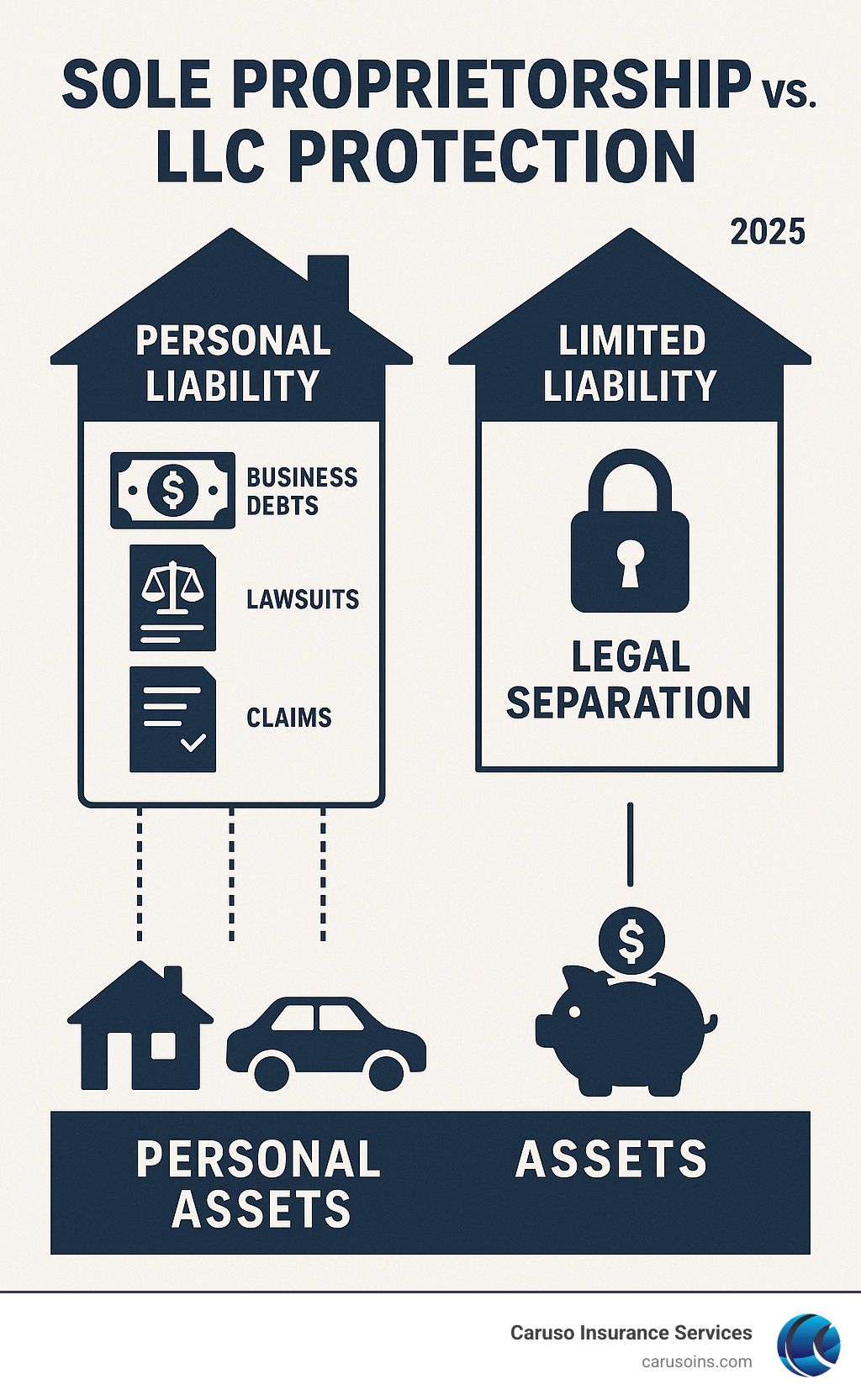

Business insurance for sole proprietorship protects your personal assets from business lawsuits, accidents, or property damage. Unlike corporations or LLCs, sole proprietors have no legal separation between personal and business assets, meaning your home, car, and savings are at risk if something goes wrong.

Essential Coverage for Sole Proprietors:

- General Liability Insurance – Covers customer injuries and property damage ($42/month average)

- Professional Liability (E&O) – Protects against claims of mistakes or negligence ($61/month average)

- Business Owner’s Policy (BOP) – Bundles liability and property coverage at lower cost

- Workers’ Compensation – Required by law when you hire employees ($45/month average)

The statistics are sobering: 43% of small businesses have faced or been threatened with a lawsuit. Without proper insurance, a single claim could wipe out everything you’ve built. A simple slip-and-fall accident could result in medical bills averaging $30,000.

As an independent agency owner and commercial insurance specialist with Caruso Insurance Services, I’ve helped countless sole proprietors find customized policies. I’ve seen how the right coverage provides peace of mind, allowing owners to focus on growth instead of worrying about financial risks.

Similar topics to business insurance for sole proprietorship:

The Solo Risk: Why Your Personal Assets Are on the Line

As a sole proprietor, you’re the boss. You make the decisions and keep the profits. The catch? There’s no legal wall between your business and your personal life, a risk many entrepreneurs overlook until it’s too late.

If your business is sued or incurs debt, creditors can pursue your personal assets: your house, car, savings, and retirement funds. This reality makes business insurance for sole proprietorship essential, not just helpful.

The numbers tell a stark story: 43% of small businesses have faced a lawsuit at some point. For an uninsured sole proprietor, one lawsuit could wipe out decades of hard work and personal savings.

Understanding this risk is the first step. Let’s explore how insurance can shield your personal assets from business liabilities at More on Business Liability Insurance.

What is a Sole Proprietorship?

A sole proprietorship is the simplest business structure. If you’re a freelancer, consultant, or service provider working under your own name, you’re likely a sole proprietor. This unincorporated business structure requires almost no paperwork to start.

The benefits are clear: full control over every decision, simple pass-through taxation, and keeping all profits. Your business income flows to your personal tax return, avoiding the double taxation corporations face.

However, because there’s no legal separation between you and your business, you have unlimited personal liability. Every business debt is your personal debt, and every lawsuit against your business is a lawsuit against you.

How Insurance Protects Your Personal Assets

Think of business insurance for sole proprietorship as a financial bodyguard. It creates a protective barrier that keeps business problems from destroying your personal financial life.

Insurance creates a financial safety net. If a client is injured by your equipment or you’re accused of giving bad advice that causes a financial loss, your policy steps in to handle the costs.

Without insurance, you’d personally cover legal fees (often $50,000+), settlements that could drain your savings, and medical bills from accidents (averaging $30,000). These costs would come directly from your personal accounts.

With the right coverage, your insurance handles these costs, protecting your home, savings, and everything else you’ve built. Most importantly, it gives you peace of mind to focus on growing your business instead of worrying about what could go wrong.

Want to understand exactly what different policies protect you from? Check out

What Does Business Liability Insurance Cover?.

Key Types of Business Insurance for Sole Proprietorship

Choosing the right business insurance for sole proprietorship isn’t overwhelming. It’s like building a custom toolkit with only the essential tools for your specific work. Every sole proprietor has unique risks based on their industry and operations. A freelance writer’s needs differ from a handyman’s, so the best approach is tailoring coverage to your actual business risks.

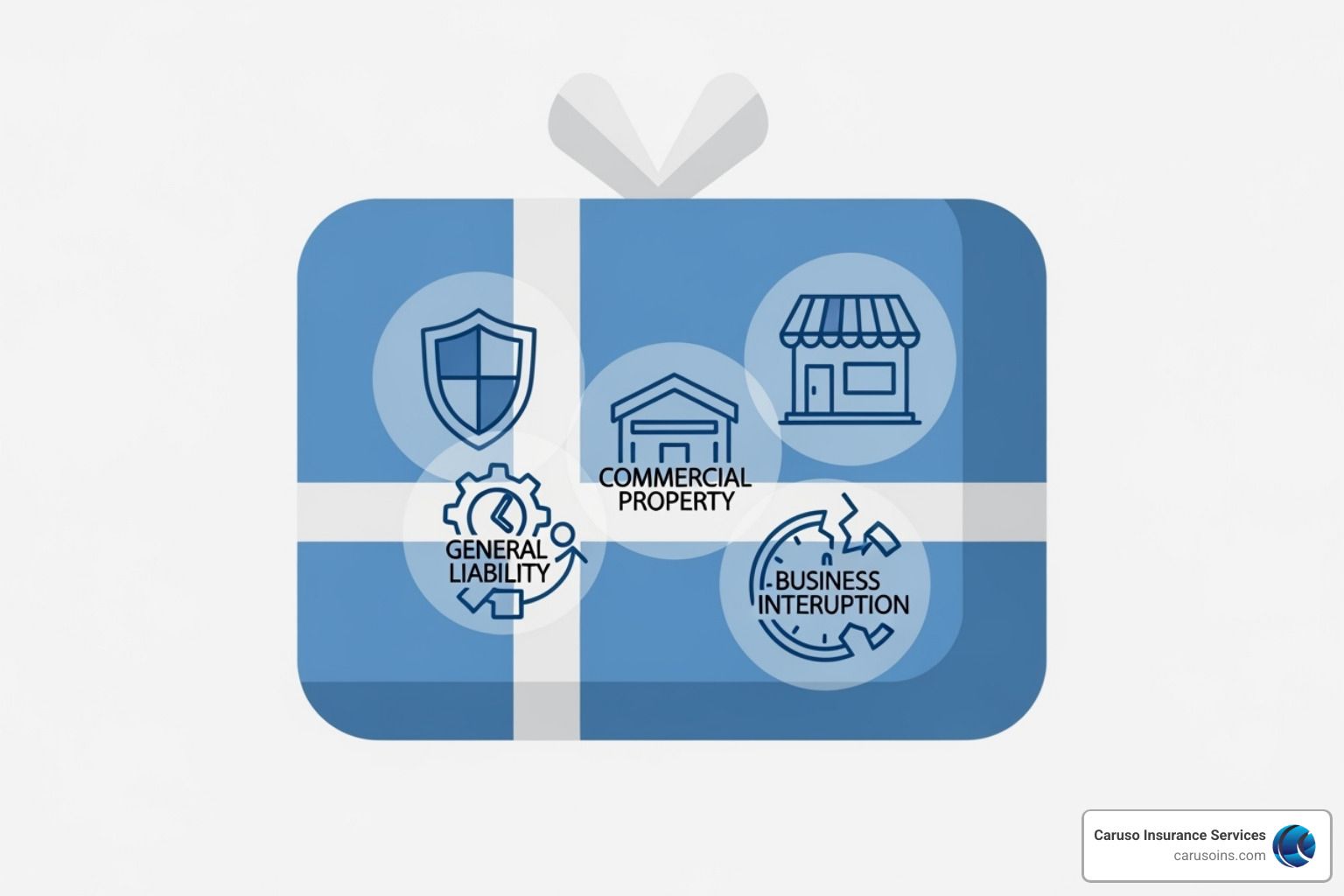

The four main types of insurance most sole proprietors should consider are General Liability Insurance, Professional Liability (Errors & Omissions), Business Owner’s Policy (BOP), and additional specialized coverages.

If you work in the trades, explore Contractors Insurance for industry-specific insights that could prevent costly coverage gaps.

General Liability Insurance (CGL)

General Liability Insurance, or Commercial General Liability (CGL), handles the everyday mishaps that can happen in any business. For example, if a client trips in your home office and breaks their wrist, or you accidentally break an expensive vase at a wedding venue, general liability covers the costs. Without it, you’d pay for medical bills and property damage out-of-pocket.

This essential coverage protects you from three main risks. Bodily injury claims arise when someone gets hurt due to your business activities. Property damage coverage kicks in when you accidentally damage someone else’s property while working. The third protection, advertising injury coverage, is vital in the digital age. It covers claims like copyright infringement, slander, or privacy violations from your marketing.

At an average cost of just $42 per month, general liability insurance delivers tremendous value. It’s often the first policy sole proprietors purchase, and for good reason.

For more specific examples, check out General Liability Insurance for Plumbers or dive into Basic Business Liability Insurance for broader details.

Professional Liability (Errors & Omissions)

If your sole proprietorship involves giving advice or providing professional services, Professional Liability Insurance – also known as Errors & Omissions (E&O) insurance – is critical. This coverage protects you when clients claim your professional work caused them financial harm. It covers claims about the quality of your work, unlike general liability which covers physical damage.

Negligence claims can arise from honest mistakes that cost clients money, like an accountant miscalculating taxes. Missed deadlines can trigger costly claims if a delay causes a client financial loss. Even bad advice given with good intentions can result in expensive lawsuits.

Service-based businesses like consultants, accountants, real estate agents, and personal trainers face these risks daily. The stakes are particularly high for businesses in regulated industries or those handling large financial decisions for clients.

At an average cost of $61 per month, professional liability insurance provides crucial protection against potentially devastating claims. For electricians and other skilled trades, Professional Indemnity Insurance for Electricians offers industry-specific guidance.

Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) is the “combo meal” of business insurance, bundling essential coverages into one convenient, cost-effective package for small businesses.

A BOP combines general liability coverage with commercial property insurance to protect your business equipment, inventory, and workspace from events like fire or theft. BOPs also include business interruption insurance. If a covered event forces you to close temporarily, this coverage replaces lost income and covers ongoing expenses like rent. For example, if a burst pipe closes your office for two weeks, it helps keep your finances stable.

BOPs are ideal for businesses with fewer than 50 employees and less than $5 million in annual revenue, which describes most sole proprietorships. The bundled approach typically costs less than buying each policy separately, making it a smart choice for comprehensive protection.

Other Essential Coverages to Consider

Beyond the core policies, you might need specialized insurance depending on your business operations.

Commercial auto insurance is necessary if you use vehicles for business. Your personal auto policy won’t cover accidents that happen while driving for work, leaving you personally liable for damages. Learn more at Drive Your Business Forward: The Essentials of Commercial Auto Insurance.

Workers’ compensation insurance becomes legally required the moment you hire your first employee. In states where Caruso Insurance Services operates – including Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho – workers’ comp laws typically kick in immediately. This coverage pays for medical expenses and lost wages for work-related injuries. Get details in All About Workers’ Compensation Insurance: Understanding the Basics.

Cyber liability insurance is essential for businesses that store customer data or process online payments. A data breach can be devastating. This coverage helps pay for data recovery, customer notification, and credit monitoring services. Find protection options in

All About Cyber Liability Insurance: What It Covers.

Decoding the Price Tag: What Does Sole Proprietor Insurance Cost?

Let’s talk numbers. The good news is that business insurance for sole proprietorship is surprisingly affordable, especially considering it protects everything you’ve built.

Here’s what most sole proprietors can expect to pay: general liability insurance typically runs about $42 per month, while professional liability coverage averages around $61 monthly. If you hire employees, workers’ compensation usually costs about $45 per month.

Most small businesses pay a few hundred to a couple thousand dollars annually for comprehensive coverage. This is a small price compared to a single lawsuit, which could cost tens of thousands or wipe out your savings. The exact cost depends on your unique situation, so we recommend getting personalized quotes.

For more detailed cost breakdowns, check out How Much Does Business Liability Insurance Cost? and Small Business Insurance Cost.

Factors That Influence Your Premium

Insurance companies calculate your premium based on your specific risk profile. Understanding these factors helps you make smarter coverage decisions.

Your industry makes a huge difference. A freelance graphic designer faces different risks than a roofing contractor. The contractor will pay more for general liability due to a higher potential for accidents. Insurers use data to assess which professions file more claims.

Where you do business matters. Operating in Colorado, Arizona, Florida, Nevada, Texas, Tennessee, or Idaho can affect your rates. Urban areas might have higher crime rates affecting property coverage, while rural areas have different liability considerations.

Your team size directly impacts workers’ compensation costs. Even if you’re solo now, understand that adding employees will affect your premiums, which are tied to payroll and job risks.

Coverage limits and deductibles give you control over costs. A higher deductible can lower your premium, but ensure you can afford the out-of-pocket cost of a claim. Higher coverage limits mean higher premiums but better protection.

Your claims history follows you. A clean record helps keep costs down, while previous claims can signal higher risk to insurers.

Time in business also plays a role. Newer businesses may face slightly higher rates until they establish a track record of safe operations.

Want to see how industry affects pricing? Take a look at

Electrician Insurance Cost for a real-world example.

Your Action Plan: Getting the Right Coverage

Finding the right business insurance for sole proprietorship is like building a custom safety net for your business—one that fits your needs and budget.

Working with an independent agency like Caruso Insurance Services takes the guesswork out of the equation. We walk you through each step, from understanding your risks to finding policies that fit your business model and budget.

Ready to explore your options? Start by checking out our guide on Business Insurance Quotes to see what the process looks like.

How to Choose the Right Business Insurance for a Sole Proprietorship

Choosing insurance is about finding the right fit for your unique situation, not just the cheapest or most expensive policy. Your coverage should match your actual risks.

Start by honestly assessing your risks. Do clients visit your office? Do you handle others’ property? Do you give professional advice? The answers guide us toward the right coverage types.

Understanding policy limits is crucial. A $1 million general liability limit is the maximum the policy will pay for one incident. We’ll help you determine limits that make sense for your line of work.

Deductibles are your trade-off between monthly costs and out-of-pocket expenses. A higher deductible means lower premiums, but you’ll pay more if a claim occurs. We’ll help you find a comfortable sweet spot.

Don’t forget about contractual requirements. Many clients or landlords require specific insurance. Having a Certificate of Liability Insurance ready can open doors and build trust.

How to Get a Quote for Your Business Insurance for a Sole Proprietorship

Getting a quote for business insurance for sole proprietorship is simple. We’ve streamlined the process to get you answers quickly.

We’ll need some basic information: Your business name and location help us understand local requirements in states like Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho.

Describing your industry and type of work is the most important part. The more specific you are, the better we can tailor your coverage.

Your annual revenue and number of employees help us gauge the size of your operation. We can structure coverage that grows with you.

Any desired coverage types you have in mind are helpful, but we can guide you if you’re unsure. We’ll also ask about past claims history to get you the best possible rates.

Ready to see what business insurance for sole proprietorship could cost? You can

Get an Instant Quote and start protecting your hard work today.

Frequently Asked Questions about Sole Proprietor Insurance

Sole proprietors often have questions about business insurance. It’s natural when making decisions to protect your livelihood. Here are the most common concerns I hear from business owners like you.

Are sole proprietors legally required to have business insurance?

This is a common question, but the answer isn’t a simple yes or no. It depends on your unique situation.

State requirements can vary. In the states where we’re licensed – Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho – certain professions need specific insurance to get their business licenses. For example, many contractors must carry insurance as part of their licensing.

Client contracts often make the decision for you. Many clients, especially larger companies, will require business insurance for sole proprietorship before signing a contract. They want to see a Certificate of Insurance (COI) first. It shows you’re a professional who takes business seriously.

Landlord requirements are another common scenario. If you rent commercial property, your lease will almost certainly require general liability insurance to protect the landlord.

So while not always legally required, it’s a practical necessity for most businesses. For specific trade requirements, learn more about being a Licensed and Insured HVAC Contractor.

Can I deduct the cost of my business insurance on my taxes?

Good news: business insurance for sole proprietorship is even more affordable because premiums are typically tax-deductible. The IRS generally views business insurance as an ordinary and necessary business expense, which can help reduce your taxable income.

However, tax laws can be tricky. While insurance is a business operating cost, I always recommend consulting with a qualified tax professional for personalized advice. They’ll ensure you’re taking every deduction you’re entitled to.

What happens if I hire my first employee?

Hiring your first employee is an exciting milestone, but it brings new insurance responsibilities. Once you bring on even one employee, workers’ compensation laws kick in. In the states where we’re licensed (Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho), workers’ compensation insurance becomes mandatory.

This coverage is about protecting your team and your business. It provides benefits to employees for work-related injuries or illnesses, covering medical expenses, lost wages, and rehabilitation costs. Importantly, it also protects you from potential lawsuits if an employee gets hurt on the job.

We can help you steer these new employer responsibilities smoothly. As your sole proprietorship grows, we’ll ensure you have the right coverage. You can learn more about

Workers Compensation Insurance and get details in

All About Workers’ Compensation Insurance: Understanding the Basics.

Secure Your Solo Venture and Move Forward with Confidence

Running a sole proprietorship means you make the decisions and keep the profits. But this freedom comes with a catch: your personal assets are directly on the line for any business mishaps.

One client slip-and-fall, professional mistake, or lawsuit could wipe out your savings and threaten your home. No entrepreneur should face this reality without protection.

This is why business insurance for sole proprietorship isn’t just another expense; it’s one of the smartest investments a solo entrepreneur can make. The right insurance acts as a financial bodyguard, standing between potential disasters and everything you’ve worked so hard to achieve.

With proper coverage, you can take calculated risks and grow your business with confidence. Instead of worrying about “what if” scenarios, you can focus on what matters: serving your clients, growing your revenue, and building the business of your dreams.

At Caruso Insurance Services, we understand the unique challenges sole proprietors face across Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho. We know no two businesses are alike, which is why we take the time to understand your specific situation, risks, and goals.

Our approach isn’t about selling you the most expensive policy. We focus on creating custom insurance solutions that fit your budget while providing comprehensive protection. Whether you’re a freelance consultant, a skilled tradesperson, or a service provider, we’ll help you find the right balance of coverage and cost.

Ready to protect your solo venture and move forward with confidence? Don’t leave your personal assets vulnerable.

Get expert help with your Business Liability Insurance and find out how affordable peace of mind can be.