See How We're Different

or Call Us: 951-547-6770

Why Classic Car Insurance Costs Matter More Than You Think

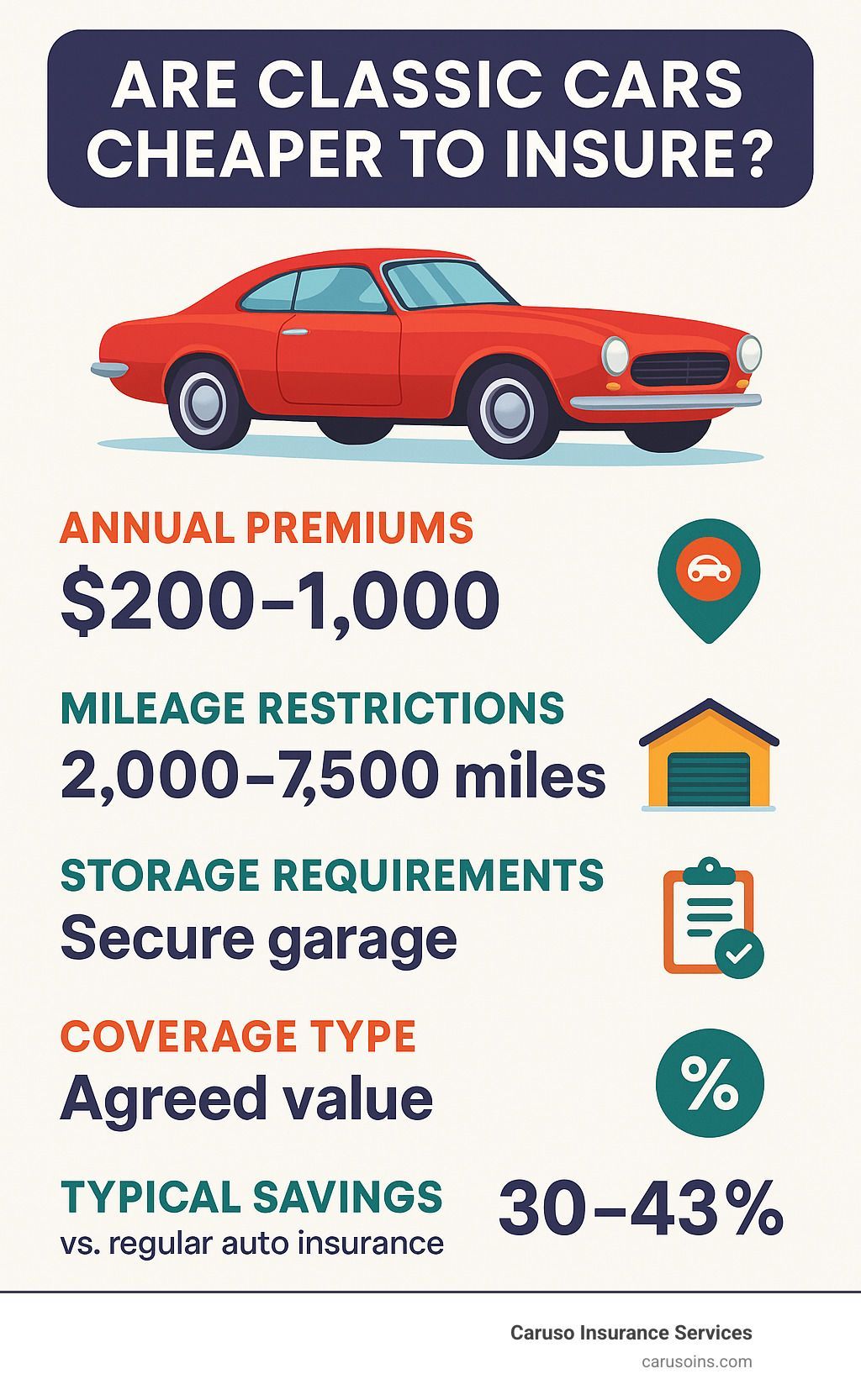

Are classic cars cheaper to insure? Yes, in most cases they are. Classic car insurance typically costs between $200-$1,000 annually, while regular auto insurance averages over $1,000-$4,200 per year – potentially saving you up to 43% on premiums.

Quick Answer for Classic Car Insurance Costs:

– Classic car insurance: $200-$1,000 per year

– Regular car insurance: $1,000-$4,200 per year

– Average savings: 30-43% lower premiums

– Why it’s cheaper: Limited usage, secure storage, careful owners, agreed-value coverage

– Requirements: Typically 15-25+ years old, restricted mileage (2,000-7,500 miles/year), garage storage

As an independent insurance agent and business owner, I’ve helped countless collectors find that their weekend warrior ’67 Camaro costs less to insure than their daily-driven Honda. My experience working with specialty insurers has shown me exactly why are classic cars cheaper to insure becomes the right question for most vintage car enthusiasts.

The math seems backwards at first – shouldn’t a rare, expensive classic cost more to protect than a regular car? But insurance companies know something important: classic car owners drive differently, store their vehicles more carefully, and treat their rides like the investments they are.

Find more about are classic cars cheaper to insure:

– classic car insurance comparison

– classic car insurance requirements

– how to insure a classic car as a daily driver

Why We’re Talking Money and Metal

Let’s be honest – owning a classic car is part passion project, part financial investment, and entirely about preserving automotive history. But when you’re budgeting for that dream ’65 Mustang or considering whether to keep grandpa’s pristine ’72 Chevelle, insurance costs become a crucial piece of the puzzle.

We’ve noticed that many classic car enthusiasts assume their vintage rides will cost a fortune to insure. They picture sky-high premiums based on the car’s value or rarity. The reality? Most classic car owners are pleasantly surprised by their insurance bills.

This isn’t just about saving money – though who doesn’t love keeping more cash in their pocket? It’s about understanding how the insurance industry views classic car ownership and why that perspective works in your favor.

The Big Question: Are Classic Cars Cheaper to Insure?

Let’s cut straight to the heart of what you really want to know. Are classic cars cheaper to insure? The answer is a resounding yes for most vintage car owners – and the savings can be substantial.

After analyzing hundreds of policies, we’ve found that classic car insurance typically runs between $200 to $1,000 annually, while regular auto insurance averages $1,000 to $4,200 per year. That’s potential savings of 30-43% on your insurance premiums.

| Insurance Type | Annual Premium Range | Average Cost |

|---|---|---|

| Classic Car Insurance | $200 – $1,000 | $400 – $600 |

| Regular Auto Insurance | $1,000 – $4,200+ | $2,500+ |

| Potential Savings | 30-43% lower | $1,000+ annually |

These aren’t just theoretical numbers either. The classic car insurance comparison data shows real savings that put money back in collectors’ pockets – money that can go toward that restoration project or the next addition to your garage.

The premium gap exists because insurance companies understand something important: classic car owners represent a fundamentally different risk profile than daily commuters rushing through traffic.

Why are classic cars cheaper to insure for most owners?

Insurance is all about risk, and classic car enthusiasts happen to be insurers’ favorite type of customer. Here’s why we vintage car lovers get the VIP treatment on premiums.

Limited mileage usage is the biggest factor working in your favor. Most classic car policies cap annual mileage between 2,000 to 7,500 miles, compared to the 12,000+ miles typical drivers rack up. When your ’69 Mustang spends most weekends in the garage and only comes out for sunny Sunday drives, there’s simply less opportunity for accidents.

Agreed value coverage changes the entire insurance equation. Unlike regular cars that lose value every year, your classic maintains or even appreciates in value. The insurer agrees upfront on your car’s worth, eliminating depreciation disputes and often resulting in more predictable premiums.

Careful driver demographics make classic car owners insurance gold. We’re not teenagers texting while driving or stressed commuters weaving through rush hour. Most of us are experienced drivers who treat our vintage rides like the treasures they are.

Secure storage requirements dramatically reduce risk exposure. Most classic car policies require garage storage, protecting your investment from theft, vandalism, and weather damage. Insurers reward this reduced risk with lower premiums.

When ‘are classic cars cheaper to insure’ isn’t true

While most classic car enthusiasts enjoy lower insurance costs, there are situations where premiums can surprise you – and not in a good way.

High-value exotic vehicles break the typical cost rules. A million-dollar Shelby Cobra will cost significantly more to insure than a nicely restored $20,000 Camaro, regardless of the policy type. When replacement costs reach astronomical levels, premiums follow suit.

Daily driver usage eliminates most classic car insurance advantages. If you’re commuting to work in your vintage Corvette, you’ll likely need regular auto insurance with standard mileage allowances. Check out our guide on how to insure a classic car as a daily driver for options.

Young or inexperienced drivers face additional challenges. Most classic car insurers require clean driving records and drivers over 25. Younger enthusiasts may encounter higher premiums or limited coverage options.

Inadequate storage conditions can kill your savings potential. If you can’t meet garage storage requirements due to space or budget constraints, you’ll lose one of the key factors that make classic car insurance affordable in the first place.

Factors That Drive Classic Car Premiums

When you’re wondering are classic cars cheaper to insure, the answer depends on several key factors that insurers use to calculate your rates. Think of it like a recipe – get the right ingredients, and you’ll enjoy those lower premiums we talked about.

Based on research from the Insurance Information Institute, insurers look at your classic car differently than your daily driver. They’re not just worried about fender benders in parking lots – they’re evaluating how you use, store, and care for your vintage ride.

The good news? Most of these factors work in your favor when you own a classic car. Let’s break down what really matters to your insurance company.

Usage & Mileage Caps

Here’s where classic car insurance gets interesting. Your insurance company actually wants you to drive less. Unlike regular car insurance, where mileage restrictions feel punitive, classic car policies are built around the reality of how we actually use our vintage vehicles.

Most insurers offer tiered mileage options that directly impact your premiums. Drive only 2,000 miles annually for those pristine show cars that only see sunlight at car shows? You’ll pay the lowest rates. Weekend cruisers who put on 3,000 to 5,000 miles fall into the sweet spot of moderate pricing.

The upper limit for most classic policies hovers around 7,500 miles per year. That’s plenty for weekend drives, car shows, cruise nights, and even the occasional road trip to that classic car meet three states over.

But here’s the catch – if you’re thinking about driving your ’69 Mustang to work every day, you’ll need different coverage. Check out our guide on how to insure a classic car as a daily driver to understand your options.

Vehicle Value & Rarity

Your classic’s value affects your premium, but probably not how you’d expect. Unlike regular cars that lose value the moment you drive them off the lot, classic cars often appreciate – and insurers know this.

Agreed value coverage is where the magic happens. You and your insurance company agree upfront on what your car is worth. No arguments about depreciation, no disputes about “actual cash value” that somehow never matches what you paid. This certainty actually helps keep premiums predictable and often lower.

Parts availability plays a bigger role than you might think. That restored Camaro with readily available parts from multiple suppliers? It’s cheaper to insure than a rare Italian exotic where a replacement headlight costs more than most people’s monthly mortgage.

Cars with strong appreciation potential might see some premium adjustments over time, but the agreed-value structure keeps these changes manageable and transparent.

Driver & Storage Requirements

Storage requirements are where classic car insurance really shines – and where you can see the biggest premium differences. Insurers love classic car owners because we actually take care of our vehicles.

Enclosed, locked garage storage isn’t just a suggestion – it’s typically required. But this isn’t the insurance company being difficult. It’s them recognizing that your classic deserves protection from weather, theft, and that neighbor who can’t park straight.

Climate-controlled storage can sometimes earn you additional discounts. Your insurance company knows that consistent temperature and humidity levels mean fewer claims for weather-related damage and deterioration.

Security features can slash your premiums by 15-20%. Anti-theft devices, tracking systems, and comprehensive garage security all signal to insurers that your car is a low theft risk.

Driver qualifications matter too. Most insurers want drivers over 25 with clean records – not because they’re ageist, but because experience and careful driving habits reduce claims. Some companies work with classic car clubs to offer programs for younger enthusiasts who demonstrate responsibility.

The multiple vehicle requirement might seem odd at first, but it makes sense. Insurers want to see that you have a daily driver, ensuring your classic stays in its proper role as a weekend warrior rather than a grocery-getter.

Policy Differences: Classic vs Regular Auto Coverage

When people ask are classic cars cheaper to insure, they’re often surprised to learn it’s not just about the price – classic car insurance works completely differently from regular auto coverage. Think of it like comparing a custom suit to something off the rack. Both protect you, but one is specifically designed for your unique needs.

The differences go far beyond cost and explain why classic car owners often get better protection for less money. Understanding these distinctions helps you make the right choice for your vintage ride. For complete details on what you’ll need, check our guide on classic car insurance requirements.

Agreed Value vs Actual Cash Value

Here’s where classic car insurance really shines – and where the cost savings often come from. Regular auto insurance and classic car insurance handle your vehicle’s value in completely opposite ways.

With regular auto insurance, you’re dealing with actual cash value coverage. This means if your car gets totaled, the insurance company pays what they think your car was worth that day, minus depreciation. Your 2015 sedan that cost $25,000 new might only be worth $12,000 after a few years of depreciation. You’ll spend time arguing with adjusters about market values and depreciation rates.

Classic car insurance uses agreed value coverage instead. Before you even buy the policy, you and the insurance company agree on exactly what your car is worth. Whether it’s $15,000 for your restored Camaro or $50,000 for your pristine Corvette, that number is locked in your policy.

This agreed-value approach actually helps keep premiums lower because insurance companies know exactly what they’ll pay if something happens. No guesswork, no lengthy investigations, no depreciation calculations. They can price the policy accurately from day one.

The best part? Your classic car’s agreed value can go up over time as you complete restorations or as the market appreciates. Try getting that from your daily driver’s insurance policy.

Specialized Coverages Every Collector Should Know

Regular auto insurance assumes you’re driving to work, running errands, and living normal life with your car. Classic car insurance understands you’re preserving automotive history – and offers coverage that matches that reality.

Spare parts coverage protects all those restoration parts sitting in your garage or storage unit. We’re talking about everything from that rebuilt engine block to boxes of trim pieces you’ve been collecting. Most policies offer spare parts protection starting at $500, with options to increase coverage to several thousand dollars.

Restoration in progress coverage is a game-changer if you’re working on a project car. Your vehicle gets protection even when it’s torn apart in your garage. The engine might be at the machine shop, the body at the paint booth, and the interior with the upholsterer – you’re still covered.

Show event medical coverage recognizes that classic car owners spend time at car shows, cruise nights, and club events. If someone gets injured at these gatherings, you have protection that regular auto insurance simply doesn’t offer.

Worldwide touring coverage lets you take your classic on those dream road trips without worrying about coverage gaps. Many policies include up to 90 days of international coverage, perfect for cross-country tours or classic car rallies.

Laid-up coverage offers a money-saving option when your classic is off the road for winter storage or long-term restoration. You maintain some protection at a fraction of the cost, then easily switch back to full coverage when you’re ready to drive again.

These specialized coverages aren’t just nice extras – they’re designed specifically for how classic car owners actually use their vehicles. Regular insurance companies don’t offer them because they don’t understand the classic car lifestyle.

Saving Money on Classic Car Insurance

You already know that are classic cars cheaper to insure than regular vehicles, but why stop there? There are plenty of ways to squeeze even more savings out of your classic car insurance without sacrificing coverage. After helping hundreds of collectors in Corona and across California, I’ve seen these strategies work time and again.

The beauty of classic car insurance is that it rewards responsible ownership. Every security measure you take, every mile you don’t drive, and every precaution you implement can translate into real dollar savings. Check out our car insurance best rates guide for more comprehensive money-saving strategies.

Quick Ways to Lower Your Classic Premium

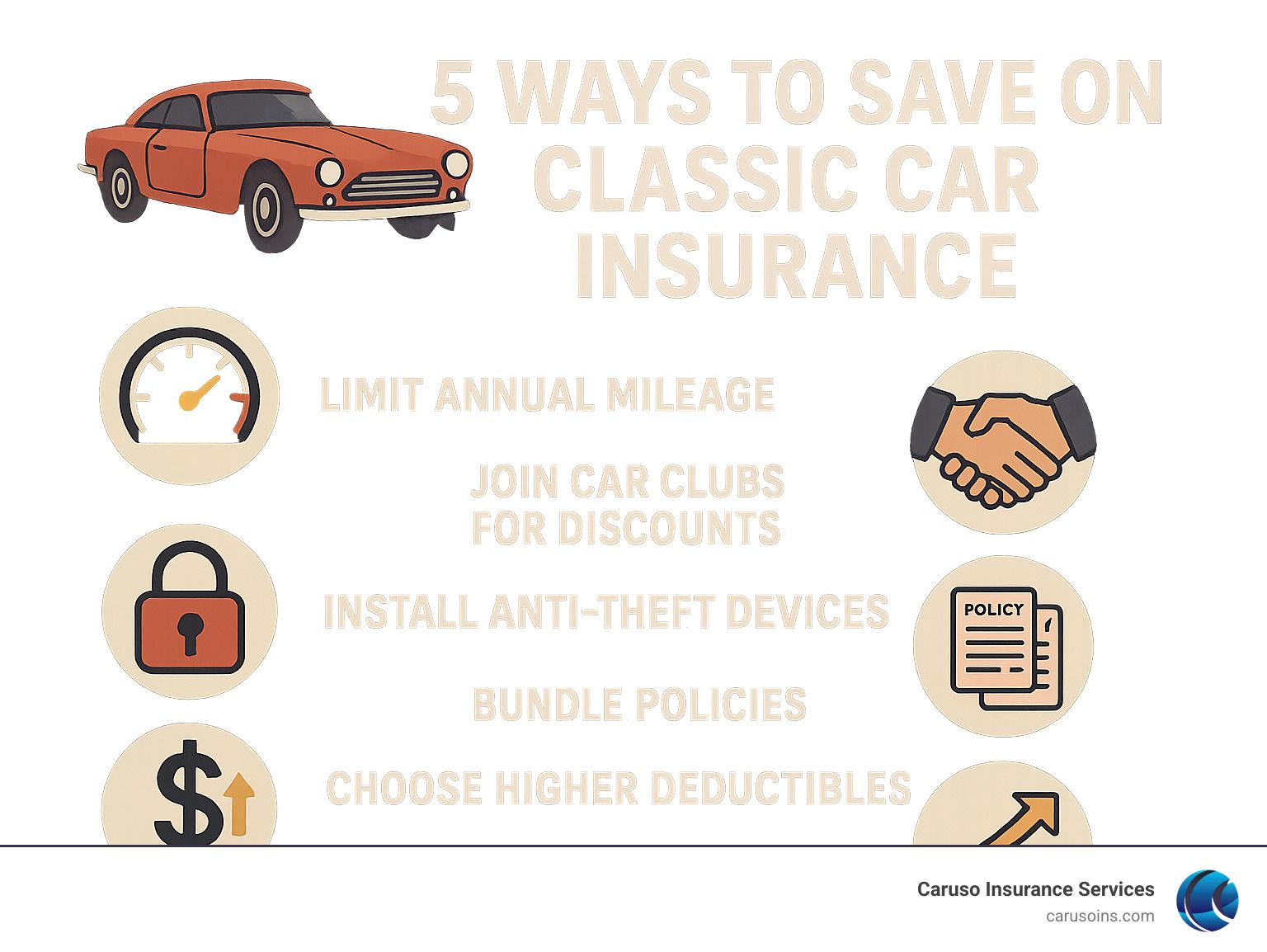

Commit to fewer miles and watch your premiums drop. The difference between a 7,500-mile policy and a 3,000-mile policy can save you 20-30% annually. Be honest about your driving habits – if you’re really just a weekend cruiser, don’t pay for mileage you’ll never use.

Join a recognized car club and start saving immediately. Whether it’s the Mustang Club of America or your local classic car club, membership discounts can reach 15% with many insurers. Plus, you’ll meet fellow enthusiasts who share your passion for vintage metal.

Install quality anti-theft devices to protect your investment and your wallet.

Certified alarm systems, GPS tracking devices, and even old-school steering wheel locks can earn you 15-20% discounts on comprehensive coverage. Modern tracking technology is surprisingly affordable and gives you peace of mind beyond just the insurance savings.

Bundle your policies for automatic savings. Combining your classic car insurance with your homeowner’s, business, or daily driver policies typically saves $72-$110 annually through multi-policy discounts. It also simplifies your insurance management – one agent, one renewal date, one relationship.

Choose your deductibles strategically to balance premium savings with out-of-pocket risk. Higher deductibles mean lower premiums, but make sure you can comfortably afford the deductible if you need to file a claim. For a garage-kept classic that rarely sees the road, a higher deductible often makes financial sense.

Consider storage-only policies during restoration periods or seasonal storage. If your classic is under restoration or tucked away for winter, storage-only coverage costs significantly less than full coverage while still protecting against fire, theft, and other garage-related risks.

Multiple classic car discounts reward serious collectors. If you’re like many enthusiasts with more than one vintage ride, insuring them all with the same company often earns fleet discounts. Some insurers offer better rates starting with your second classic.

Loyalty pays off in the classic car insurance world. Long-term customers with clean claims histories often receive loyalty pricing that improves over time. Building a relationship with your insurer can lead to better rates and more personalized service when you need it most.

Frequently Asked Questions about Classic Car Insurance Costs

Let me answer the most common questions I hear from classic car owners about insurance costs. These are the real concerns that come up when people are deciding whether to buy that dream car or figuring out how to protect the one they already own.

How much does classic car insurance typically cost per year?

Are classic cars cheaper to insure? Absolutely, and the numbers prove it. Classic car insurance typically runs between $200-$1,000 annually, with most of my clients paying around $400-$600 per year. Compare that to regular auto insurance averaging $2,500+ annually, and you’re looking at real savings.

Your exact cost depends on what matters most to insurers. A higher-value classic will cost more to protect than a nice but common restoration. Your annual mileage limit plays a huge role too – choosing 2,000 miles instead of 7,500 can cut your premium by hundreds of dollars.

Garage storage is another big factor. Insurers love knowing your classic sleeps safely indoors every night. Your driving record and age matter just like with regular insurance, but classic car companies tend to work with experienced, careful drivers who’ve earned their trust over the years.

The coverage limits you choose will adjust your premium up or down, but even high-limit classic policies often cost less than basic coverage on a daily driver. That’s the beauty of insuring something you truly care about – insurers recognize the difference.

What are the eligibility requirements for classic car insurance?

Getting classic car insurance isn’t as simple as calling up and asking for a quote. Insurers have specific requirements because they’re offering specialized coverage for a unique situation.

Your vehicle needs to be 15-25+ years old depending on the company, and it should be in good working condition or undergoing documented restoration. The car must be used for recreational purposes only – weekend drives, car shows, club events, and pleasure cruising. Most importantly, you’ll need enclosed, locked garage storage to protect your investment.

Driver requirements are pretty straightforward but firm. You’ll typically need to be 25 or older with a clean driving record and several years of licensed driving experience. Here’s the catch that surprises some people – you must have another vehicle for daily transportation. Insurers want to know your classic isn’t your only ride.

Usage restrictions keep premiums low but require discipline. You’re limited to 2,000-7,500 miles annually depending on your policy. You can drive to car shows, club meetings, exhibitions, and for pure enjoyment, but daily commuting, commercial use, and racing are off-limits unless specifically covered.

These requirements might seem strict, but they’re exactly why classic car insurance costs so much less than regular coverage. Insurers know they’re dealing with careful owners who treat their vehicles as investments, not just transportation.

Can I use classic car insurance if I drive my classic car daily?

This is where things get tricky, and I have this conversation with clients regularly. Traditional classic car insurance simply won’t work for daily driving because of those mileage restrictions and usage limitations we just discussed.

If you’re planning to drive your classic to work every day, you’ll need regular auto insurance instead. Yes, it costs more, but it provides the right coverage for higher-mileage, daily-use situations. You can’t squeeze 15,000 commuting miles into a 5,000-mile classic policy.

Some insurers offer modified classic policies with higher mileage allowances – sometimes 10,000+ miles annually. These cost more than traditional classic coverage but still offer agreed-value protection and some of the benefits that make classic insurance special.

I’ve seen clients use a hybrid approach successfully. They carry classic car insurance during storage seasons and switch to regular coverage when they’re driving more frequently. It takes some planning, but it can work for seasonal driving patterns.

For anyone seriously considering daily driving their classic, I always recommend reading our detailed guide on how to insure a classic car as a daily driver. It covers all the options and helps you make the right choice for your situation.

The bottom line? Are classic cars cheaper to insure when used as intended? Absolutely. But once you change how you use them, the insurance equation changes too.

Are Classic Cars More Affordable to Insure?

So, are classic cars cheaper to insure? The answer is a resounding yes for most vintage car enthusiasts. With premiums typically running $200-$1,000 annually compared to regular auto insurance that can hit $4,200 or more, you’re looking at genuine savings of 30-43% while getting coverage that’s actually designed for your classic.

The math works because insurance companies understand something important: classic car owners are different. We don’t weave through rush hour traffic every day. We don’t park our babies in questionable grocery store lots. We keep our classics in garages, drive them on sunny weekends, and treat them like the rolling pieces of history they are.

This isn’t just about saving money – though who doesn’t love keeping more cash for that restoration project? It’s about getting insurance that actually makes sense for how you use your classic. Agreed-value coverage means no arguments about depreciation when you need to file a claim. Specialized coverages protect your spare parts collection and cover you at car shows. Storage-only options let you save even more when your classic is tucked away for winter.

At Caruso Insurance Services, we’ve seen how the right classic car policy can transform an owner’s peace of mind. Whether you’re protecting a pristine numbers-matching muscle car or a lovingly restored daily driver, we can tailor an agreed-value policy that keeps both your wallet and your vintage wheels protected. Our experience with specialty insurers means we understand the unique needs of classic car owners – and how to get you the coverage you need at rates that make sense.

For personalized classic car insurance solutions that fit your specific needs and budget, explore our personal classic car insurance options.

Drive Smart, Pay Less, Preserve the Past

Every time you fire up that classic engine, you’re not just going for a drive – you’re preserving a piece of automotive history. The fact that protecting these mechanical treasures costs less than insuring a modern commuter car is just one more reason to accept the classic car lifestyle.

The money you save on insurance premiums can go toward the fun stuff: that chrome you’ve been eyeing, the engine rebuild you’ve been planning, or simply more weekend trips. Your classic deserves protection that understands its true value, and your budget deserves the savings that come with specialized coverage.

Ready to find exactly how much you could save? Let’s talk about your specific classic and find coverage that’s as unique as your ride. Because preserving the past shouldn’t break the bank – it should improve the joy of ownership.