See How We're Different

or Call Us: 951-547-6770

Understanding 6-Pack Charter Boat Insurance Expenses

6-pack charter boat insurance cost typically ranges from 1-3% of your vessel’s value annually. However, a full understanding requires looking beyond basic premiums to specialized coverages that protect your business, passengers, and professional license.

Quick Cost Overview:

- Annual Premium Range: 1-3% of vessel value (industry standard)

- Sample Costs: $50,000 boat = $500-$3,000/year | $200,000 boat = $3,000-$6,000/year

- Mariner Liability: Starting at $25.83/month for license protection

- Key Cost Factors: Vessel value, age, operating area, captain experience, and charter type

A 6-pack charter refers to vessels operating under an Operator of Uninspected Passenger Vessels (OUPV) license, which allows captains to carry up to six paying passengers. This commercial operation creates significantly different insurance needs compared to pleasure boating.

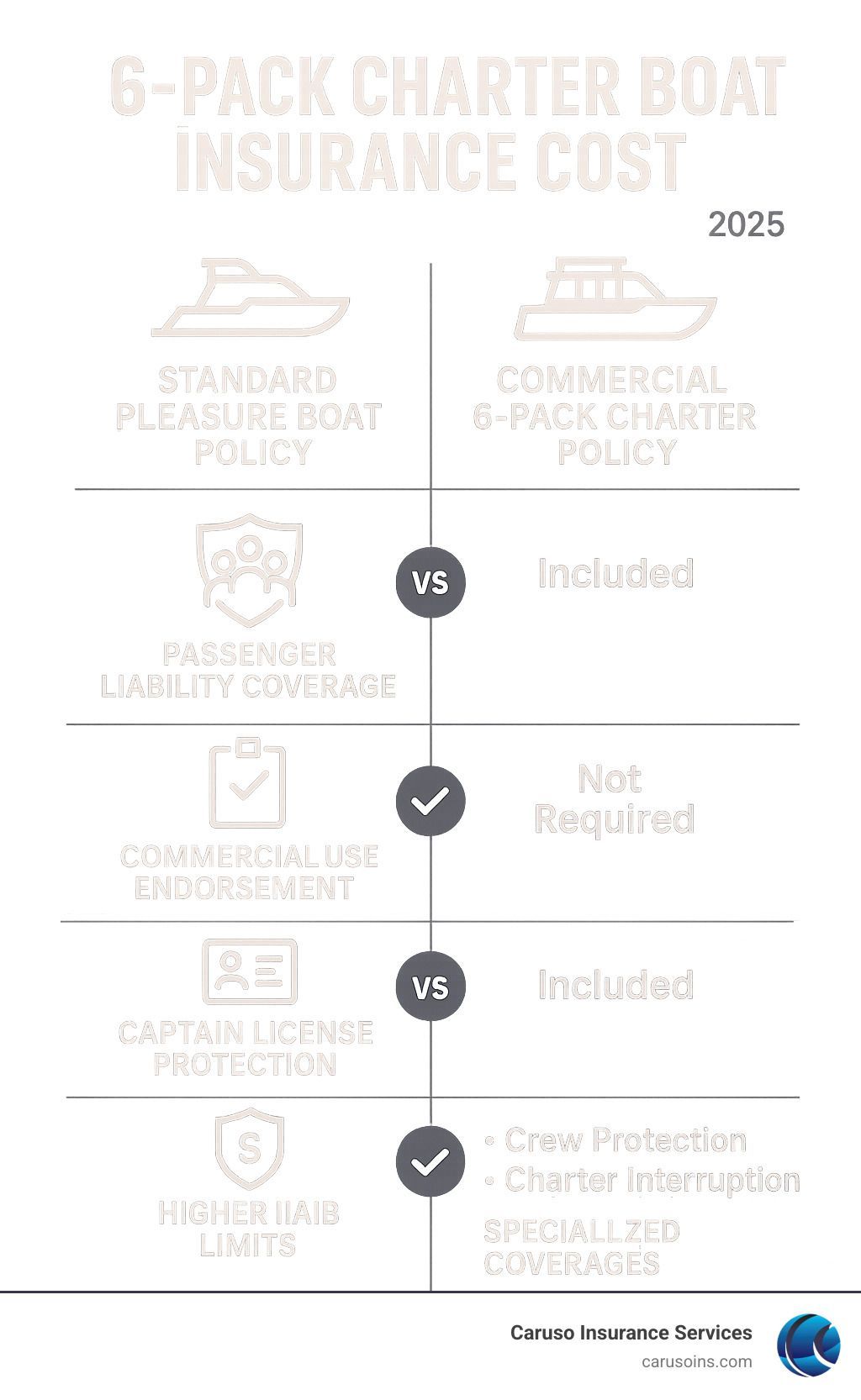

The main difference between private boat insurance and charter insurance is passenger liability coverage. As one insurance specialist explains: “The main difference is the passenger liability coverage, which is included in charter boat insurance if you accept payment for any type of boat ride.”

When you accept paying passengers, you transition from recreational boating to a commercial operation. This means taking on substantial new risks, including increased liability exposure, Coast Guard regulations, and the potential for license suspension.

I’m Patrick Caruso, an independent commercial insurance specialist. I’ve worked extensively with charter operators to secure comprehensive coverage that protects their vessels and livelihoods. My experience with 6-pack charter boat insurance cost considerations has shown me how the right coverage can prevent a minor setback from becoming a business-ending catastrophe.

6-pack charter boat insurance cost terms simplified:

Breaking Down the 6-pack Charter Boat Insurance Cost

When considering the 6-pack charter boat insurance cost, you’re looking at something very different from a pleasure boat policy. Carrying paying passengers makes you a business owner with significant responsibilities.

A charter boat policy has two main pillars: Hull insurance protects your vessel (fiberglass, engine, electronics), while Protection & Indemnity (P&I) coverage handles your liability to passengers and third parties. This is far more complex than standard boat insurance.

Your liability limits must be much higher than a recreational boater’s. You’ll likely need at least $1 million in liability coverage to protect your business. The deductibles you choose also directly impact your premium; a higher deductible lowers your annual cost but increases your out-of-pocket expense in a claim.

The industry rule of thumb puts annual premiums between 1-3% of your vessel’s value. For a $100,000 boat, that’s $1,000 to $3,000 per year. However, this is just a starting point; your actual 6-pack charter boat insurance cost will vary based on your specific situation.

For a deeper dive into general boating costs, check out our comprehensive guide on boat insurance cost.

Key Factors That Determine Your 6-pack Charter Boat Insurance Cost

Your 6-pack charter boat insurance cost is calculated by insurers based on several key risk factors.

Vessel value is the most straightforward factor—a $200,000 boat costs more to replace than a $50,000 one. But boat age and condition are also crucial. Insurers often require current surveys for boats over 20-30 years old to prove seaworthiness, which can cost $500-$1,500.

The size and type of your boat matters. A 45-foot offshore sportfisher presents different risks than a 28-foot bay boat. High-performance engines and complex electronics all factor into premium calculations.

A captain’s experience carries significant weight. Operator experience includes your years with an OUPV license and your track record. A clean claims history, especially regarding passenger liability, is vital for lower rates.

Cruising area can dramatically impact your costs. Operating in hurricane-prone zones along the Florida or Texas coast will push premiums higher than running charters on a calm Tennessee lake. Seasonal restrictions might apply in high-risk areas.

The type of charter you run also influences pricing. A calm-water sightseeing operation faces different risks than an offshore fishing charter that ventures 30 miles out. Dive charters present yet another risk profile.

If you’re operating in Texas waters, our article on What is the Average Cost of Boat Insurance in Texas? provides helpful regional insights.

Here’s how these factors might impact a sample premium:

| Factor | Lower Risk Scenario (Annual Premium) | Higher Risk Scenario (Annual Premium) |

|---|---|---|

| Vessel Value | $50,000 boat ($1,000) | $200,000 boat ($4,000) |

| Cruising Area | Protected inland waters ($800) | Hurricane-prone coastal area ($1,500) |

| Captain Experience | 10+ years, clean record ($900) | New captain, limited experience ($1,200) |

| Vessel Age | 5-year-old boat ($1,000) | 25-year-old boat requiring survey ($1,300) |

| Charter Type | Bay sightseeing tours ($900) | Offshore fishing charters ($1,400) |

Licensing and Certification Requirements

Your US Coast Guard OUPV license is essential for legal operation and insurability. Insurers require and verify this license before providing coverage.

While the OUPV is your federal requirement, state-specific regulations in places like Florida or Texas can add another layer of complexity, demonstrating to insurers your full compliance.

Safety certifications and boating safety courses often lead to premium discounts. Certifications like First Aid and CPR, along with advanced navigation or weather courses, signal to insurers that you are a professional who prioritizes safety.

Keeping certifications current and maintaining a strong safety record demonstrates your commitment to safe operations. This professionalism helps keep your 6-pack charter boat insurance cost low while ensuring proper protection.

For the most current licensing information, the

US Coast Guard websiteis your authoritative source. Staying informed helps ensure your operation remains compliant and insurable.

Essential Coverages for Your Charter Operation

For a 6-pack charter, your boat is your office and income source. The right insurance is about risk mitigation, passenger safety, and protecting the assets that keep your business afloat.

Comprehensive charter insurance is your business’s safety net. Without it, a single incident could lead to financial ruin. Fortunately, understanding your coverage needs is manageable. For more general information on boat insurance coverage, you can explore our detailed guide on boat insurance coverage.

Core Policy Components

Every 6-pack charter boat insurance cost calculation includes two essential pillars. These are the minimum coverages needed for safe and legal operation.

Hull & Machinery Coverage is property insurance for your boat. It covers physical damage to the hull, engines, electronics, and other attached equipment from collision, fire, theft, storm damage, or grounding.

You’ll choose between Agreed Value and Actual Cash Value coverage. With Agreed Value, you and your insurer agree on your boat’s worth when you buy the policy. If you face a total loss, you get that agreed amount without arguments about depreciation. Actual Cash Value pays replacement cost minus depreciation. For charter operators, Agreed Value typically makes more financial sense.

Protection & Indemnity (P&I) Liability distinguishes charter from pleasure boat policies. It protects you if your boat’s operation causes injury or property damage.

Passenger liability is crucial—it covers medical bills, lost wages, and pain and suffering if a paying customer is injured. Third-party property damage coverage applies when your vessel damages someone else’s boat or dock. Wreck removal handles the costs of hauling your sunken vessel out of the water. Pollution liability covers cleanup costs and fines if fuel or other contaminants spill from your boat, which is vital in environmentally sensitive areas in states like Florida and Texas.

Specialized and Optional Coverages

Beyond the basics, several specialized coverages can prevent a manageable setback from becoming a business-ending catastrophe.

Mariner Liability Insurance (License Protection) is a game-changer for professional captains. It protects your OUPV license during Coast Guard investigations, covering legal defense costs, fines, and Loss of Income if your license is suspended. Starting at just $25.83 per month, this coverage can save your career.

Charter Interruption coverage pays you when your boat is out of commission due to covered damage, helping replace lost revenue and cover ongoing expenses.

Personal Property & Fishing Tackle protection covers expensive gear like high-end fishing equipment or dive gear that standard coverage might not fully protect.

Towing and Emergency Assistance covers towing costs, fuel delivery, jump-starts, and other emergency services up to your policy limits.

Crew Coverage (Jones Act) is essential if you hire even one crew member. The Jones Act allows injured crew to sue employers for negligence, and standard P&I policies often exclude these claims. This coverage is mandatory if you have employees.

Medical Payments coverage provides quick, no-fault payment for smaller medical bills, regardless of who is at fault, offering faster resolution for minor injuries.

Trailer Coverage protects your trailer against damage or theft, which is important if you operate across states like Arizona, Nevada, Colorado, Tennessee, or Idaho.

The key is matching coverage to your operation’s risks. We help charter operators across Florida, Texas, Arizona, Colorado, Nevada, Tennessee, and Idaho build policies that provide comprehensive protection.

How to Lower Your Charter Insurance Premiums

You have more control over your 6-pack charter boat insurance cost than you might think. Proactive risk management leads to meaningful savings. By demonstrating a commitment to safety, you show insurers you are a low-risk captain, which can lower your premiums.

Insurers are betting on your success. A safer, more professional operation appears less risky, which translates directly into lower premiums and better coverage options. For more insights into managing your premiums, check out our guide on boat insurance rates.

The key is demonstrating that you go above and beyond minimum requirements to protect your passengers, vessel, and business. Every safety measure you implement sends a clear message to insurers.

Strategies for Lowering Your 6-pack Charter Boat Insurance Cost

A straightforward way to reduce your 6-pack charter boat insurance cost is by increasing your deductible. While this means more out-of-pocket cost in a claim, it shows insurers you are willing to share more of the initial risk, often resulting in premium savings.

Completing advanced boating safety courses beyond your OUPV requirements is another powerful way to demonstrate professionalism. Many insurers offer discounts for captains who invest in continuing education like advanced weather routing or emergency response training.

Your claims history is one of the most influential factors for your rates. Maintaining a clean record, especially avoiding liability claims, is critical. Handling minor incidents out-of-pocket instead of filing a claim can pay off with lower long-term premiums.

Paying your premium annually instead of monthly can often lead to discounts from reduced administrative fees.

Installing modern safety equipment signals your commitment to safety. Fire suppression systems, up-to-date GPS, EPIRBs, and reliable bilge pumps show you are investing in prevention, which insurers often reward with better rates.

Keeping your vessel well-maintained is crucial for insurability. A well-serviced boat is less likely to have mechanical failures leading to claims. For older vessels, a strong maintenance record is even more critical.

Working with a specialized agent who understands charter operations can significantly impact your coverage and costs. An experienced agent knows the best carriers for your operation and can structure a policy to maximize protection and savings. This is invaluable whether you’re in the waters of Florida and Texas or the inland lakes of Colorado and Tennessee.

These strategies work best together as part of a comprehensive approach to risk management, building a safer and more successful charter business.

Frequently Asked Questions about 6-Pack Charter Insurance

Running a 6-pack charter brings unique insurance challenges. Here are answers to the most common concerns we hear from captains in states like Florida and Texas.

What liability limit should I carry for my 6-pack charter?

Liability limits are a major part of your 6-pack charter boat insurance cost. $1 million in liability coverage is the industry standard for most charter operations, providing solid protection at a reasonable price.

However, your specific situation might require different limits. States like Florida and Texas have unique requirements, and their busy waterways and litigious environments make adequate coverage even more critical.

Your marina might also have its own requirements. Many facilities require specific minimum coverage amounts before allowing you to operate from their location. Always check with your home marina before finalizing your policy.

Assessing your operation’s actual risk is key. Are you running calm-water sightseeing tours or taking anglers 20 miles offshore? The difference in risk exposure is huge. High-traffic areas and the inherent dangers of your charter type all factor into your decision.

A lawsuit can easily exceed your coverage limits, with any excess coming out of your pocket. It’s often worth spending more on higher limits rather than gambling with your financial future.

Do I need a marine survey to get my older boat insured?

Yes, you will likely need a marine survey for an older boat. Most insurers require a current survey for vessels over 20 to 30 years old, especially for commercial policies.

A marine survey is a thorough physical exam for your boat. A qualified surveyor checks the hull integrity, mechanical systems, electrical components, and safety equipment for anything that could affect seaworthiness.

While there’s an upfront survey cost, it protects you by giving your insurer confidence in your vessel’s condition, which can help your 6-pack charter boat insurance cost. It also uncovers potential problems before they become emergencies.

Finding the right surveyor matters. Look for someone with experience in commercial vessels and your specific boat type. A good survey can strengthen your position with insurers and help justify agreed value coverage.

Can I use my boat for personal trips if it has charter insurance?

Yes, you can typically use your charter boat for personal trips, but your policy must explicitly cover both commercial and personal use.

Your commercial charter policy is designed for paying passenger operations. When you’re out with family or friends, you’re operating under different circumstances.

The critical step is ensuring your policy includes pleasure use coverage or the appropriate endorsements. Some policies include this automatically, while others require it to be added. Adding personal use coverage usually doesn’t significantly impact your 6-pack charter boat insurance cost.

If you don’t disclose all uses to your insurer, you risk a denied claim. An accident during a personal trip might not be covered if your policy is only for commercial operations.

Being upfront with your insurance provider about all intended uses is the smart play. An experienced agent can help structure your policy to cover your complete boating lifestyle while keeping costs reasonable across Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho.

Securing the Right Protection for Your Business

Understanding 6-pack charter boat insurance cost and coverage options is about more than meeting minimum requirements. It’s about protecting the business you’ve worked so hard to build.

Your 6-pack charter is your office, income source, and passion. The insurance protecting it must reflect that reality. We’ve covered essential components like Hull & Machinery to protect your investment and Protection & Indemnity for liability claims. We also explored specialized coverages like Mariner Liability to protect your license and Loss of Income coverage.

The factors influencing your premiums are equally important. Your vessel’s value and age, operating area, experience level, and the type of charters you run all determine costs. Whether you’re running fishing charters off the Florida coast or sightseeing tours on Tennessee lakes, each operation has a unique risk profile.

Custom policies make all the difference. A one-size-fits-all insurance approach doesn’t work for charter operations. Your policy needs to be custom to your specific situation, providing real protection while being flexible enough for you to operate comfortably.

At Caruso Insurance Services, we understand the charter boat industry. We know operators in Florida face different challenges than those in Colorado or Idaho. That’s why we provide personalized guidance that goes beyond just selling a policy.

We are licensed to help charter operators across Colorado, Arizona, Florida, Nevada, Texas, Tennessee, and Idaho, from coastal to inland charters. Our approach is simple: we listen to your needs, assess your risks, and craft coverage that provides peace of mind.

Don’t let insurance uncertainty keep you docked. The right coverage protects your assets and gives you the confidence to focus on what you do best: providing safe, memorable experiences for your passengers.

Ready to secure comprehensive protection for your charter business?

Get a personalized boating insurance quote todayand find how the right coverage can help your operation sail smoothly.