A sudden equipment breakdown in an advanced manufacturing facility can interrupt production lines, lead to costly claims, and require rapid response to minimize losses. Manufacturing insurance coverage in California is essential given the high stakes and dynamic risk environment. For those seeking reliable information, insights from sources like Risk & Insurance provide valuable context.

Understanding the Manufacturing Insurance Landscape

California’s manufacturing industry plays a key role in the state’s economy. From aerospace components to high-tech electronics, the manufacturing process involves a wide range of potential hazards that require specialized insurance coverage. The insurance market is evolving amid increasing claims complexity and heightened exposure to risks.

In recent years, rising costs have stretched insurers’ capacities and altered underwriting practices. The manufacturing sector, with its unique mix of physical assets, liability exposures, and regulatory compliance requirements, has driven changes in policy structures. This environment demands robust risk management strategies that are adapted to both new technological advancements and emerging threats.

The Role of Manufacturing Insurance Policies

Manufacturing insurance policies provide comprehensive protection. Policy coverage typically includes property damage, business interruption, product liability, and equipment breakdown. These policies are tailored to each facility’s specific risks.

If a manufacturing facility faces unexpected shutdowns due to equipment failure or supply chain disruptions, the insurance acts as a financial safety net that keeps operations stable during transition periods. Insurers develop specialized coverage to address specific manufacturing processes that differ significantly from service sectors.

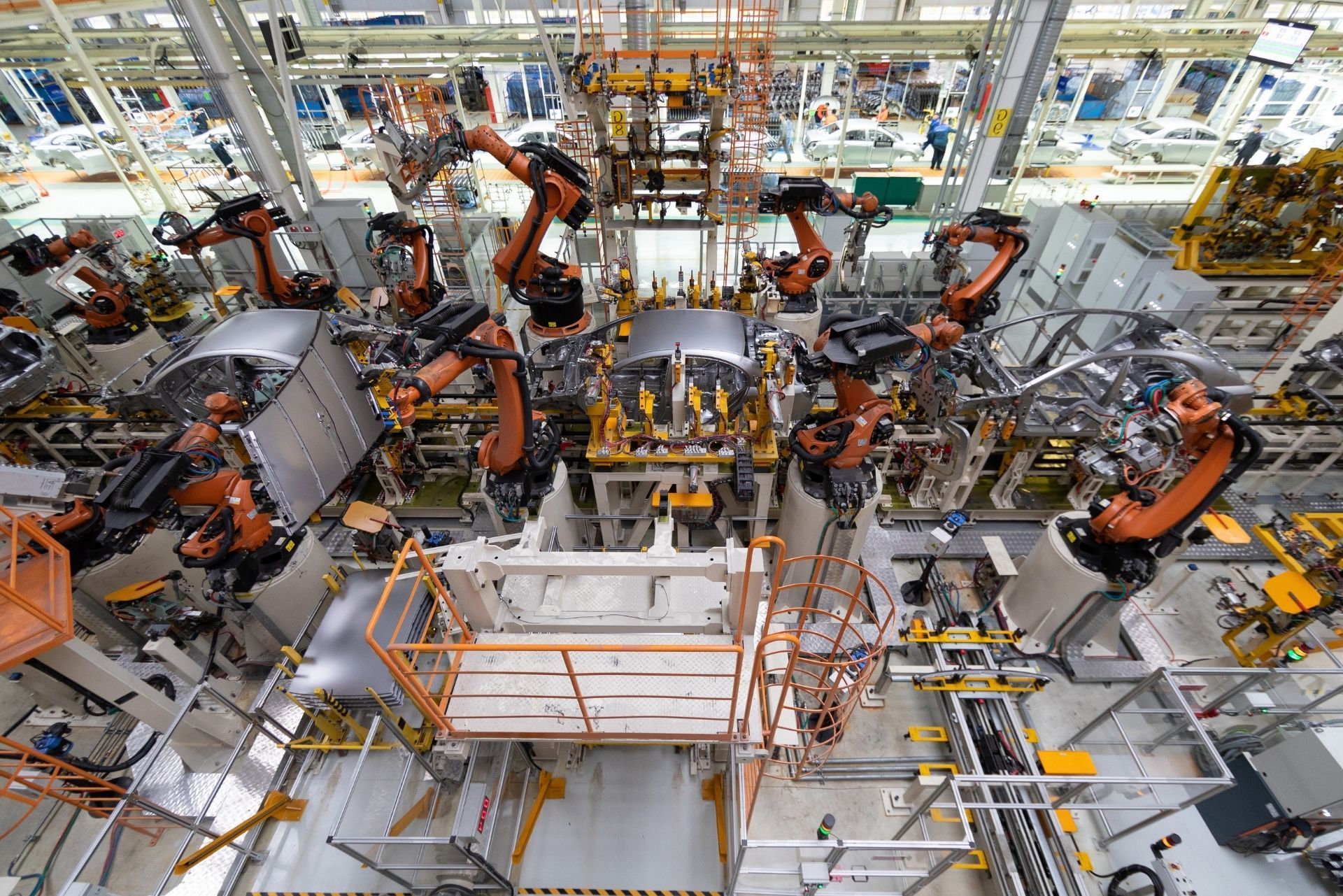

Coverage also encompasses specialized areas such as cyber risks, particularly for automated production lines that are reliant on advanced computer systems. This added layer of protection ensures that both traditional and technology-driven risks are accounted for.

By: Danielle Sweet

Commercial Insurance Agent at Caruso Insurance Services

Key Challenges Faced by the Manufacturing Industry

Cost escalations, complex claims, and evolving regulatory landscapes make manufacturing insurance a dynamic field. Recent developments in the workers’ compensation market highlight how issues like escalating medical costs and increased litigation expenses can impact premiums. According to Risk & Insurance, combined ratios have reached historic highs in some sectors, influencing insurer risk appetites.

Claim complexity is not limited to workers’ compensation claims; it also appears in manufacturing claims that involve cumulative trauma and liability issues. Production facilities, where heavy machinery is constantly in use, are at increased risk if safety protocols are not strictly adhered to. Preventative measures and continuous safety training play a vital role in minimizing these exposures.

Another challenge comes from regulatory constraints and the overarching need to remain compliant with state standards. Insurers must balance financial viability with support for businesses operating in high-risk industries. The interplay of regulations and market dynamics creates a landscape that demands up-to-date expertise and adaptable insurance solutions.

Escalating Costs and Litigation Complications

Manufacturers often face skyrocketing costs stemming from equipment repairs, campaign delays, and claims litigation. An expert in workers’ compensation described increased litigation expenses and escalating medical costs as reaching a critical point in coverage management (Risk & Insurance). This trend emphasizes the necessity for manufacturing firms to secure comprehensive insurance policies that address both immediate risks and long-term liabilities.

Litigation costs can be unpredictable. When combined with the rising expense of medical care for injured workers, these factors lead to higher combined ratios for insurers. Industries that experience frequent claims must always soon factor in these additional pressures when negotiating premiums.

The need for a meticulous claims management approach and predictive risk assessments has never been more evident. The integration of advanced data analysis and machine learning in similar fields demonstrates promise for reducing claim complexities over time.

Impact of Technological Advancements in InsurTech

Technological innovations have made it possible to enhance risk assessment and claims management significantly. The advent of machine learning and emerging data sources are now being integrated into loss models to better classify risks, a trend highlighted by a 2024 study available on arXiv. These innovations are improving the accuracy and efficiency of risk underwriting, a crucial development for the manufacturing sector.

In manufacturing settings, where data on machinery performance, maintenance schedules, and production processes are readily available, technology offers new ways to preemptively address risks. Insurers can now predict which areas might be vulnerable before an incident turns into a costly claim. This shift toward data-driven solutions makes insurance more responsive and tailored.

The benefits are twofold. First, improved risk classification leads to more appropriate premium pricing for businesses. Second, enhanced claims management processes result in quicker settlements and minimized operational interruptions.

InsurTech Innovations Explained

InsurTech brings significant efficiency to risk evaluation. Machine learning algorithms analyze vast amounts of data from production processes, maintenance logs, and even employee safety reports. This leads to refined risk profiles and potentially lower premium costs as risk management strategies improve.

Another area of impact is real-time monitoring. Sensors and data collection devices embedded in machinery can alert managers to potential hazards before they escalate into major issues. These proactive measures help manufacturing firms maintain a safer work environment while easing the burden on insurers.

Integrating technological solutions not only modernizes the insurance process but also reinforces risk management practices. This development is especially relevant in California, where manufacturing operations are intertwined with high-tech production and innovation.

Wildfires and Other Catastrophic Risks

Wildfire risks present a unique challenge for manufacturers in California. The wildfire catastrophe review conducted by the California Department of Insurance in July 2025 paved the way for closing coverage gaps statewide (California Department of Insurance). Rapid changes in wildfire behavior require manufacturers to re-evaluate their risk exposures and integrate disaster recovery plans into their insurance policies.

For manufacturers located in high-risk areas, property losses or business interruptions due to wildfires can be devastating. Providers now offer specialized endorsements in response to these heightened risks. These adjustments in coverage are integral to ensuring businesses can recover quickly when a wildfire strikes.

Insurance providers are increasingly using forward-looking catastrophe models to assess wildfire impacts. The new models not only help in rate-setting but also encourage manufacturers to invest in proactive fire prevention strategies. This alignment between predictive analytics and coverage design ensures that policies remain comprehensive while reflecting the current risk environment.

Protective Measures for Catastrophic Risks

Manufacturing facilities can adopt several measures to improve their resilience. Upgrading fire suppression systems, maintaining clear evacuation routes, and implementing rigorous safety protocols are critical first steps. These improvements potentially lower the risk profile and reduce insurance costs in the long run.

Another effective strategy is to integrate business interruption coverage that addresses the specific needs arising from wildfire damages. With such provisions in place, manufacturers can manage cash flow disruptions more effectively. The evolving regulatory expectations underscore these safety enhancements as fundamental aspects of a strong risk management plan.

This tailored coverage strategy offers reassurance that manufacturing operations can continue even in the wake of a disruptive catastrophic event.

Economic Influences on Manufacturing Insurance

Economic factors have a profound impact on the insurance industry. In 2024, the workers’ compensation market in California experienced pressures that led to a combined ratio of 127% (Risk & Insurance). Such figures highlight the tightening margins insurers face and underscore the importance of comprehensive coverage policies.

Fluctuations in the economic climate can trigger adjustments in coverage terms and premium pricing. Supply chain disruptions, inflation in repair costs, and regulatory financial requirements all contribute to varied economic risks. Manufacturers must remain agile, ensuring that their coverage terms are revisited regularly to accommodate economic shifts.

The underlying message for manufacturers is clear. Investing in risk management is not just a compliance exercise but a proactive strategy for navigating uncertain economic waters. A resilient insurance strategy can help companies weather economic storms while maintaining operational stability.

Economic Impact and Job Creation

Insurance, including manufacturing insurance, drives significant economic activity in California. The state’s insurance sector supports diverse industries and has a considerable economic impact, as highlighted by California Insurance Commissioner Ricardo Lara in October 2025 (California Department of Insurance). With over 29,000 jobs supported and more than $917 million generated in state tax revenues, manufacturing insurance plays an essential role in the broader economic ecosystem.

This robust economic support goes hand in hand with innovative coverage solutions. As insurance revenues help sustain the workforce, companies in the manufacturing sector may find additional stability in a supportive economic framework. The cycle of risk management driving economic stability, in turn, encourages insurers to develop improved and cost-effective policies for manufacturers.

In this scenario, both manufacturers and insurers benefit from enhanced risk awareness and smarter policy design. Such an approach reassures manufacturing firms that resilient strategies are in place should any crisis occur.

The State of the Insurance Market and Future Trends

California’s insurance market is currently undergoing a hardening cycle. The 2025 State of the Market & Industry Insights Report indicates that many lines of insurance, including those for manufacturing, are facing rate increases due to various risk factors such as wildfire exposure and regulatory constraints (C3 Insurance). Rate adjustments are reshaping premium structures and policy details across the state.

Manufacturers are observing these changes closely, as shifts in premium pricing may affect operational costs significantly. Insurers are being cautious with underwriting, and the use of forward-looking models is becoming more prevalent to accurately predict and control risk exposures. This market response, although challenging, also leads to more tailored and clearer policies that reflect real-time risks and business needs.

Manufacturers should monitor both economic indicators and market trend reports to remain informed about changes. This ongoing awareness can drive better preparedness and informed decisions in selecting insurance policies that protect business continuity while aligning with market realities.

Embracing Future Innovations

As the industry evolves, new opportunities and challenges are on the horizon. Incorporating advanced data analytics, telematics, and IoT (Internet of Things) devices into conventional insurance practices is a promising development. These innovations can often reduce the frequency and severity of claims by alerting facilities to potential hazards before they escalate.

Future manufacturing insurance policies are likely to become more customized as insurers collect real-time data. This shift could result in premium models that are closely aligned with actual risk exposures. Companies that invest in predictive maintenance and safety drills will likely see benefits in both reduced downtime and lower insurance costs.

Technological integration in the insurance realm is poised to transform how manufacturers manage risks. By embracing these next-generation tools, companies can stay ahead of unexpected disruptions and optimize the use of their coverage.

Policy Recommendations for Manufacturing Firms

Manufacturing firms should take active steps in updating and tailoring their insurance policies. Start by conducting thorough risk assessments. Ensure that every potential hazard-from equipment breakdowns to wildfires-is factored into policy conditions.

Business interruption coverage is essential. Manufacturers that face production halts can depend on this coverage to mitigate the financial fallout from unexpected events. In a state where economic fluctuations and natural disasters are common, such comprehensive planning is critical.

Supplementing traditional policies with endorsements that cover cyber risks and advanced technologies is also advisable. With increased reliance on automated systems and data, the threat landscape is expanding. Manufacturers who bridge the gap between classical and modern risks can achieve more resilient and flexible coverage solutions.

Designing a Comprehensive Insurance Package

Key factors in a robust insurance package include five main areas: property damage, business interruption, equipment breakdown, product liability, and cyber risk. Each element should be discussed with a trusted broker to ensure it fully represents the company’s exposure. Testing various coverage options and customizing policies to specific operational parameters is critical.

A comparative approach can be especially useful. Manufacturers looking to tailor a policy should consider creating a table of needs versus available coverage options, enabling clearer decision-making.

| Coverage Type | Key Inclusions | Benefits |

|---|---|---|

| Property Damage | Equipment, buildings, storage | Protects capital investments |

| Business Interruption | Lost revenue, extra expenses | Stabilizes cash flow during downtime |

| Equipment Breakdown | Machinery repairs, replacements | Minimizes production delays |

| Product Liability | Defective products, recalls | Mitigates reputational and financial risks |

| Cyber Risk | Data breaches, system failures | Enhances risk management for modern systems |

Customizing each section to match the specific needs of a manufacturing facility ensures balanced risk management. A targeted insurance package that reflects operational realities delivers not just financial security but also a competitive advantage.

Integrating Best Practices for Manufacturing Risk Management

Best practices in manufacturing risk management extend well beyond insurance purchase. Manufacturers are advised to embed safety procedures and ongoing employee training programs into daily operations. These proactive measures not only help reduce claims frequency but also contribute to a more resilient business culture.

Regular review of insurance policies, coupled with audits of risk management practices, can drive operational improvements. Insurers now appreciate proactive risk reduction efforts, and such practices may even lead to premium discounts over time. Efficiency in managing risks translates directly into financial savings and smoother operational workflows.

Collaboration with insurance specialists who understand the manufacturing ecosystem is essential. By partnering with experts, manufacturers gain insights into emerging trends and tailored coverage solutions that align with their evolving needs.

Risk Mitigation Strategies in Practice

Implementing robust maintenance schedules and safety protocols helps manufacturers mitigate many risks. Preventative maintenance reduces the likelihood of equipment failure-a leading cause of production downtime. Routine audits ensure that safety measures are consistently applied, leading to a reduction in claims incidents.

Another key strategy is investing in predictive analytics. Manufacturers utilizing telematics and sensor-driven data can preemptively act on potential issues before they turn costly. This forward-thinking approach supports both the operational and financial stability of a manufacturing facility.

Training programs aimed at enhancing safety awareness and emergency response are equally important. Employees who are well-trained in safety practices contribute significantly to a safer workplace, effectively lowering insurance risks. Combined, these practices build a resilient infrastructure that stands up to both everyday hazards and major crises.

Analyzing Insurance Market Metrics and Trends

Recent metrics in the insurance industry reveal contrasting trends in underwriting performance and market pressures. While the overall U.S. property/casualty industry reported a net combined ratio of 96.6, marking the best underwriting performance since 2013 (Insurance Information Institute), certain California sectors like workers’ compensation have faced more challenging ratios.

For manufacturers, these metrics underscore the variable risk climate in which insurers operate. While favorable industry ratios indicate some resilience in underwriting, localized hardening cycles-especially in high-risk areas-mean that premiums must be carefully scrutinized. Monitoring these trends helps manufacturers understand where coverage gaps might exist and what adjustments may be necessary for future policies.

Trends also point toward increased integration of new technologies into underwriting practices. The emerging blend of real-time monitoring and data analytics is reshaping risk profiles and guiding rate-setting procedures. This alignment of technology and market metrics holds promise for a more responsive insurance landscape.

Market Hardening Cycle and Its Effects

A hardening market means stricter underwriting and higher premium rates. For manufacturers, this results in increased scrutiny of their risk management practices by insurers. It also encourages manufacturers to proactively upgrade safety measures to negotiate better policy terms.

Some manufacturers are experimenting with self-insurance strategies or alternative risk financing models. Such approaches, while requiring significant upfront investment, can lower long-term insurance costs if managed properly. This market dynamic serves as a reminder for manufacturing firms to regularly assess both internal and external risk factors.

The evolving landscape requires constant monitoring. Transparent communication with insurers about risk mitigation measures can sometimes result in more favorable premiums and policy terms. In a state where risks can change rapidly, staying adaptable is key.

Policy Comparison and Customization Options

Given the complex risk environment, manufacturers often benefit from comparing multiple policies. A side-by-side review of policy features can help pinpoint the coverage that best addresses specific operational risks. Customization is critical-each manufacturing facility has distinct needs based on location, production type, and business scale.

The following table outlines a comparison between two common types of manufacturing insurance packages, enabling clear communication during broker consultations:

| Feature | Standard Coverage | Enhanced Coverage |

|---|---|---|

| Property Protection | Basic property loss protection | Extended coverage for machinery and high-value assets |

| Business Interruption | Revenue loss reimbursement | Customizable downtime coverage with additional limits |

| Liability Protection | General liability | Product and environmental liability endorsements |

| Cyber Coverage | Not typically included | Expanded to cover cyber threats and data breaches |

Comparative analyses like these highlight the critical differences in coverage. Precise comparisons enable better value assessments and support informed decision-making. Manufacturers who are thorough in their procurement processes typically secure more favorable outcomes.

Tailoring Policies to Operational Needs

Customization can extend to policy limits, deductibles, and endorsements. For facilities with a high concentration of automated systems or sensitive data storage, additional cyber risk coverage might be advisable. On the other hand, a manufacturer heavily reliant on physical infrastructure may benefit more from extended property and business interruption limits.

Working directly with insurance brokers and risk consultants is recommended. In-depth discussions regarding operational specifics ensure that policies are structured to provide optimal protection. A custom-tailored policy not only enhances coverage but also provides manufacturers with greater confidence in their daily operations.

This level of detail, combined with clear comparisons, helps manufacturers clearly see the value in their coverage investments.

Frequently Asked Questions

This section addresses common inquiries concerning manufacturing insurance and operational risk management in California.

Q: Why is manufacturing insurance so important in California?

A: California’s dynamic risk environment, including exposure to natural disasters and regulatory challenges, makes specialized manufacturing insurance critical. Comprehensive policies protect against property, business interruptions, and liability risks.

Q: How can manufacturers reduce their insurance premiums?

A: Advanced risk management measures, regular safety audits, and investment in predictive analytics can lower claims frequency and severity, often resulting in better premium rates.

Q: What role does technology play in manufacturing insurance?

A: Technology, such as machine learning and IoT devices, helps refine risk assessments, predict equipment failures, and streamline claims management, leading to more tailored coverage solutions.

Q: How do wildfire risks affect manufacturing insurance in California?

A: Wildfire risks increase both property damage and business interruption exposures. Insurers now include specialized endorsements and forward-looking catastrophe models to address these challenges (California Department of Insurance).

Q: Can technology-driven solutions lower business interruption losses?

A: Yes. Implementing technology that monitors operational performance can alert manufacturers to potential hazards early, reducing downtime and associated losses.

Q: How should manufacturing firms approach policy customization?

A: Firms should conduct thorough risk assessments, compare multiple policy options, and work with trusted brokers to tailor coverage that addresses specific operational exposures.

Wrapping Things Up

Manufacturing insurance in California represents a crucial investment for businesses facing an array of interconnected risks. With evolving technological integrations, economic pressures, and natural hazards like wildfires, manufacturers must adopt proactive, comprehensive approaches to insurance. Detailed comparisons and continuous engagement with risk management experts lead to stronger, more resilient policies.

Industry developments, such as the integration of advanced analytics showcased in recent studies available on arXiv, represent promising steps toward more accurate risk assessments and claims management procedures. Such advancements not only help in setting more realistic premiums but provide manufacturers with peace of mind during an increasingly unpredictable era.

Ultimately, a well-structured insurance policy is more than a regulatory requirement-it is a strategic asset that protects both physical assets and operational continuity. By focusing on tailored coverage options and leveraging technology, California manufacturers can secure strong protection for their future.

Looking Ahead: Future Trends and Considerations

As the manufacturing landscape continues to evolve, insurers and manufacturers are likely to see a growing role for specialized insurance products. The market’s response to environmental pressures, technology, and economic fluctuations will shape industry practices. Understanding these trends is key for companies wishing to stay competitive and secure.

Forward-looking models and innovative products are set to redefine the coverage paradigm. Continued collaboration between technology firms and insurance providers may further enhance the precision of risk assessments and streamline claims processes for manufacturers. This synergy is paving the way for policies that are not only reactive but predictive.

Future policies will likely place a greater emphasis on data transparency and real-time analytics, helping facilities anticipate risks before they escalate. This proactive approach can illustrate to insurers that a commitment to safety can yield better terms and potentially reduced premiums. Manufacturers preparing for these changes stand to benefit significantly from enhanced, technology-backed insurance solutions.

Staying Informed and Proactive

Manufacturers must keep up with market trends and regulatory updates to ensure that their risk management strategies remain relevant. Regular consultations with insurance experts and participation in industry forums are beneficial for staying ahead. Alerts regarding shifts in underwriting practices or catastrophic modelling-such as the wildfire catastrophe model published by the California Department of Insurance-can inform timely policy updates.

Proactive risk management and regular internal audits complement a robust insurance strategy. These steps not only reduce claim frequencies but also foster a safer environment for employees and operational workflows. In a competitive marketplace, staying informed is a key asset.

The evolving manufacturing industry in California demands a flexible, well-informed approach to insurance. With technology playing an increasingly significant role, manufacturers can look forward to more adaptive coverage that aligns with modern operational risks.

Final Thoughts on Tailored Manufacturing Insurance Solutions

California manufacturers operate in a complex risk environment where rapid technological changes and environmental challenges intersect. This intricate landscape calls for insurance solutions that are both comprehensive and adaptable. Tailored manufacturing insurance policies not only safeguard against operational disruptions but also empower enterprises to innovate confidently.

Investment in detailed risk assessments, leveraging InsurTech innovations, and engaging with experienced brokers can transform the traditional static insurance approach. Manufacturers are encouraged to treat insurance as a dynamic part of their overall operational resilience strategy. Smart coverage selection and continuous policy review ensure that businesses remain prepared for emerging risks while satisfying regulatory requirements.

As market challenges persist and opportunities evolve, informed decision-making remains the best defense against unforeseen setbacks. Solid, technology-enhanced insurance solutions enable manufacturers to focus on sustaining production, improving quality, and contributing to California’s robust economic ecosystem.

Looking to the Future

The future of manufacturing insurance in California lies in its adaptability. With economic pressures and new risks emerging consistently, manufacturers must maintain a forward-thinking approach. Insurers who leverage cutting-edge technology and innovative risk assessment practices are better positioned to offer policies that truly meet the needs of modern industry.

As the insurance market adjusts to trends like the hardening cycle and rising claim complexities, staying proactive remains essential. Regular policy reviews, ongoing engagement with risk management experts, and readiness to adapt to technological advancements will help manufacturers safeguard their operations effectively.

Ultimately, the goal is clear: secure a comprehensive insurance strategy that not only provides robust protection but also empowers a thriving, innovative manufacturing landscape in California.

ABOUT THE AUTHOR:

DANIELLE SWEET

HI! I am Danielle Sweet your insurance extraordinaire. I have been in the insurance industry since I was 19 years old working in many different areas of insurance to provide a broad knowledge base to our clients. I have three amazing children who keep me on my toes even as they are older. I have a passion for horses and am lucky to ride every week. I am truly blessed to be able to help business owners and individuals navigate the world of insurance and educate you to make an informed decision that is right for you.

Contact Us

Service that stays with you.

Our team helps simplify insurance decisions for families and businesses. We focus on clear explanations, fast responses, and dependable service. You can count on us for help with coverage questions, updates, and long-term support.

Home insurance helps protect your house, personal belongings, and liability risks. We explain coverage options clearly so you know what your policy includes.

Auto insurance provides protection for accidents, liability, and vehicle damage. We help you compare options so you can choose coverage that fits your driving needs.

Motorcycle insurance provides coverage for riders and their bikes. We help you select options that match how and where you ride.

RV insurance supports protection for motorhomes and recreational vehicles. Coverage applies during travel and while parked.

Coverage Built for Contractors and Trades

Support that keeps your work moving.

General Liability Insurance

General liability insurance helps protect contractors from injury and property damage claims. It supports jobsite requirements and contracts.

Workers Compensation

Workers compensation insurance helps protect employees injured while working. It also supports compliance with state requirements.

Commercial Auto Insurance

Commercial auto insurance provides coverage for work vehicles used on jobsites. It helps protect drivers and company vehicles.

Contractor Insurance

Contractor insurance supports trades and service professionals across Southern California. It helps protect tools, equipment, and daily operations.

Cyber Liability Insurance

Cyber liability insurance helps protect business data and customer information. It supports recovery from digital incidents.

Commercial Property Insurance

Commercial property insurance helps protect offices, shops, and equipment. It supports recovery after covered damage.

Coverage Built for Specialized Work

Support for high-risk and service-driven industries.

Simple Steps Supported by Steady Guidance

A Clear Path to Coverage

Trusted by Clients Across Southern California

Clear service backed by real experiences.

Answers to Common Questions.

Clear explanations to guide your decisions.

How do I know which insurance policy is right for me?

We compare coverage options from multiple carriers to help you see differences in protection and price. You can review clear details and ask questions so you understand what each policy covers. Our team guides you step by step so you feel sure about your decision.

What factors affect my auto insurance premium?

Auto insurance premiums are influenced by your driving history, age, location, vehicle type, and coverage choices. A clean driving record and good safety features can help lower costs. We review these factors with you and help find coverage that fits your budget and needs.

Does homeowners insurance cover all types of damage?

Standard homeowners insurance protects your structure, personal belongings, liability, and additional living expenses in many cases. However, it usually does not include flood or earthquake damage without separate policies. We help you decide if extra coverage is right for your home and location.

Can I update my policy or get certificates online?

Yes. You can submit requests for policy changes and certificates through our online service form at any time. Our team processes those requests quickly and confirms updates once complete so you have the documents you need.

Do I need separate insurance for business risks like EPLI or E&O?

Yes. General liability and workers compensation cover many business risks but do not protect against all exposures. For example, Employment Practices Liability Insurance (EPLI) covers claims like wrongful termination or discrimination, and Errors & Omissions (E&O) covers claims based on mistakes in professional services. We help you identify which extra policies your business may need.

What happens if I need to file a claim?

If you need to file a claim, we guide you through the process and help you contact the insurance carrier. We explain what information you should provide, answer your questions, and stay available while the carrier reviews your claim. This support helps you move forward with confidence.

Contact Us