See How We're Different

or Call Us: 951-547-6770

Safeguard Your Cleaning Business with Affordable Insurance

Understanding your cleaning business insurance cost is crucial for financial security. Premiums typically range from $500 to $2,000 annually, but this varies. For example, basic general liability can start around $40-$50 per month, while self-employed cleaners might find policies beginning at $500 annually.

Every day, cleaning businesses in Colorado, Texas, Arizona, Florida, Nevada, Tennessee, and Idaho face risks like client slip-and-falls, employee accidents, or vehicle collisions. Without proper insurance, a single incident could be financially devastating, jeopardizing everything you’ve built.

Fortunately, protecting your business is an affordable and smart investment in your long-term success. At Caruso Insurance, we specialize in helping cleaning business owners find comprehensive, budget-friendly protection. We work with you to secure the right coverage at competitive rates, giving you peace of mind.

Similar topics to cleaning business insurance cost:

What is Cleaning Business Insurance and Who Needs It?

Cleaning business insurance is a specialized set of policies designed to protect your company from the financial consequences of accidents, mistakes, and lawsuits. It’s a safety net that covers costs like legal fees, medical bills, and property damage claims, which could otherwise drain your business and personal finances.

This protection is essential for everyone in the cleaning industry, from a solo house cleaner in Colorado to a large janitorial company in Texas.

- Sole Proprietors: Your personal assets (home, savings) can be at risk in a lawsuit. Insurance creates a crucial barrier.

- LLCs and Small Businesses: While your business structure offers some protection, legal and claim costs can easily deplete business funds and halt operations.

- Larger Cleaning Agencies: More employees and job sites mean increased exposure to risk, making comprehensive coverage an absolute necessity.

Types of Cleaning Services That Require Insurance

If you work on a client’s property, you need insurance. This applies to all service types, each with unique risks:

- Residential and Commercial Cleaning: Risks include slip-and-falls and damage to client property.

- Carpet and Upholstery Cleaning: Involves risks of water damage or harm from cleaning chemicals.

- Window and Pressure Washing: Higher risk of employee injury and significant property damage.

- Specialized Services: Post-construction, medical facility, or auto detailing services have unique hazards and liabilities.

Why Insurance is a Non-Negotiable Business Asset

Viewing insurance as an investment rather than an expense is key to building a resilient business. Here’s why it’s essential:

- Client Requirements: Many commercial and even residential clients require proof of insurance before hiring you.

- Builds Trust: Being fully insured signals professionalism and sets you apart from uninsured competitors.

- Legal Compliance: States like Colorado, Arizona, and Florida legally require Workers’ Compensation for businesses with employees. Commercial auto insurance is also typically mandatory for business vehicles.

- Asset Protection: It shields your personal and business assets from lawsuits.

- Employee Protection:

Workers’ Comp covers medical costs and lost wages for injured employees, protecting them and your business from litigation.

| Feature | Classic Car Policy | Standard Auto Policy |

|---|---|---|

| Usage | Limited pleasure driving, car shows, club events | Daily commuting, unlimited mileage |

| Valuation | Agreed value | Actual cash value (depreciation applies) |

| Mileage Limits | Typically 2,500-7,500 annually | No restrictions |

| Premium Cost | Lower (21-40% less on average) | Higher |

| Storage Requirements | Secured garage or facility | No specific requirements |

| Daily Driver Requirement | Separate vehicle needed for each licensed driver | Not required |

| Parts Coverage | Original/OEM parts often included | Aftermarket parts typically used |

| Roadside Assistance | Specialized (flatbed towing, soft straps) | Standard |

Core Insurance Policies for Cleaning Businesses

Building the right insurance plan involves selecting the right policies for your specific operations. At Caruso Insurance Services, we assess your unique risks—whether you’re a solo cleaner in Colorado or run a large crew in Arizona—to bundle the right coverages. This approach, known as policy bundling, saves money and eliminates protection gaps.

General and Professional Liability

- General Liability Insurance: Your foundational coverage for third-party claims. It covers bodily injury (a client slips on a wet floor), property damage (you break a client’s vase), and advertising injury. Most clients require this. Learn more at our Business Liability Insurance page.

- Professional Liability (E&O) Insurance: Protects against claims of negligence or errors in your service that cause a client financial loss. For example, if you fail to properly sanitize a medical office, leading to a failed inspection. Get details on our Errors and Omission (E&O) Insurance page.

Coverage for Your Team and Property

- Workers’ Compensation Insurance: Mandatory in most states (including Colorado, Arizona, and Florida) if you have employees. It covers medical bills and lost wages for work-related injuries. This protects your employees and shields your business from lawsuits. See requirements on our Workers Compensation Insurance page.

- Commercial Auto Insurance: Essential if you use vehicles for business. Personal auto policies won’t cover work-related accidents. It also covers hired or non-owned vehicles used by employees for work. More info is on our Commercial Auto Insurance page.

- Commercial Property Insurance: Protects your owned or leased office or storage space and the contents within from events like fire or theft. Often bundled into a Business Owner’s Policy (BOP). Protect your assets with Commercial Property Insurance.

- Tools and Equipment Insurance (Inland Marine): Covers your portable equipment (vacuums, buffers, pressure washers) against theft or damage while in transit or at a job site—a crucial gap not covered by other policies.

Essential Add-Ons and Bonds

- Janitorial Bonds: Reimburses a client if an employee steals from them. It’s a powerful tool for building trust and often required for commercial contracts.

- Cyber Liability Insurance: Protects against data breaches and cyberattacks if you store client information digitally (e.g., billing, scheduling). Learn how to protect your data with our Cyber Liability Insurance page.

What is the Average Cleaning Business Insurance Cost?

So, how much will cleaning business insurance cost? While it depends on your specific operation, most small cleaning businesses pay between $700 and $2,000 annually for a comprehensive package. Based on current industry data, a basic general liability policy can start as low as $450 per year.

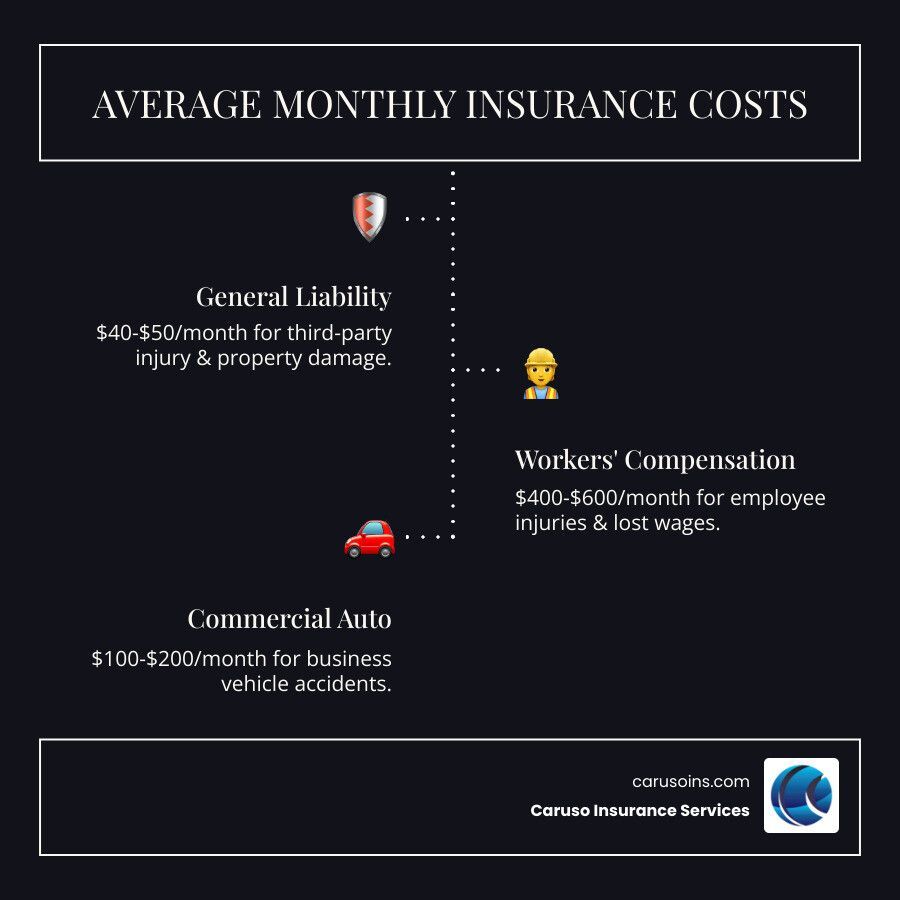

Average cleaning business insurance cost by Policy Type

Here’s a breakdown of typical monthly costs:

- General Liability Insurance: $40 – $50 per month.

- Workers’ Compensation Insurance: $400 – $600 per month (highly variable).

- Commercial Auto Insurance: $100 – $200 per month.

- Business Owner’s Policy (BOP): Around $76 per month.

- Tools & Equipment Insurance: $35 – $50 per month.

Key Factors That Influence Your Premiums

Your final cost is determined by several risk factors:

- Business Location: Rates vary between states like Texas and Idaho due to local regulations and risk levels.

- Number of Employees: More employees increase payroll and Workers’ Comp costs.

- Services Offered: High-risk services like pressure washing cost more to insure than standard residential cleaning.

- Claims History: A clean record can earn you discounts.

- Coverage Limits: Higher limits provide more protection but increase premiums.

- Annual Revenue: Higher revenue often correlates with greater exposure.

Example cleaning business insurance cost Scenarios

- Solo Residential Cleaner: Might pay around $600 – $1,000 annually for General Liability and Tools & Equipment coverage.

- Small Commercial Crew (2-3 employees, one van): Could expect to pay $7,000 – $9,000 annually, with Workers’ Comp being the largest expense.

- Midsized Janitorial Company (8-10 employees, multiple vehicles): May invest $15,000 – $20,000+ annually for a comprehensive package including higher liability limits and property coverage.

What is Cleaning Business Insurance and Who Needs It?

In short, cleaning business insurance is a financial safety net designed for the specific risks of the cleaning industry. It protects your business from the high costs of lawsuits, accidents, and property damage.

This coverage is crucial for any cleaning operation, regardless of size:

- Sole proprietors

- LLCs and small businesses

- Larger agencies

From residential maids to commercial janitorial teams, anyone working on a client’s property needs insurance. It is a fundamental asset for protecting your finances, meeting client and legal requirements, and building a professional, trustworthy brand.

Types of Cleaning Services That Require Insurance

Nearly every type of cleaning service requires insurance due to inherent risks. This includes, but is not limited to:

- Residential and Commercial Cleaning

- Carpet and Upholstery Cleaning

- Window and Pressure Washing

- Auto Detailing

- Post-Construction Cleanup

Why Insurance is a Non-Negotiable Business Asset

Insurance is more than an expense; it’s a strategic tool. It’s often required by clients, legally mandated for those with employees or vehicles, and essential for protecting your personal and business assets from devastating claims. It also protects your employees and demonstrates a commitment to professionalism that helps you win and retain business.

Core Insurance Policies for Cleaning Businesses

Assembling the right insurance package is key. While we tailor bundles to your specific needs, most cleaning businesses are built on a foundation of these core policies.

General and Professional Liability

- General Liability Insurance (GL): Covers third-party injuries and property damage. Learn more about Business Liability Insurance.

- Professional Liability Insurance (E&O): Covers financial loss due to professional errors or negligence. Explore Errors and Omission (E&O) Insurance.

Coverage for Your Team and Property

- Workers’ Compensation Insurance: Covers employee injuries on the job. A legal must-have for most employers. See our Workers Compensation Insurance page.

- Commercial Auto Insurance: Covers vehicles used for business purposes. Protect your fleet with Commercial Auto Insurance.

- Commercial Property Insurance: Protects your office or storage space. Details are on our Commercial Property Insurance page.

- Tools & Equipment Insurance (Inland Marine): Protects your portable gear anywhere you go.

Essential Add-Ons and Bonds

- Janitorial Bonds: Protects clients from employee theft.

- Business Owner’s Policy (BOP): A cost-effective bundle of GL and Property insurance for small businesses.

- Cyber Liability Insurance: Covers data breaches and cyberattacks. Learn more about Cyber Liability Insurance.

What is the Average Cleaning Business Insurance Cost?

The cleaning business insurance cost for your company will be unique, but understanding the averages provides a helpful baseline. Most small to midsized cleaning businesses can expect to pay between $700 and $2,000 annually for a standard policy, with basic liability coverage for self-employed cleaners starting around $500 per year.

Average cleaning business insurance cost by Policy Type

Here are median costs to help you budget. Your actual premium will vary.

| Policy Type | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| General Liability | $48 | $580 |

| Workers’ Compensation | $136 | $1,627 |

| Commercial Auto | $173 | $2,075 |

| Business Owner’s Policy (BOP) | $76 | $907 |

| Janitorial Bond | $11 | $126 |

Key Factors That Influence Your Premiums

Insurers calculate your premium based on several factors, including:

- Your business location (e.g., Arizona vs. Florida)

- Number of employees and total payroll

- The specific services you offer (e.g., high-risk window cleaning)

- Your business’s claims history

- Your chosen coverage limits and deductibles

- Annual revenue and value of your equipment

How to Reduce Premiums and Get a Quote

Lowering your cleaning business insurance cost is achievable with smart strategies and proactive risk management. You can secure the protection you need without overpaying.

Smart Strategies to Lower Your Insurance Costs

- Bundle Policies: Combine coverages like General Liability and Commercial Property into a Business Owner’s Policy (BOP) to save 10-25%.

- Adjust Deductibles: Choose a higher deductible to lower your premium, but ensure it’s an amount you can comfortably pay out-of-pocket.

- Maintain a Clean Claims History: Fewer claims lead to lower rates over time. Consider handling minor incidents yourself.

- Implement a Safety Program: Regular training and proper safety equipment demonstrate low risk to insurers, often resulting in discounts.

- Shop Around Annually: Rates change, so reviewing your policy and comparing quotes yearly ensures you always have the best deal.

- Ask for Discounts: Inquire about savings for paying annually, being part of a professional association, or having security systems.

Steps to Get Your Custom Insurance Quote

Getting a personalized quote is a straightforward process.

- Gather Your Information: Collect your business license/EIN, service details, annual revenue, payroll, vehicle information, and a list of your tools and equipment.

- Reach Out for Quotes: Contact us to handle the legwork. We’ll ask targeted questions to understand your unique needs.

- Compare Your Options: We’ll present quotes from top providers and explain the differences in plain English.

- Make Your Decision: We’ll help you choose the policy that offers the best value and protection for your budget.

- Get Your Certificate of Insurance: Once you decide, we handle the paperwork and can often provide your proof of insurance within 24 hours.

Ready to find an affordable policy? Get a Quote today.

Frequently Asked Questions about Cleaning Business Insurance

Here are quick answers to some of the most common questions we hear about cleaning business insurance cost and coverage.

What’s the difference between general liability and professional liability insurance?

It’s a simple but important distinction:

- General Liability (GL) covers physical harm. It pays for claims if your business operations cause bodily injury to a third party (like a client slip-and-fall) or damage their property (like breaking a window).

- Professional Liability (E&O) covers financial harm. It pays for claims that your professional mistakes or negligence caused a client a financial loss, even if no one was physically hurt (e.g., your service led to a failed health inspection, costing the client revenue).

Do I need insurance if I’m a self-employed solo cleaner?

Yes, absolutely. As a sole proprietor, your personal assets are not separate from your business assets. Without insurance, a lawsuit could put your home, car, and savings at risk. Furthermore, many clients will require you to show proof of insurance before hiring you, making it essential for winning jobs and establishing credibility.

Does my policy cover my cleaning tools and equipment?

Not automatically. Your General Liability policy does not cover your own property. To protect your valuable vacuums, buffers, and other portable gear from theft or damage while in transit or at a job site, you need a specific policy called Tools & Equipment Insurance (also known as Inland Marine coverage). It’s a vital add-on to protect the equipment you rely on to do your job.

Protect Your Business and Your Bottom Line

We’ve covered the essentials of cleaning business insurance cost and the key coverages that protect your livelihood. Whether you’re a solo cleaner in Nevada or run a large crew in Arizona, the right insurance is a strategic investment in your company’s future.

At Caruso Insurance Services, we specialize in creating custom policies that fit the unique needs and budget of your cleaning business. We serve professionals across Colorado, Tennessee, Idaho, Texas, and Florida, ensuring you get comprehensive protection without paying for coverage you don’t need.

Don’t leave your hard work vulnerable to a single accident. Safeguard your business, your team, and your bottom line. Ready to polish up your protection? Reach out today for a personalized quote.