See How We're Different

or Call Us: 951-547-6770

Protecting Renters: The Cost of Comprehensive Coverage

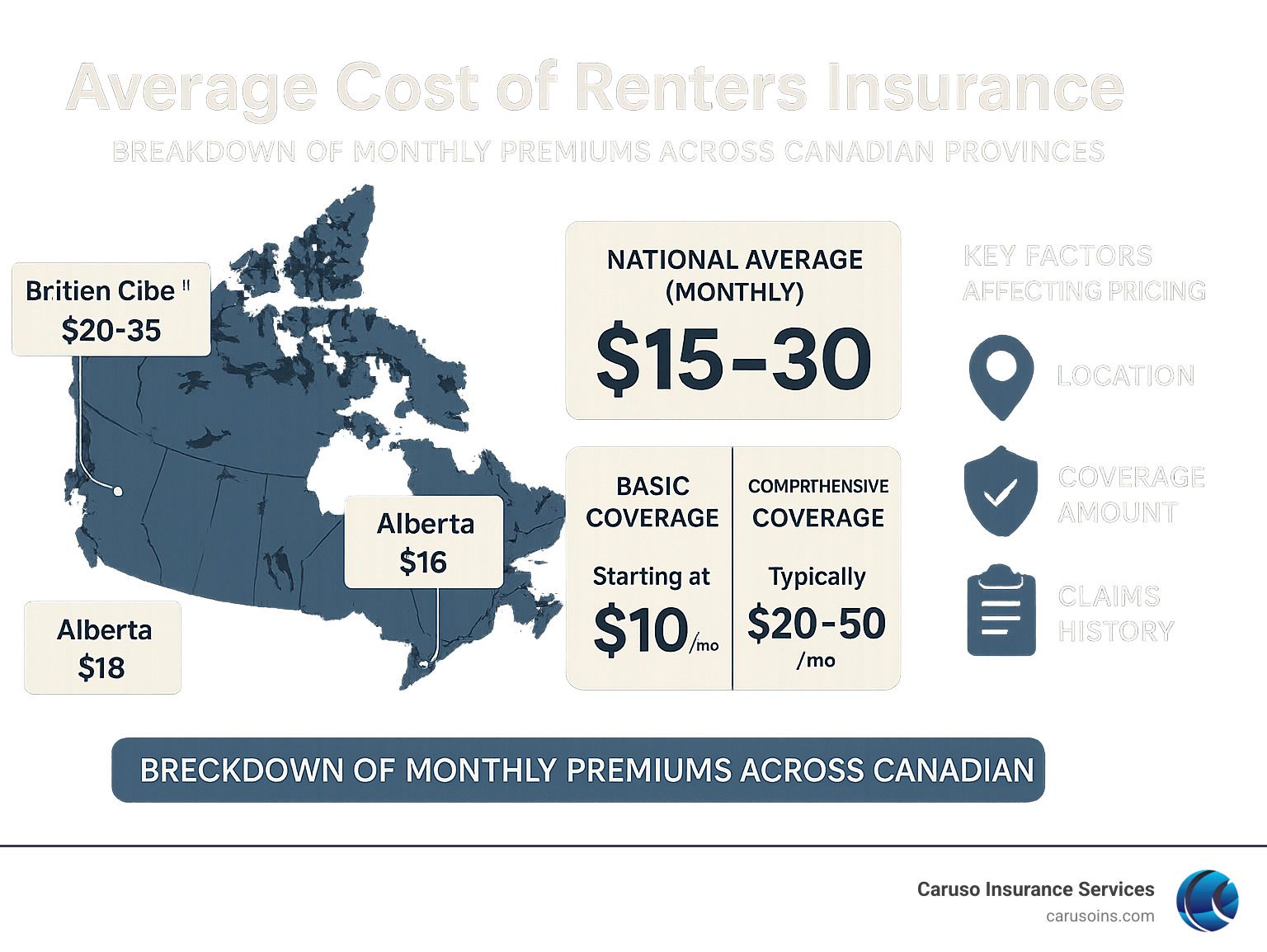

The average cost of renters insurance in the United States ranges from $15 to $25 per month, making it one of the most affordable ways to protect your personal belongings and financial security as a renter.

Quick Answer: Average Renters Insurance Costs in the U.S.

– National Average: $15–$25 per month ($180–$300 annually)

– California: $196 per year (about $16.33 per month)

– Texas: $219 per year (about $18.25 per month)

– Florida: $195 per year (about $16.25 per month)

– Basic Coverage: Can start as low as $10 per month

– Comprehensive Coverage: Typically $20–$40 per month

Many renters assume their landlord’s insurance covers their belongings, but that’s not the case. Your landlord’s policy only protects the building structure—leaving your personal property, liability risks, and temporary living expenses completely unprotected.

With roughly 44 million renter households in the U.S., understanding these costs helps you make informed decisions about protecting what matters most. The good news? Renters insurance costs significantly less than homeowners insurance because it doesn’t cover the building itself.

What Is Tenant (Renters) Insurance & What Does It Cover?

Tenant insurance (also called renters insurance) protects you and your belongings when you’re renting a home or apartment. Here’s the thing many renters don’t realize: your landlord’s insurance only covers the building itself – not your stuff, not your liability, and not your extra costs if something goes wrong.

Picture this scenario: a kitchen fire damages your apartment. Your landlord’s insurance will fix the walls, replace the stove, and repair the flooring. But your couch, TV, clothes, and that collection of books you’ve been building for years? Those are completely on you to replace. That’s exactly where tenant insurance steps in to save the day.

Core Protections Explained

Personal property coverage is the heart of your tenant insurance policy. This protects all your belongings against common disasters like fires, theft, vandalism, and water damage from burst pipes. Most policies offer “All Risks” coverage, which protects against any disaster unless your policy specifically excludes it.

Liability protection might be even more important. If your friend slips on your freshly mopped floor and breaks their ankle, or if your washing machine overflows and floods the apartment downstairs, liability coverage helps pay for medical bills, legal fees, and property damage. Most policies start with $100,000 in liability coverage.

Additional living expenses (ALE) coverage becomes your best friend when disaster strikes. If a fire forces you out of your apartment for several weeks, ALE helps pay for hotel rooms, restaurant meals, and other costs above what you’d normally spend.

Common Exclusions & Add-Ons

Standard tenant insurance policies have some important gaps you should know about. Earthquake and flood damage typically aren’t covered unless you add special endorsements to your policy.

High-value items like jewelry, artwork, or collectibles often have coverage limits around $5,000 under basic policies. If you own valuable items, you’ll need to schedule them separately with additional coverage.

Here’s something crucial about roommates and sublets: standard policies typically only cover you and your immediate family members living in the unit. Roommates need their own separate policies, and subletting or running an Airbnb usually cancels your coverage unless you have specific endorsements.

Average Cost of Renters Insurance in the United States

When you’re looking at the average cost of renters insurance across the U.S., you’ll find it’s surprisingly affordable—most renters pay between $15 and $25 per month for solid protection. That’s less than what many people spend on their daily coffee habit, yet it protects everything they own.

What makes tenant insurance so reasonably priced? The secret is that your policy doesn’t need to cover the building itself—your landlord takes care of that. You’re only insuring your personal belongings, liability risks, and temporary living costs if something goes wrong.

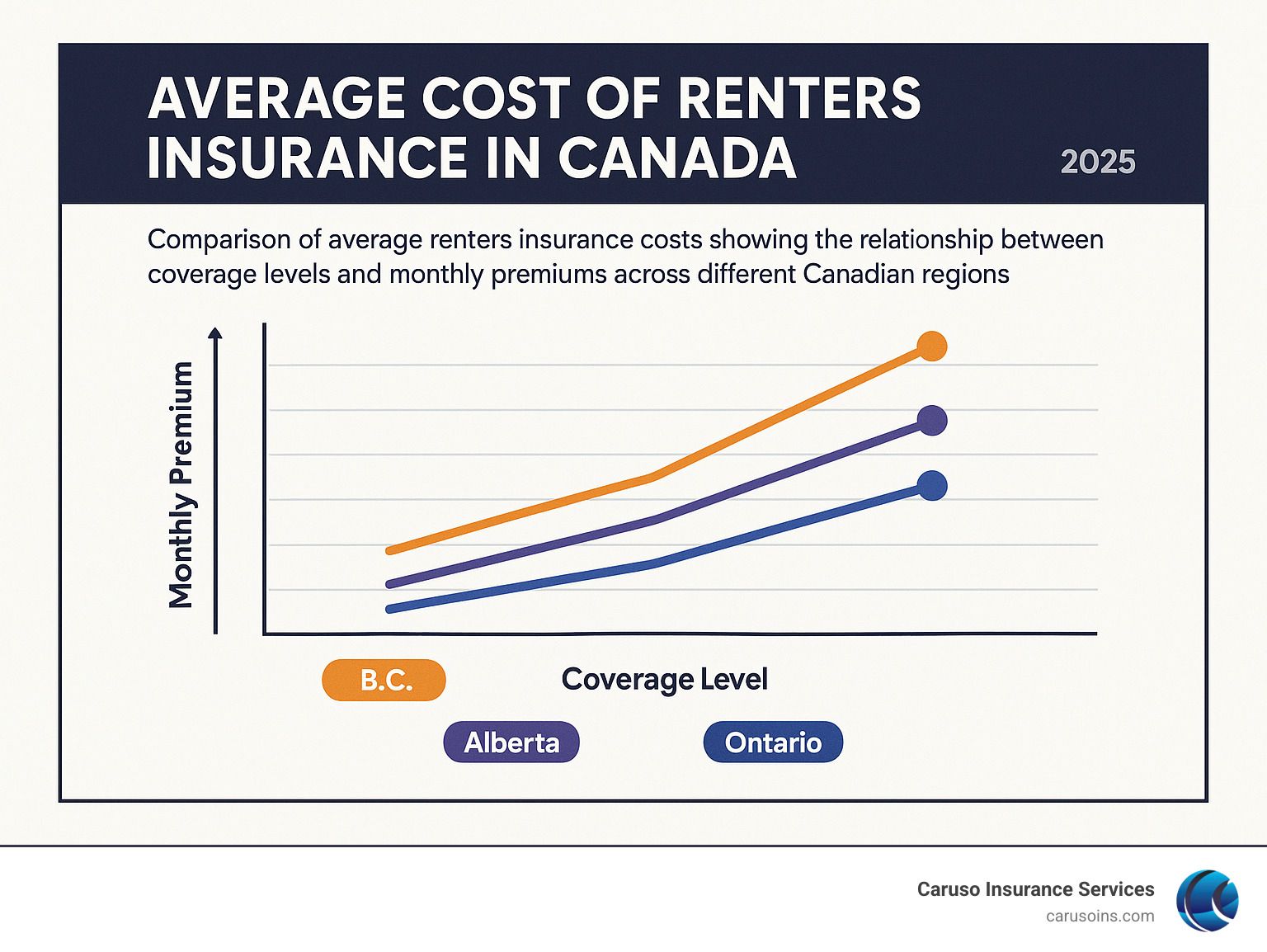

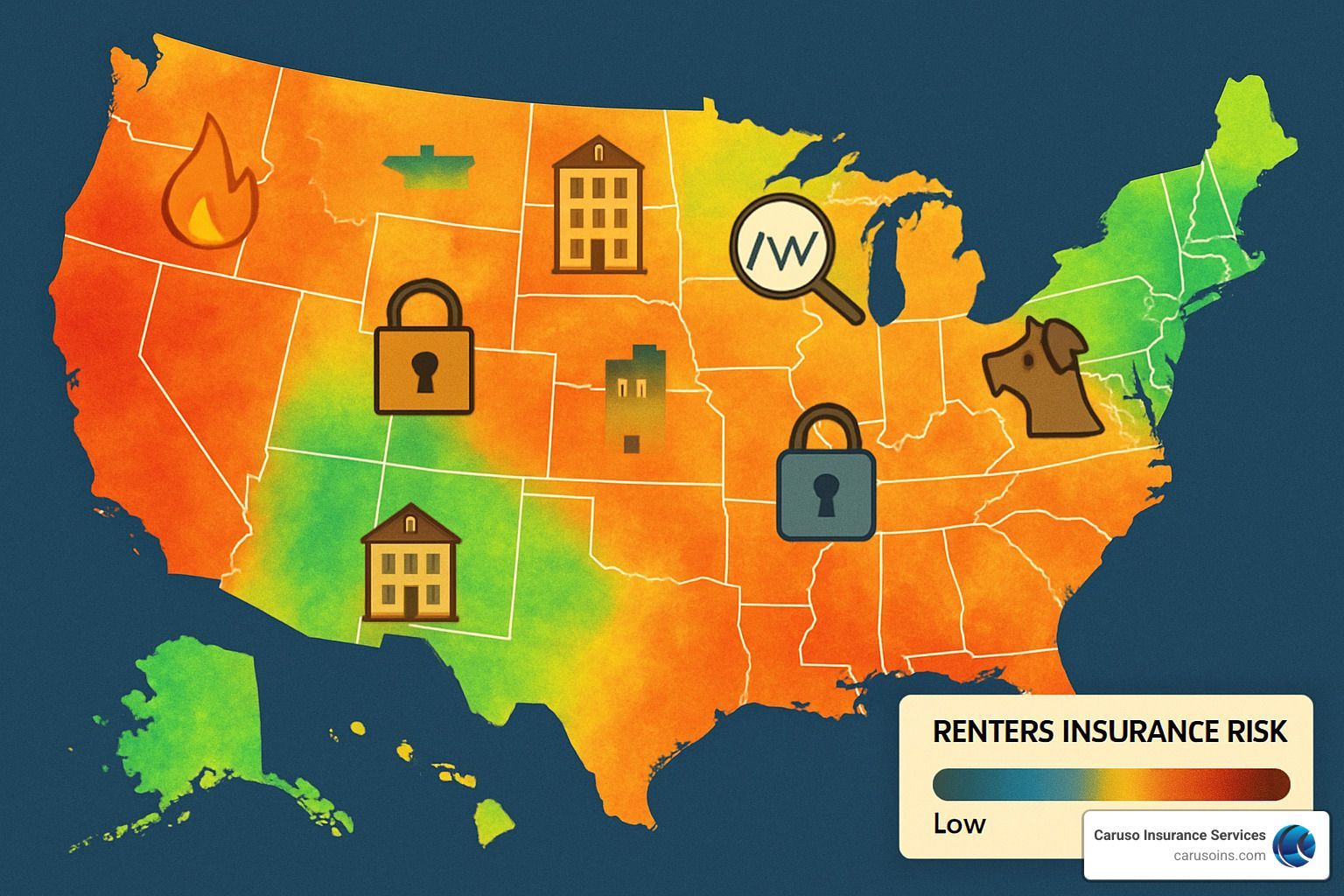

Your location plays a big role in determining your exact costs. If you’re renting in Los Angeles or San Francisco, you’ll likely pay toward the higher end of that range due to increased theft risk and higher property values. But if you’re in a smaller city or rural area, your premiums will often be closer to the lower end

Average Cost of Renters Insurance: California vs Texas vs Florida

California renters see an average premium of $196 per year—only about $16.33 per month. Coastal cities like Los Angeles and San Diego usually fall toward the upper end because of higher property values, while inland areas tend to enjoy lower rates.

Texas renters pay slightly more, with an average of $219 per year or about $18.25 per month. Severe weather—think hurricanes and hail—pushes rates up a bit. Houston averages around $222 annually, while Dallas sits near $215.

Florida renters land close to the national average at $195 per year (about $16.25 per month). Hurricane exposure drives premiums higher in coastal regions like Miami, whereas inland communities often see lower costs.

National Market Statistics & Trends

The U.S. rental market is massive—about 44 million renter households, representing roughly 35% of all U.S. households. This robust market fosters competition among insurers, helping keep tenant insurance rates reasonable for everyone.

Despite the affordability and importance of tenant insurance, there’s still a troubling gap in coverage. Surveys show that over 40% of U.S. renters don’t carry tenant insurance. Many skip it because they think it costs too much or don’t understand what it covers.

You can find the latest statistics on U.S. rental housing, including detailed breakdowns and current trends tracking housing costs and rental patterns nationwide.

Factors That Influence Your Premium

When you’re shopping for tenant insurance, understanding what affects your average cost of renters insurance can help you make smarter choices and potentially save money.

Your neighborhood matters more than you might think. Areas with higher crime rates, frequent break-ins, or vandalism naturally cost more to insure. The building you call home plays a big role too. That brand-new condo with sprinkler systems, security cameras, and modern electrical work? It’ll likely earn you better rates than a charming century-old house with original wiring.

Your credit score affects your insurance rates in most provinces. Insurance companies have found that people who manage their finances well tend to file fewer claims.

Your claims history follows you from policy to policy, and

pet lovers should know that certain dog breeds might affect your rates.

Actual Cash Value vs Replacement Cost

This might be the most important decision you’ll make when buying tenant insurance. The choice between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage affects both what you pay and what you get back after a claim.

Actual Cash Value pays you what your used items were worth on the day they got stolen or damaged – not what you need to buy replacements. Replacement Cost Value costs about 14% more according to industry data, but when items get stolen, you get enough money to buy comparable new ones.

If you lost $15,000 worth of belongings in a fire, would you rather receive $9,000 (after depreciation with ACV) or the full $15,000 to actually replace everything? That extra few dollars per month suddenly seems like a pretty good deal.

How Much Coverage Do You Need?

Start with a home inventory – walk through your place with your phone and take pictures of everything while making a list. Don’t just count the obvious stuff like your TV and laptop. Count your clothes, shoes, kitchen gadgets, books – literally everything you’d need to buy again if it all disappeared tomorrow.

Use realistic replacement costs when you’re adding things up. Check current prices for electronics online, think about what you actually spend on clothes, and be honest about furniture costs.

Don’t forget about liability coverage. The standard $100,000 might sound like a lot, but if someone gets seriously hurt in your apartment, legal and medical costs can add up fast. Bumping up to $300,000 in liability coverage typically costs about $1 per month but gives you much better protection.

How to Save Money on Tenant Insurance

Finding ways to reduce your average cost of renters insurance doesn’t mean sacrificing the protection you need. Smart renters can trim their premiums significantly while still maintaining comprehensive coverage.

The most effective savings come from multi-policy discounts when you bundle your tenant insurance with auto coverage. Industry data shows renters can save an average of $850 annually through bundling.

Security improvements to your rental unit often qualify for meaningful discounts. Installing monitored burglar alarms, smoke detectors, or even basic security cameras shows insurers you’re taking steps to prevent losses.

Payment method choices offer easy savings. Many insurers provide discounts for paying your annual premium upfront rather than monthly installments. Choosing paperless billing and automatic payments can also qualify for additional small discounts.

For more comprehensive information about coverage options, check out our detailed guide on Home Insurance Coverage Options which covers many concepts that also apply to tenant insurance.

Bundling Renters & Auto/Home Policies

Bundling multiple insurance policies represents the single biggest opportunity for most renters to reduce their insurance costs. That average savings of $850 when combining tenant and auto insurance makes bundling worth serious consideration.

Insurance companies love customers with multiple policies because they’re more profitable and much less likely to switch to competitors. Multi-policy savings typically start around 10-15% but can reach 25% or more when you have multiple policies with the same insurer.

Comparing Quotes & Adjusting Deductibles

Online quote comparison has made insurance shopping much easier, but getting the best rates requires a strategic approach. The most effective method involves getting quotes from at least three different insurers using identical coverage specifications.

Deductible adjustments provide one of the most direct ways to control your premium. Increasing your deductible from $500 to $1,000 typically reduces your annual premium by $20-30. Moving to a $2,000 deductible can provide even larger savings, though you need to ensure you can comfortably afford the higher out-of-pocket cost if you file a claim.

For additional insights into insurance shopping behaviors and effective comparison strategies, research from the Insurance Information Institute provides valuable data on how consumers can make better insurance decisions.

Frequently Asked Questions about the Average Cost of Renters Insurance

Why is the average cost of renters insurance lower than homeowners coverage?

The average cost of renters insurance stays remarkably affordable compared to homeowners insurance for one simple reason: you’re not insuring the building itself. Think of it this way – if your landlord’s house burns down, they need to rebuild walls, install plumbing, rewire electricity, and replace the roof. That’s expensive stuff.

As a renter, your insurance only needs to cover your personal belongings and protect you from liability. While homeowners in Canada typically pay $1,200 to $2,000 annually for coverage, renters enjoy protection for just $180 to $360 per year.

The math makes perfect sense when you consider what’s actually being protected. A homeowner might need $300,000 in dwelling coverage to rebuild their house, plus another $75,000 for personal belongings. Meanwhile, a renter typically needs $20,000 to $50,000 in personal property coverage – no dwelling replacement required.

Most renters also own fewer possessions than established homeowners. You might have a couch, bed, TV, and kitchen basics, while homeowners often accumulate decades worth of furniture, tools, and household items. Less stuff to replace means lower premiums.

Does the average cost of renters insurance cover roommates or sublets?

Here’s where things get tricky, and it’s one of the biggest misconceptions about tenant insurance. Standard policies typically don’t cover roommates unless they’re immediate family members like your spouse or children.

Each roommate really needs their own policy. I know it seems like extra expense, but think about it – if someone breaks into your apartment and steals everyone’s laptops, whose policy pays for what? Having separate policies eliminates confusion and ensures everyone’s belongings are properly protected.

Subletting creates even bigger complications for your coverage. Planning to rent out your place on Airbnb while you’re away? Your standard tenant insurance probably won’t cover you during those periods. Most insurers consider short-term rentals a business activity, which standard policies exclude.

If you occasionally sublet, you’ll need to have an honest conversation with your insurance provider about endorsements or special coverage. Some companies offer add-ons for occasional subletting, but you must disclose this upfront. Trying to hide subletting activities could void your entire policy when you need it most.

The bottom line? Individual policies for roommates and proper endorsements for subletting prevent nasty surprises when you file a claim.

What happens to the average cost of renters insurance after a claim?

Filing a claim doesn’t automatically skyrocket your average cost of renters insurance, but it can definitely impact your future rates. The effect depends on what happened, how much the claim cost, and your history with previous claims.

Small claims often have minimal impact, especially if you’ve been claims-free for several years. However, filing multiple small claims sends a red flag to insurers that you might be higher risk. This is why many insurance professionals recommend paying for minor damages out of your own pocket rather than filing claims that barely exceed your deductible.

Larger claims or liability incidents typically have more noticeable rate impacts. A major theft or fire claim might bump your renewal rates by 15% to 25%, though this varies significantly between insurers and depends on your overall risk profile.

The good news is that claims-free periods work in your favor. Maintaining a clean record for several years can qualify you for discounts, and some insurers offer accident forgiveness programs where your first claim in years doesn’t affect your rates.

Claims generally stay on your insurance record for five to seven years, so their impact isn’t permanent. The key is weighing the immediate benefit of claim payment against potential long-term rate increases. For significant losses well above your deductible, filing usually makes financial sense despite possible rate adjustments.

Insurance exists to protect you from major financial losses. Don’t let fear of rate increases prevent you from using coverage when you genuinely need it.

Conclusion

Understanding the average cost of renters insurance puts you in control of your financial security as a renter. At just $15–$25 per month across the United States—and about $16 in California—tenant insurance offers incredible value, protecting your belongings, covering liability risks, and ensuring you have somewhere to stay if disaster strikes your rental home.

The numbers tell a compelling story. Whether you’re paying California’s average of $196 annually or living in another state with similar rates, these costs represent pennies compared to what you’d face replacing everything you own out of pocket.

Smart shopping makes protection even more affordable. Bundling with auto insurance can save you hundreds annually, while simple steps like installing smoke detectors or maintaining good credit can trim your premiums further.

Millions of renter households still go without tenant insurance. Many assume it’s too expensive or unnecessary—but as we’ve seen, neither assumption holds true. Your landlord’s insurance won’t replace your laptop, cover liability if someone gets hurt in your apartment, or pay for hotel stays if a fire makes your home unlivable.

Your peace of mind shouldn’t be left to chance. Every day without tenant insurance is a day you’re gambling with your financial future. The good news? Getting protected is easier than ever, and professional guidance ensures you get exactly the coverage you need without paying for protection you don’t.

Ready to stop worrying about “what if” and start enjoying the confidence that comes with proper coverage? Get your personalized

Renters Insurance quote today and find out why so many California renters wish they’d made this smart financial move sooner.